UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a party other than the Registrant | ☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive additional materials |

|

☐ |

Soliciting material under Rule 14a-12 |

Energy Recovery, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies: |

|

(2) |

Aggregate number of securities to which transactions applies: |

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

(4) |

Proposed maximum aggregate value of transaction: |

|

(5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials: |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

(1) |

Amount previously paid: |

|

(2) |

Form, Schedule or Registration Statement No. |

|

(3) |

Filing Party: |

|

(4) |

Date Filed: |

|

Energy Recovery, Inc. |

|

1717 Doolittle Drive San Leandro, CA 94577 |

|

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS |

Dear Stockholders of Energy Recovery, Inc.:

We are pleased to invite you to attend our 2018 Annual Meeting of Stockholders to be held on Thursday, June 14, 2018, at 10:00 a.m. Pacific Daylight Time at the Company’s headquarters located at 1717 Doolittle Drive, San Leandro, CA 94577 (the “Annual Meeting”). At the Annual Meeting, we will ask you to consider the following proposals:

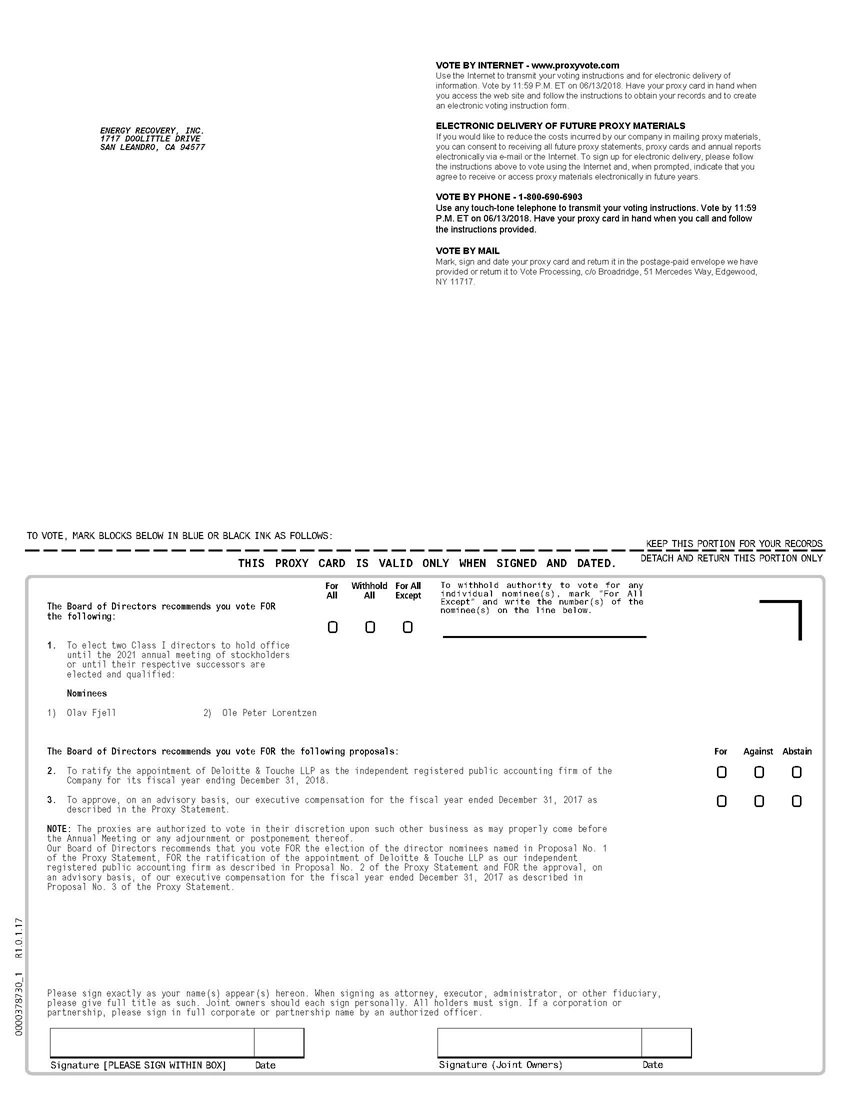

| ● | To elect two (2) Class I directors to serve until our 2021 annual meeting of stockholders or until their respective successors have been elected and qualified, or until the director’s earlier removal or resignation; | |

|

● |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; |

|

● |

To hold a non-binding advisory vote on executive compensation; and |

|

● |

To transact such other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Our Board of Directors has fixed the close of business on April 20, 2018, as the record date for the Annual Meeting. Stockholders of record as of April 20, 2018 may vote at the Annual Meeting or any postponements or adjournments of the meeting. This notice of annual meeting, notice of internet availability, proxy statement, annual report on Form 10-K and form of proxy are being made available on or about April 30, 2018.

Your vote is important. Whether or not you plan to attend the meeting in person, we would like for your shares to be represented. Please vote as soon as possible via the Internet, telephone, or mail.

At the meeting, we will also report on our 2017 business results and other matters of potential interest to our stockholders.

|

Sincerely,

Chris Gannon |

San Leandro, California

April 30, 2018

Whether or not you expect to participate in the Annual Meeting, please vote via the Internet, by phone, or complete, date, sign and promptly return the accompanying proxy card or voting instruction card in the enclosed postage-paid envelope so that your shares may be represented at the Annual Meeting.

| Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder Meeting To Be Held on June 14, 2018: This Proxy Statement, along with the Annual Report on Form 10-K for the fiscal year ended December 31, 2017, is available free of charge at the following website: www.proxyvote.com. |

|

PROXY STATEMENT |

||

|

|

||

|

To Be Held On Thursday, June 14, 2018 |

||

|

|

||

|

Page |

||

|

1 |

|||

|

1 |

|||

|

|

1. |

1 |

|

|

|

2. |

1 |

|

|

|

3. |

How does the Board of Directors recommend I vote on these proposals |

2 |

|

|

4. |

2 |

|

|

|

5. |

2 |

|

|

|

6. |

3 |

|

|

|

7. |

Can I change my vote or revoke my proxy after submitting my proxy |

3 |

|

|

8. |

3 |

|

|

|

9. |

What if I return a proxy card but do not make specific choices |

3 |

|

|

10. |

Who pays for the expenses related to the preparation and mailing of the Proxy Statement |

3 |

|

|

11. |

4 |

|

|

|

12. |

4 |

|

|

|

13. |

4 |

|

|

|

14. |

4 |

|

|

|

15. |

4 |

|

|

|

16. |

4 |

|

|

|

17. |

5 |

|

|

|

18. |

6 |

|

|

|

19. |

How do I access the proxy materials and annual report via the Internet |

6 |

|

|

20. |

What should I do if I get more than one proxy or voting instruction card |

7 |

|

|

21. |

7 |

|

|

|

22. |

What if I have questions about my Energy Recovery shares or need to change my mailing address |

8 |

|

|

23. |

8 |

|

|

9 |

|||

|

9 |

|||

|

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

11 |

||

|

|

12 |

||

|

|

12 |

||

|

PROPOSAL NO. 3 NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION |

13 |

||

|

14 |

|||

|

|

14 |

||

|

|

14 |

||

|

|

15 |

||

|

|

15 |

||

|

|

16 |

||

|

|

16 |

||

|

|

16 |

||

|

|

17 |

||

|

|

17 |

||

|

|

18 |

||

|

|

19 |

||

|

|

19 |

||

|

|

19 |

||

|

|

20 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

21 |

||

|

23 |

|||

|

|

23 |

||

|

|

|

23 |

|

|

|

|

24 |

|

|

|

|

25 |

|

|

|

|

Independent Compensation Consultant for Compensation Committee |

26 |

|

|

|

26 |

|

|

|

|

27 |

|

|

|

|

27 |

|

|

|

|

28 |

|

|

|

|

29 |

|

|

|

|

29 |

|

|

|

|

30 |

|

|

|

|

30 |

|

|

|

|

30 |

|

|

|

|

31 |

|

|

|

|

Compensation Policies and Practices as They Relate to Risk Management |

31 |

|

31 |

|||

|

|

32 |

||

|

|

33 |

||

|

|

35 |

||

|

|

36 |

||

|

|

36 |

||

|

|

37 |

||

|

|

40 |

||

|

40 |

|||

|

41 |

|||

|

43 |

|||

|

|

43 |

||

|

|

43 |

||

|

|

46 |

||

|

48 |

|||

|

49 |

|||

|

50 |

|||

|

|

Requirements for Stockholder Proposals to be Brought Before an Annual Meeting |

50 |

|

|

|

50 |

||

|

50 |

|||

|

|

50 |

||

|

50 |

|||

|

50 |

|||

ENERGY RECOVERY, INC.

2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 10:00 a.m. Pacific Daylight Time on Thursday, June 14, 2018

This proxy statement and the enclosed form of proxy (“Proxy Statement”) are furnished in connection with the solicitation of proxies by our Board of Directors (the “Board” or “Board of Directors”) for use at the 2018 annual meeting of stockholders of Energy Recovery, Inc., a Delaware corporation, and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on Thursday, June 14, 2018 at 10:00 a.m. Pacific Daylight Time at the Company’s headquarters located at 1717 Doolittle Drive, San Leandro, CA 94577. The telephone number at that location is (510) 746-7370. References in this Proxy Statement to “we,” “us,” “our,” “the Company” or “Energy Recovery” refer to Energy Recovery, Inc.

The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report is first being mailed on or about April 30, 2018 to all stockholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully.

ENERGY RECOVERY, INC.

INFORMATION ABOUT THE annual MEETING

|

What is the purpose of the Annual Meeting? |

|

A: |

Stockholders of record at the close of business on April 20, 2018 (the “Record Date”) will vote on the following items at the Annual Meeting: |

|

● |

to elect Ole Peter Lorentzen and Olav Fjell as Class I directors to serve until our 2021 annual meeting of stockholders or until their respective successors have been elected and qualified; |

|

● |

to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; |

|

● |

to hold a non-binding advisory vote on executive compensation; |

|

● |

to transact such other business that may properly come before the Annual Meeting or at any adjournment or postponement thereof. |

|

How do I vote? |

|

A: |

If you are a stockholder of record as of the Record Date, there are four ways to vote: |

|

● |

In person. You may vote in person at the Annual Meeting. The Company will give you a ballot when you arrive. |

|

● |

Via the Internet. You may vote by proxy via the Internet by following the instructions found on the proxy card or the Notice. |

|

● |

By Telephone. You may vote by proxy by calling the toll-free number found on the proxy card or the Notice. |

|

● |

By Mail. You may vote by proxy by filling out the proxy card and returning it in the envelope provided. If you vote by mail, your proxy card must be received by June 13, 2018. |

Please note that the Internet and telephone voting facilities will close at 11:59 p.m. Eastern Daylight Time (8:59 p.m. Pacific Daylight Time) on June 13, 2018.

If, as of the Record Date, you are a beneficial owner of shares held in street name, you should have received from your broker, bank, trustee or other nominee instructions on how to vote or instruct the broker to vote your shares, which are generally contained in a “vote instruction form” sent by the broker, bank, trustee or other nominee. Please follow their instructions carefully. Street name stockholders generally may vote by one of the following methods:

|

● |

In person. If you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares. Please contact that organization for instructions regarding obtaining a legal proxy to you by your broker, bank, trustee, or other nominee. |

|

● |

Via the Internet. You may vote by proxy via the Internet by following the instruction form provided to you by your broker, bank, trustee, or other nominee. |

|

● |

By Telephone. You may vote by proxy by calling the toll-free number found on the vote instruction form provided to you by your broker, bank, trustee, or other nominee. |

|

● |

By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the envelope provided to you by your broker, bank, trustee, or other nominee. |

|

How does the Board of Directors recommend I vote on these proposals? |

|

A: |

The Board recommends a vote: |

|

● |

FOR the election of directors Ole Peter Lorentzen and Olav Fjell; |

|

● |

FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

|

● |

FOR the approval of our executive compensation. |

|

What is included in the proxy materials? |

|

A: |

The proxy materials include this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2017, as filed with the Securities and Exchange Commission (“SEC”) on March 8, 2018 (the “Annual Report”). These materials were first made available to you via the Internet on or about April 30, 2018. Our principal executive offices are located at 1717 Doolittle Drive, San Leandro, CA 94577, and our telephone number is (510) 483-7370. We maintain a website at www.energyrecovery.com. The information on our website is not a part of this Proxy Statement. |

|

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials? |

|

A: |

In accordance with the rules of the SEC, we have elected to furnish our proxy materials, including this Proxy Statement and the Annual Report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 30, 2018 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials via the Internet to help reduce the environmental impact of our Annual Meetings. |

|

How many votes do I have? |

|

A: |

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date. |

|

Can I change my vote or revoke my proxy after submitting my proxy? |

|

A: |

You may change your vote or revoke your proxy at any time prior to the taking of the vote at the Annual Meeting. |

If you are the stockholder of record, you may change your vote by (1) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described on pages 1 and 2 of this Proxy Statement (and until the applicable deadline for each method); (2) providing a written notice of revocation to the Company’s Secretary at Energy Recovery, Inc., 1717 Doolittle Drive, San Leandro, CA 94577 prior to your shares being voted; or (3) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the Annual Meeting.

For shares you hold beneficially in street name, you generally may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

|

Can I attend the meeting in person? |

|

A: |

You are invited to attend the Annual Meeting if you are a registered stockholder or a street name stockholder as of April 20, 2018, the Record Date. In order to enter the Annual Meeting, you must present a form of photo identification acceptable to us, such as a valid driver’s license or passport. If you hold your shares beneficially in street name, you will need to provide proof of stock ownership as of the Record Date. Please note that since a street name stockholder is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. |

|

What if I return a proxy card but do not make specific choices? |

|

A: |

When proxies are properly dated, executed, and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board of Directors as described on page 2 of this Proxy Statement. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described above under “Can I change my vote or revoke my proxy after submitting my proxy?” |

|

Who pays for the expenses related to the preparation and mailing of the Proxy Statement? |

The Company will bear the costs of soliciting proxies, including the costs for the preparation, assembly, printing, and mailing of the Proxy Statement and related proxy materials. In addition, the Company will reimburse brokerage firms and other nominees representing beneficial owners of shares for their expenses in forwarding solicitation materials to beneficial owners of those shares. We have retained Alliance Advisors as our proxy solicitors, and proxies may be solicited by a representative of that firm. For its services, we will pay Alliance Advisors a fee of $6,000, plus reasonable expenses. Proxies may also be solicited by certain of the Company’s directors, officers, and regular employees, without additional compensation, either personally, by telephone, facsimile, or mail.

|

Who can vote at the Annual Meeting? |

Only stockholders of record at the close of business on April 20, 2018, the Record Date, will be entitled to notice of, and to vote at, our Annual Meeting. Each stockholder of record will be entitled to one vote on each matter for each share of common stock held on the Record Date. On the Record Date, the Company had 53,651,381shares of common stock outstanding, held by 38 holders of record.

|

Will there be any other items of business on the agenda? |

|

A: |

We do not know of any business to be considered at the Annual Meeting other than the proposals described in this Proxy Statement; however, the proxy holders (who are the management representatives named on the proxy card) may vote using their discretion with respect to any other matters properly presented for a vote at the meeting. |

|

How many votes are required for the approval of each item? |

|

A: |

Proposal No. 1 (election of directors): The candidates who receive the greatest number of votes cast at the Annual Meeting will be elected, provided that a quorum is present. The Board recommends a vote “FOR” all nominees. |

Proposal No. 2 (ratification of Deloitte & Touche LLP as our independent registered public accountants) and Proposal No. 3 (advisory approval of the Company’s executive compensation): An affirmative vote of a majority of the shares of the Company’s common stock present and entitled to vote is required to approve Proposals No. 2 and No. 3, provided that a quorum is present. The Board recommends a vote “FOR” each of the Proposals No. 2 and No. 3.

|

What is the quorum requirement? |

|

A: |

A “quorum” of stockholders must be present for us to hold a valid meeting of stockholders. Stockholders representing a majority (more than 50%) of the voting power of our outstanding common stock as of the Record Date, present in person or represented by proxy, constitute a quorum for the transaction of business at the Annual Meeting. |

Your shares will be counted towards the quorum only if you submit a valid proxy or if you vote in person at the meeting. Stockholders who submit signed and dated proxies without specifying their votes and broker “non-votes” described below will be counted towards the quorum requirement. If there is no quorum, the chairperson of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

|

What is a record holder? |

|

A: |

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered a “record holder” of those shares. If you are a record holder, you will receive a Notice on how you may access and review the proxy materials on the Internet. |

|

What is a beneficial owner? |

|

A: |

If your shares are held in a stock brokerage account, by a bank, or by another nominee, those shares are registered with American Stock Transfer & Trust Company in the “street name” of the brokerage account, bank, or other nominee, and you are considered the “beneficial owner” of those shares. If you are a beneficial owner, your broker or other nominee will send you a form of voting instructions along with instructions on how to access proxy materials. |

As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote your shares by using the voting instruction form included in the mailing or by following the instructions on the voting instruction card for voting via the Internet or telephone.

If there are multiple beneficial owners in the same household, your broker or other nominee may send only one set of voting instructions or copy of the proxy materials to your household. If you are receiving multiple copies of these materials and would like to receive a single copy in the future, please contact your broker, bank, or other nominee to request a single copy in the future.

|

How are votes counted? |

|

A: |

All shares of common stock represented by valid proxies will be voted in accordance with their instructions. In the absence of instructions, proxies will be voted “FOR” Proposals 1, 2 and 3. |

Brokers, banks, and other nominees may submit a proxy card for shares of common stock that they hold for a beneficial owner, but may decline to vote on certain items because they have not received instructions from the beneficial owner. These are called “Broker Non-Votes” and are not included in the tabulation of the voting results for the election of directors or for purposes of determining the number of votes cast with respect to a particular proposal. Consequently, Broker Non-Votes will not count as votes cast for purposes of Proposals No. 1 and 3.

Brokers have the discretion to vote such shares for which they have not received voting instructions from the beneficial owners on routine matters but not on non-routine matters. The only routine matter up for vote this year is the ratification of the independent registered public accounting firm (Proposal No. 2).

A broker is prohibited from voting on a non-routine matter unless the broker receives specific voting instructions from the beneficial owner of the shares. The election of directors (Proposal No. 1) and the advisory vote on executive compensation (Proposal No. 3) are non-routine matters, and your broker cannot vote your shares on these proposals unless you have timely returned applicable voting instructions to your broker.

Abstentions have no effect on the outcome of voting for Proposal No. 1, election of directors. Abstentions are treated as shares present or represented and voting regarding Proposals No. 2 and No. 3, so abstentions have the same effect as negative votes on those proposals.

A summary of the voting provisions, provided a valid quorum is present or represented at the Annual Meeting, for the matters described in “What is the purpose of the Annual Meeting?” is as follows:

|

Proposal No. |

Vote |

Board Voting Recommendation |

Routine or Non-Routine |

Discretionary Voting by Broker Permitted? |

Vote Required for Approval |

Impact of Abstentions |

Impact of Broker Non- votes (Uninstructed Shares) |

|

1 |

Election of director nominees |

FOR |

Non-routine, thus if you hold your shares in street name, your broker may not vote your shares for you. |

No |

Plurality1 |

No impact |

No impact |

|

2 |

Ratification of independent registered public accountants |

FOR |

Routine, thus if you hold your shares in street name, your broker may vote your shares for you absent any other instructions from you. |

Yes |

Majority of shares present or represented by proxy and entitled to vote |

Has the same effect as a vote against |

Broker has the discretion to vote |

|

3 |

Advisory, non-binding approval of executive compensation |

FOR |

Non-routine, thus if you hold your shares in street name, your broker may not vote your shares for you. |

No |

Majority of shares present or represented by proxy and entitled to vote |

Has the same effect as a vote against |

No impact |

1“Plurality” means that the nominees who receive the largest number of votes cast “for” are elected as directors. Accordingly, the two nominees receiving the highest number of affirmative votes will be elected as Class I directors to serve until the 2021 annual meeting of stockholders or until their respective successors are duly elected and qualified. Abstentions and broker non-votes will have no effect on the outcome of the vote.

|

Who counts or tabulates the votes? |

|

A: |

The votes of stockholders attending the Annual Meeting and voting in person will be counted or tabulated by an independent inspector of election. For our meeting, a representative of Broadridge Investor Communications Solutions, Inc. will tabulate votes cast by proxy and in person. |

|

How do I access the proxy materials and annual report via the Internet? |

|

A: |

A Notice will be mailed or emailed with instructions on how to access proxy materials via the Internet. This Proxy Statement, the 2017 Annual Report, and related proxy materials for the Annual Meeting of Stockholders to be Held on June 14, 2018 will also be available electronically at http://ir.energyrecovery.com. |

If you have previously chosen to receive the proxy materials via the Internet, you will be receiving an e-mail on or about April 30, 2018 with information on how to access stockholder information and instructions for voting over the Internet. Stockholders of record may vote via the Internet until 11:59 p.m. Eastern Daylight Time on June 13, 2018.

If your shares are registered in the name of a brokerage firm and you have not elected to receive proxy materials over the Internet, you may still be eligible to vote shares electronically over the Internet. Many brokerage firms participate in programs that provide eligible stockholders who receive a paper copy of the Proxy Statement and Annual Report the opportunity to vote via the Internet. If your brokerage firm participates in such a program, a form from the broker will provide voting instructions.

Stockholders can elect to view future Proxy Statements and Annual Reports over the Internet instead of receiving paper copies. Stockholders of record wishing to receive future stockholder materials electronically can elect this option by following the instructions provided when voting over the Internet at www.proxyvote.com.

Upon electing to view future Proxy Statements and Annual Reports over the Internet, you will receive an e-mail notification next year with instructions containing the Internet address of those materials. The choice to view future Proxy Statements and Annual Reports over the Internet will remain in effect until you contact your broker or the Company to rescind the instructions. Internet access does not have to be elected each year.

Stockholders who elected to receive this Proxy Statement electronically over the Internet and who would now like to receive a paper copy of this Proxy Statement so that they may submit a paper proxy in lieu of an electronic proxy should contact either their broker or the Company.

|

What should I do if I get more than one proxy or voting instruction card? |

|

A: |

Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials and multiple Notices, proxy cards, or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials or one Notice. You should vote in accordance with all of the proxy cards and voting instruction cards you receive relating to our Annual Meeting to ensure that all of your shares are counted. |

|

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

|

A: |

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for Proxy Statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single Proxy Statement addressed to those stockholders. This process is commonly referred to as “house-holding.” |

Brokers with account holders who are Energy Recovery stockholders may be house-holding our proxy materials. A single set of proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be house-holding communications to your address, house-holding will continue until you are notified otherwise or until you notify your broker or The Company that you no longer wish to participate in house-holding.

If, at any time, you no longer wish to participate in house-holding and would prefer to receive a separate Proxy Statement and Annual Report, you may (1) notify your broker, (2) direct your written request to: Investor Relations, Energy Recovery, Inc., 1717 Doolittle Drive, San Leandro, CA 94577 or (3) contact our Investor Relations department by email at IR@energyrecover.com or by telephone at (510) 746-2501. Stockholders who receive multiple copies of the Proxy Statement or Annual Report at their address and would like to request house-holding of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the Annual Report and Proxy Statement to a stockholder at a shared address to which a single copy of the documents was delivered.

|

What if I have questions about my Energy Recovery shares or need to change my mailing address? |

|

A: |

You may contact our transfer agent, American Stock Transfer & Trust Company, by telephone at (800) 937-5449 (U.S.) or (718) 921-8124 (outside the U.S.), or by email at info@amstock.com, if you have questions about your Energy Recovery shares or need to change your mailing address. |

|

Where can I find the voting results of the Annual Meeting? |

|

A: |

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to this Current Report on Form 8-K as soon as they become available. |

PROPOSALs to be voted on at the meeting

Proposal NO. 1

ELECTION OF DIRECTORS

The Company’s Amended and Restated Certificate of Incorporation (our “Charter”) provides that the Board shall be divided into three classes, with the directors in each class serving three-year terms. At the Annual Meeting, two Class I directors will be elected for three year terms.

The Nominating and Corporate Governance Committee of the Board of Directors has recommended, and the Board of Directors approved Ole Peter Lorentzen and Olav Fjell as nominees for election as Class I directors at the Annual Meeting. If elected, each newly elected director will serve until the 2021 annual meeting of stockholders, or until each director’s successor is duly elected and qualified, or until the director’s earlier removal or resignation.

Each of the nominees is currently a director of the Company and each of the nominees named below has consented, if elected as a director of the Company, to serve until his term expires.

In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of as many of the nominees listed below as possible. In such event, the specific nominees to be voted for will be determined by the proxy holders. The Board has no reason to believe that any of the persons named below will be unable or unwilling to serve as a director, if elected. Each of the two nominees for director who receives the greatest number of votes will be elected.

Set forth below are the names, ages, and certain biographical information relating to the Class I director nominees as of April 20, 2018.

DIRECTOR NOMINEES

|

Olav Fjell |

Age: 66

Director Since: 2015 Current Board Committees: -Nominating and Corporate Governance -Audit |

Education: M.Sc. Business Administration and Economics, Norwegian School of Economics and Business Administration |

Mr. Fjell joined the Board of Directors of the Company in June 2015. Mr. Fjell is a seasoned business leader with experience in the oil and gas industry, finance industry and high tech engineering industry. He is chair of the boards of Moelven AS, Nofima AS, Concedo ASA, Bene Agere Norden AS, IFE and Franzefoss AS. He is the deputy chair of Lotos Exploration and Production Norge and a member of the board of Turbulent Flux AS. Mr. Fjell was the CEO of Statoil from 1999 to 2003, Lindorff from 2005 to 2007 and Hurtigruten from 2007 to 2012. He has also served as the CEO of Postbanken and been part of the senior management teams at Kongsberg Våpenfabrikk and DNB. Mr. Fjell holds an M.Sc. in Business Administration and Economics (sivilokonom) from the Norwegian School of Economics and Business Administration.

|

Ole Peter Lorentzen |

Age: 65

Director Since: 2015 Current Board Committees: -Nominating and Corporate Governance (chair) -Compensation |

Education: Bachelor’s Business Administration, Lund University |

Mr. Lorentzen previously served on our Board from January 2007 until the Company went public in 2008. He joined our Board again in 2015. Since December 1987 Mr. Lorentzen has been the Chairman and beneficial owner of Ludvig Lorentzen, an investment company that typically holds a concentrated portfolio of investments for seven to fifteen years. He has extensive experience in working with management teams and Boards to seek methods of enhancing value for all shareholders. He served as Director of Agasti Holding ASA from May 2010 through May 2013. He served as a Director of Opera Software ASA until June 21, 2007. Mr. Lorentzen holds a bachelor’s degree in business administration from Lund University in Sweden.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF Ole peter Lorentzen AND Olav fjell AS CLASS I DIRECTORS.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC Accounting firm

The Audit Committee has appointed Deloitte & Touche LLP, as our independent registered public accounting firm for the fiscal year ending December 31, 2018. Deloitte & Touche LLP was retained by us on April 11, 2018, as announced in our Current Report on Form 8-K, filed on April 13, 2018. Prior to Deloitte & Touche LLP, BDO USA, LLP acted as our independent registered public accounting firm. BDO USA, LLP audited the Company’s financial statements for the fiscal years ending December 31, 2017 and 2016. On April 11, 2018, in connection with its selection of Deloitte & Touche LLP, the Audit Committee approved the dismissal of BDO USA, LLP. A representative of Deloitte & Touche LLP is expected to be present at the Annual Meeting. The representative will have an opportunity to make a statement and to respond to any questions. Representatives of BDO USA, LLP are not expected to be present at the Annual Meeting.

The Audit Committee recognizes the importance of maintaining the independence of the Company’s independent auditor, both in fact and appearance. Each year, the Audit Committee evaluates the qualifications, performance and independence of the Company’s independent auditor and determines whether to re-engage the current independent auditor. In doing so, the Audit Committee considers the quality and efficiency of the services provided by the auditors, the auditors’ (global) capabilities and the auditors’ technical expertise and knowledge of the Company’s operations and industry. Based on this evaluation, the Audit Committee has retained Deloitte & Touche LLP as the Company’s Independent Auditor for fiscal 2018. The members of the Audit Committee and the Board believe that, due to Deloitte & Touche’s knowledge of the Company and of the industries in which the Company operates, it is in the best interests of the Company and its stockholders to retain Deloitte to serve as the Company’s independent auditor during 2018.

During the years ended December 31, 2017 and 2016 and for the period from January 1, 2018 to April 11, 2018, neither the Company nor anyone on its behalf has consulted with Deloitte & Touche LLP with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Deloitte & Touche LLP concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a “reportable event” (as defined in Item 304(a)(1)(v) of Regulation S-K).

The reports of BDO USA, LLP on the Company’s consolidated financial statements for the years ended December 31, 2017 and 2016 did not contain an adverse opinion or a disclaimer of an opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the years ended December 31, 2017 and 2016 and for the period from January 1, 2018 to April 11, 2018, there were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) with BDO USA, LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BDO USA, LLP, would have caused BDO USA, LLP to make reference to the subject matter of the disagreements in its reports on the consolidated financial statements for such years.

During the years ended December 31, 2017 and 2016 and for the period from January 1, 2018 to April 11, 2018, there were no “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K.

Principal Accountant Fees and Services

The following table sets forth all fees accrued or paid to BDO USA, LLP, our independent registered public accountants, for fiscal years ended December 31, 2017 and 2016.

|

2017 |

2016 |

|||||||

|

Audit Fees (1) |

$ | 805,502 | $ | 640,685 | ||||

|

Audit-Related Fees |

$ | 0 | $ | 0 | ||||

|

Tax Fees |

$ | 0 | $ | 0 | ||||

|

All Other Fees |

$ | 0 | $ | 0 | ||||

|

Total |

$ | 805,502 | $ | 640,685 | ||||

|

(1) |

Audit Fees consist of fees for professional services rendered in connection with the audit of our annual consolidated financial statements and review of the financial statements included in our quarterly reports on Form 10-Q and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years. |

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee pre-approves audit, audit-related, tax, and all other services provided by our independent registered public accountants, Deloitte & Touche LLP and will not approve services that are impermissible under applicable laws and regulations. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision of that member to pre-approve specific services must be reported to the full Audit Committee at its next scheduled meeting. In the fiscal years ended December 31, 2017 and 2016, all fees identified above under the captions “Audit Fees” that were billed by BDO USA, LLP were approved by the Audit Committee in accordance with SEC requirements.

In the fiscal year ended December 31, 2017, there were no other professional services provided by BDO USA, LLP, other than those listed above, that would have required our Audit Committee to consider their compatibility with maintaining the independence of BDO USA, LLP.

Ratification of Deloitte & Touche LLP

Although ratification is not required, the appointment of Deloitte & Touche LLP as the Company’s independent auditors for fiscal year 2018 is being submitted for ratification at the Annual Meeting because the Board believes doing so is a good corporate governance practice. Furthermore, the Audit Committee will take stockholders’ opinions regarding the appointment of Deloitte & Touche LLP into consideration in future deliberations. If Deloitte & Touche LLP’s appointment is not ratified at the Annual Meeting, the Audit Committee will consider the engagement of other independent auditors. The Audit Committee may terminate Deloitte & Touche LLP’s engagement as the Company’s independent accountants without the approval of the Company’s stockholders whenever the Audit Committee deems appropriate.

THE BOARD OF DIRECTORS unanimously RECOMMENDS that

stockholders VOTE “FOR” RATIFICATION

OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC accountING FIRM FOR

THE YEAR ENDING DECEMBER 31, 2018

PROPOSAL NO. 3

non-binding ADVISORY vote ON EXECUTIVE COMPENSATION

The Compensation Discussion and Analysis beginning on page of this Proxy Statement describes the Company’s executive compensation program and the compensation decisions made by the Compensation Committee for our fiscal year ended December 31, 2017, with respect to the executive officers named in the Summary Compensation Table on page 32. The Board of Directors is asking our stockholders to cast a non-binding advisory vote to approve the following resolution:

“RESOLVED, that the stockholders of Energy Recovery, Inc. approve, on an advisory basis, the compensation of the executive officers named in the Summary Compensation Table for 2017, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and the related footnotes and narratives accompanying the tables).”

The Board is asking our stockholders to vote “FOR” this proposal because it believes that the policies and practices described in the Compensation Discussion and Analysis section of this Proxy Statement are necessary to achieve the Company’s primary objective of the executive compensation program, that of attracting, retaining, and motivating the talent we need to meet and/or exceed the strategic, operational, and financial goals of the Company. Additionally, we want to reward superior performance and align the long term interests of our executives with our stockholders.

This proposal, commonly known as a “Say on Pay” proposal, gives you, as a stockholder, the opportunity to express your views on our executive compensation programs and policies and the compensation paid to the executive officers named in the Summary Compensation Table.

The Company’s current policy is to hold a Say on Pay vote each year. We expect to hold another advisory vote with respect to executive compensation at the annual meeting of stockholders to be held in 2019.

Although your vote on this proposal is advisory and non-binding, the Compensation Committee values the views of our stockholders and will take into account the outcome of the vote when considering future compensation decisions for our named executive officers. We are providing this advisory vote pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THE COMPENSATION DISCUSSION AND ANALYSIS, THE ACCOMPANYING COMPENSATION TABLES AND THE RELATED NARRATIVE DISCLOSURE INCLUDED IN THIS PROXY STATEMENT.

BOARD AND CORPORATE GOVERNANCE MATTERS

Our business and affairs are managed under the direction of our Board of Directors. The number of directors is fixed by our Board of Directors, subject to the terms of our Charter and the Bylaws. Our Board of Directors currently consists of seven directors, all of whom qualify as “independent” under the listing standards of The NASDAQ Stock Market. As previously announced in our Current Report on Form 8-K, filed on February 27, 2018, the Board accepted the resignation of Mr. Joel Gay from the Board of Directors effective on February 25, 2018.

In accordance with our Charter and the Bylaws, our Board of Directors is divided into three classes with staggered three year terms. Prior to the Annual Meeting, the Board consisted of:

|

Committee Memberships |

|||||||

|

Director |

Class I |

Class II |

Class III |

Audit |

Compensation |

Nominating & Corporate Governance |

|

|

Mr. Alexander J. Buehler |

X |

Chairman |

Member |

||||

|

Mr. Olav Fjell |

X |

Member |

Member |

||||

|

Mr. Sherif Foda |

X |

Member |

Member |

||||

|

Mr. Arve Hanstveit |

X |

Member |

Chairman |

||||

|

Mr. Ole Peter Lorentzen |

X |

Member |

Chairman |

||||

|

Mr. Robert Yu Lang Mao |

X |

Member |

|||||

|

Mr. Hans Peter Michelet |

X |

Member |

|||||

Effective immediately following the Annual Meeting, our directors will be divided among the three classes as follows:

|

● |

Class I directors – Messrs. Fjell and Lorentzen’s terms will expire at the Annual Meeting, and they are standing for election at the Annual Meeting for terms that will expire at the annual meeting of stockholders to be held in 2021; |

|

● |

Class II directors – Messrs. Foda, Hanstveit and Michelet’s terms will expire at the annual meeting of stockholders to be held in 2019; and |

|

● |

Class III directors – Messrs. Buehler and Mao’s terms will expire at the annual meeting of stockholders to be held in 2020. |

The division of our Board of Directors into three classes with staggered three year terms may delay or prevent a change of our management or a change of control. Under Delaware law, our directors may be removed for cause by the affirmative vote of the holders of a majority of our outstanding voting stock. Directors may not be removed by our stockholders without cause.

Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one third of the directors.

During 2017 and the first two months of 2018, the Board of Directors evaluated all business and charitable relationships between the Company and the Company’s non-employee directors and all other relevant facts and circumstances. Based on information provided by each director concerning his background, employment, and affiliations, including family relationships, our Board of Directors has determined that none of Messrs. Buehler, Fjell, Foda, Hanstveit, Lorentzen, Mao and Michelet have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC, and the listing standards of The NASDAQ Stock Market (the “Applicable Rules”). In making these determinations, our Board of Directors considered the current and prior relationships that each director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence.

The Board of Directors also has determined that each director is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code, as amended.

Factors considered by our Board in determining if a non-employee director will not be deemed “independent,” including without limitation, the following: if (a) the director is, or in the past three years has been, an employee of the Company; (b) the director or a member of the director’s immediate family is, or in the past three years has been, an executive officer of the Company; (c) the director or a member of the director’s immediate family has, in the past three years, received more than $120,000 per year in direct compensation from the Company (other than for service as a director or, for the immediate family member, as a non-executive employee); (d) the director is an employee, or the director or a member of the director’s immediate family is employed as a partner, of the Company’s independent registered public accountants, or the director has an immediate family member who is a current employee of such firm and works in any capacity on the Company’s audit, or the director or an immediate family member was within the last three years a partner or employee of such firm and personally worked on the Company’s audit within that time; (e) the director or a member of the director’s immediate family is, or in the past three years has been, employed as an executive officer of a company where an Energy Recovery executive officer at the same time serves or served on the compensation committee; or (f) the director is an employee, or a member of the director’s immediate family is an executive officer, of a company that makes payments to, or receives payments from, the Company in an amount which, in any twelve-month period during the past three years, exceeds the greater of $200,000 or two percent of the consolidated gross revenues of the company receiving the payment.

Relationships Among Directors or Executive Officers

There are no family relationships among any of the directors or executive officers of the Company.

Board Leadership and Risk Oversight

The offices of Chairman and Chief Executive Officer at our Company are held by different individuals. Mr. Michelet is currently Chairman of the Board and has served as our Board Chairman since September 2004. Mr. Chris Gannon was appointed as President and Chief Executive Officer in February 2018. Previously, Mr. Joel Gay served as the Company’s President and Chief Executive Officer from April 2015 to February 2018. The Company believes that having the roles of Chief Executive Officer and Chairman of the Board filled by different individuals enhances our internal system of checks and balances and the Board’s oversight role. The practice also enables the Chief Executive Officer to focus on the Company’s operations. Nevertheless, the Board believes it is appropriate to retain the discretion and flexibility to change the structure from time to time as needed to provide appropriate leadership for the Company. At this time, the Board believes that it has achieved the best Board leadership structure for the Company by separating the roles of Chairman and Chief Executive Officer.

Mr. Michelet, as Chairman, presides at all meetings of the Board, including executive sessions of the Board and the independent directors, facilitates discussions among independent directors on key issues and concerns outside of Board meetings, serves as a liaison between the Chief Executive Officer and the other directors, reviews information to be sent to the Board, collaborates with the Chief Executive Officer and other members of Company management to set meeting agendas and Board information, assists the chairs of the committees of the Board as requested, and performs such other functions and responsibilities as requested by the Board or the independent directors from time to time. In performing the duties described above, the Chairman is expected to consult with, and does consult with, the chairs of the appropriate Board committees.

The goal of the Company’s risk management process is to understand and manage risk; management is responsible for identifying and managing the risks, while directors provide oversight to management in this process. Management identifies the significant risks facing the Company and the approaches to mitigate such risk. In addition to its general oversight of management, the Board of Directors is responsible for a number of specific functions, including assessing major risks facing the Company and reviewing options for their mitigation.

Our Board of Directors has three standing independent committees: Audit, Nominating and Corporate Governance and Compensation. Our Audit Committee is primarily responsible for overseeing the Company’s risk management processes on behalf of the Board. The Audit Committee charter provides that the Audit Committee should discuss and consider the process by which senior management of the Company and the relevant departments assess and manage the Company’s exposure to risk, and discuss the Company’s major financial risk exposure and the steps management has taken to monitor, control, and report such exposures. In addition, the Audit Committee reports to the Board of Directors, which also considers the Company’s risk profile. The Audit Committee and the Board of Directors obtain input from management regarding the most significant risks facing the Company and the Company’s risk management strategy.

The Audit Committee and the Board ensure that the risks undertaken are consistent with the Board’s tolerance for risk. While the Board is responsible for setting, monitoring, and maintaining the Company’s risk management policies and practices, the Company’s executive officers and members of our management team are responsible for implementing and overseeing our day-to-day risk management processes.

In addition to the oversight provided by our full Board of Directors, Audit Committee, executive officers and the members of our management team, our independent directors hold regularly scheduled executive sessions as often as they deem appropriate, but in any event at least four times each year. These executive sessions provide an additional avenue through which we monitor the Company’s risk exposure and policies regarding risk management.

Committees and Meetings of the Board of Directors

During the year ended December 31, 2017, the Board met twenty-three times. The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. During the year ended December 31, 2017, no director attended fewer than 75% of all the meetings of the Board or its committees on which he or she served after becoming a member, with the exception of Mr. Trempont, who attended 0 meetings in 2017. Mr. Trempont had provided notice to the board early in 2017 of his intention to resign from the Board. The Company encourages, but does not require, its directors to attend the annual meeting of stockholders. In 2017, all of our directors attended our annual meeting except Mr. Trempont.

The members of each of our standing committees as of December 31, 2017 are identified below.

|

Audit Committee* |

Compensation Committee |

Nominating and Corporate Governance Committee |

|

Alex Buehler (chair) |

Arve Hanstveit (chair) |

Ole Peter Lorentzen (chair) |

|

Olav Fjell |

Alex Buehler |

Olav Fjell |

|

Arve Hanstveit |

Sherif Foda |

Sherif Foda |

|

Robert Yu Lang Mao |

Ole Peter Lorentzen |

Hans Peter Michelet |

* Mr. Trempont was a director and the Chairman of the Audit Committee up to the 2017 Annual Meeting.

The Audit Committee held five meetings in the year ended December 31, 2017. The Audit Committee is responsible for assisting the full Board in fulfilling its oversight responsibilities relating to:

|

● |

overseeing the accounting and financial reporting processes and audits of our financial statements; |

|

● |

selecting and hiring our independent registered public accounting firm and approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

|

● |

assisting the Board in monitoring the integrity of our financial statements, our internal accounting and financial controls, our compliance with legal and regulatory requirements, and the qualifications, independence, and performance of our independent registered public accountants; |

|

● |

providing to the Board information and materials to make the Board aware of significant financial and audit-related matters that require attention; and |

|

● |

reviewing and discussing with management and our independent registered public accounting firm, our annual and quarterly financial statements and annual and quarterly reports on Forms 10-K and 10-Q. |

The Board has determined that all members of the Audit Committee are independent directors as defined in the listing rules of NASDAQ and SEC rules and regulations. The Board has further determined that Mr. Buehler is an “audit committee financial expert” as defined by SEC rules. The Board has adopted and approved a charter for the Audit Committee, a copy of which can be viewed on the Company’s website at www.energyrecovery.com under the Investor Relations tab.

The Compensation Committee held eight meetings in the year ended December 31, 2017. The Compensation Committee is responsible for, among other things:

|

● |

reviewing and approving, with respect to our Chief Executive Officer and other executive officers, annual base salaries, annual incentive bonuses, equity compensation, employment agreements, severance arrangements, change of control agreements/provisions, and any other benefits, compensation, or arrangements; |

|

● |

administering our Equity Incentive Plan and other employee benefit plans as may be adopted by us from time to time; and |

|

● |

recommending inclusion of the Compensation Discussion and Analysis in the Proxy Statement and our Annual Report on Form 10-K. |

The Board has determined that all members of the Compensation Committee are independent directors as defined in the listing rules of NASDAQ and SEC rules and regulations. The Board has adopted and approved a charter for the Compensation Committee, a copy of which can be viewed on the Company’s website at www.energyrecovery.com under the Investor Relations tab.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee held three meetings in the year ended December 31, 2017. The Nominating and Corporate Governance Committee is responsible for:

|

● |

assisting in identifying prospective director nominees and recommending to the Board nominees for each annual meeting of stockholders; |

|

● |

evaluating the performance of current members of the Board; |

|

● |

developing principles of corporate governance and recommending them to the Board; |

|

● |

recommending to the Board persons to be members of each committee; and |

|

● |

overseeing the evaluation of the Board and management. |

The Nominating and Corporate Governance Committee operates under a written charter setting forth the functions and responsibilities of the Committee. A copy of the charter can be viewed on the Company’s website at www.energyrecovery.com under the Investor Relations tab. The Board has determined that all members of the Nominating and Corporate Governance Committee are independent directors as defined in the listing rules of NASDAQ and SEC rules and regulations.

The Nominating and Corporate Governance Committee considers and makes recommendations to the Board regarding any stockholder recommendations for candidates to serve on the Board. Our Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board. In order to nominate a candidate for director, a stockholder must give timely notice in writing to our Secretary and otherwise comply with the provisions of our Bylaws. To be timely, a stockholder’s notice to our Secretary must be delivered to or mailed and received at our principal executive offices, in the case of an annual meeting, not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to the anniversary date on which we first mailed our Proxy Statement to stockholders in connection with the immediately preceding annual meeting. If no annual meeting was held in the previous year or the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the stockholder to be timely must be so received not later than the close of business the 10th day following the day on which such notice of the date of the meeting was mailed or public disclosure of the date of the meeting was made, whichever occurs first. In the case of a special meeting of stockholders called for the purpose of electing directors, notice must be delivered to or mailed and received not later than the close of business on the 10th day following the day on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever occurs first.

Stockholder nominations must also include the information required by our Bylaws. Under the Bylaws, information as to each person whom the stockholder proposes to nominate for election as a director must include (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class or series and number of shares of capital stock of the corporation that are owned beneficially or of record by the person, (iv) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nominations are to be made by the stockholder, and (v) any other information relating to such person that is required to be disclosed in solicitations of proxies for elections of directors, or is otherwise required, in each case pursuant SEC regulations. The stockholder giving notice must also provide certain other information required under our Bylaws.

A stockholder who wishes to nominate a candidate to serve on the Board should carefully review the applicable provisions of our Bylaws. Any such nomination must be made in accordance with the procedures outlined in, and include the information required by, the Bylaws. The nomination must be addressed to 1717 Doolittle Drive, San Leandro, California 94577 Attn: Secretary. You can obtain a copy of our Bylaws by writing to the Secretary at this address.

While the Nominating and Corporate Governance Committee does not have a written policy regarding diversity in identifying nominees for directors, the committee takes diversity into account when looking for best available candidates to serve on the Board. In the past, when new directors have been added to our Board, the Board or Nominating and Corporate Governance Committee has endeavored to select director candidates who have business, scientific, or regulatory specializations; technical skills; or other backgrounds that increased the range of experience and diversity of perspectives within our Board in ways that pertain to our current and future business goals. The Committee also considers diversity in terms of gender, ethnic background, and national origin.

There are no differences in the manner in which the Nominating and Corporate Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder or by the Nominating and Corporate Governance Committee itself.

In reviewing potential candidates for the Board, the Nominating and Corporate Governance Committee considers numerous factors including:

|

● |

whether or not the person has any relationships that might impair his or her independence, such as any business, financial, or family relationships with the Company, its management, its stockholders, or their affiliates; |

|

● |

whether or not the person serves on boards of, or is otherwise affiliated with, competing companies; |

|

● |

whether or not the person is willing to serve as, and willing and able to commit the time necessary for the performance of the duties of, a director of the Company; and |

|

● |

the contribution that the person can make to the Board and the Company, with consideration given to the person’s experience in the fields of energy, technology, and manufacturing as well as leadership or entrepreneurial experience in business or education. |

Of greatest importance is the individual’s integrity and ability to bring to the Company experience and knowledge in areas related to the Company’s current and future business. The Board intends to continue using these criteria to evaluate candidates for election to the Board.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was at any time during fiscal year 2017 or at any other time, an officer or employee of the Company, or had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K. None of our current executive officers serve on the Compensation Committee or the Board of Directors of another entity whose executive officer(s) serve(s) on the Company’s Compensation Committee or Board of Directors.

Communication between Stockholders and Directors

Our Board currently does not have a formal process for stockholders to send communications to the Board. The Company, however, makes every effort to ensure that the views of stockholders are heard by the Board or individual directors and that the Company responds to stockholders on a timely basis. The Board does not recommend that formal communication procedures be adopted at this time because it believes that informal communications are sufficient to convey questions, comments, and observations that could be useful to the Board. Stockholders wishing to formally communicate with the Board may send communications directly to Secretary, Energy Recovery, Inc., 1717 Doolittle Drive, San Leandro, California 94577.

Directors who are non-employees of the Company received the following fees for their services on the Board during the year ending December 31, 2017:

|

● |

$50,000 annual retainer paid in quarterly installments for services as a member of the Board; or |

|

● |

$200,000 annual retainer paid in monthly installments for services as Chairman of the Board. |

Additionally, directors receive:

|

● |

$15,000 annual retainer paid in quarterly installments for services as Chairman of the Audit Committee; |

|

● |

$10,000 annual retainer paid in quarterly installments for services as Chairman of the Compensation Committee; and |

|

● |

$5,000 annual retainer paid in quarterly installments for services as Chairman of the Nominating and Corporate Governance Committee. |

Our non-employee directors also receive:

|

● |

an annual grant of stock options of common stock valued (based on market prices on the date of grant) at $85,000, with 100% vesting on the first anniversary of the vesting commencement date. |

In June 2017, we granted to each continuing non-employee director, options to purchase 16,726 shares of our common stock. The options have a one year vesting period and become fully vested in June 2018, subject to the director providing service to the Board through such date.

Director Compensation for the Year Ended December 31, 2017

The table below summarizes the compensation paid to non-employee directors for the year ended December 31, 2017. Directors who are also our employees receive no additional compensation for their service as a director. During the fiscal year ended December 31, 2017, one director, Mr. Gay, our former President and Chief Executive Officer was an employee, and his compensation is discussed in “Executive Compensation.”

|

Director |

Fees Earned and Paid in Cash |

Option Awards (1) |

Total |

|||||||||

|

Mr. Alexander J. Buehler(2) |

$ | 57,056 | $ | 85,002 | $ | 142,058 | ||||||

|

Mr. Sherif Foda |

$ | 50,000 | $ | 85,002 | $ | 135,002 | ||||||

|

Mr. Olav Fjell |

$ | 50,000 | $ | 85,002 | $ | 135,002 | ||||||

|

Mr. Arve Hanstveit (3) |

$ | 60,000 | $ | 85,002 | $ | 145,002 | ||||||

|

Mr. Ole Peter Lorentzen(4) |

$ | 52,625 | $ | 85,002 | $ | 137,627 | ||||||

|

Mr. Robert Yu Lang Mao(5) |

$ | 50,858 | $ | 85,002 | $ | 135,860 | ||||||

|

Mr. Hans Peter Michelet (6) |

$ | 224,582 | $ | 85,002 | $ | 309,584 | ||||||

|

Mr. Dominique Trempont (7) |

$ | 29,875 | $ | 0 | $ | 29,875 | ||||||

|

(1) |

The amount in the Option Awards column sets forth the fair value on the grant date of the options awards granted in 2017 as calculated in accordance with FASB ASC Topic 718 without regard to estimated forfeitures. The method and assumptions used to calculate the fair value on the grant date of our equity awards is discussed in Note 11 of our Notes to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ending December 31, 2017. As of December 31, 2017, the number of shares underlying unvested stock options held by each of the directors was: Mr. Buehler, 16,726; Mr. Fjell, 16,726; Mr. Foda 16,726; Mr. Hanstveit, 16,726; Mr. Lorentzen, 16,726; Mr. Mao, 16,726; Mr. Michelet, 16,726; and Mr. Trempont, 0. |

|

(2) |

Mr. Buehler is a director and the Chairman of the Audit Committee since July 12, 2017. |

|

(3) |

Mr. Hanstveit is a director and the Chairman of the Compensation Committee. |

|

(4) |

Mr. Lorentzen is a director and the Chairman of the Nomination and Corporate Governance Committee since June 22, 2017. |

|

(5) |

Mr. Mao is a director and was the Chairman of the Audit Committee from June 22, 2017 to July 12, 2017. |

|

(6) |

Mr. Michelet is a director and the Chairman of the Board of Directors. He was the Chairman of the Nominating and Corporate Governance Committee through June 22, 2017. |

|

(7) |

Mr. Trempont was a director and the Chairman of the Audit Committee up to the 2017 Annual Meeting. Mr. Trempont did not stand for re-election and ceased being a board member on June 22, 2017. |

Our non-employee directors are also reimbursed for travel, lodging and other reasonable expenses incurred in connection with their attendance at Board of Directors or committee meetings.

The Board believes that our non-employee directors and executive officers should own and hold shares of our common stock to further align their interests with the long term interests of stockholders and further promote our commitment to sound corporate governance. Toward this end, in April 2016, the Board adopted guidelines with respect to ownership levels of the Company’s common stock of our CEO, other executive officers, and members of our Board. The guidelines state that our CEO, other executive officers, and each director must beneficially own Common Stock having a value equal to:

|

● |

For our CEO, three times his annual base salary; |

|

● |

For our other executive officers, one time his or her annual base salary; and |

|

● |

For each non-employee director, three times the amount of the annual cash retainer paid to directors for general service on the Board. |

The guidelines were established to promote a long-term perspective in managing the Company and align the interests of our stockholders, executives, and directors.

For purposes of determining ownership under these guidelines we include shares of common stock actually owned by the covered individual or family members, certain indirect forms of ownership, such as stock held in a grantor trust for the benefit of the covered individual, as well as the net exercise or “spread” value of vested stock options. Unvested options or restricted stock units (“RSUs”) and the unvested portion of any performance-based restricted stock or other equity-based award are not included. Directors and executive officers were given a period of three years from the adoption of the original guidelines to meet these ownership requirements while newly appointed directors or executive officers are given a period of five years from their date of appointment to meet these requirements. Covered individuals are required to hold 25% of the net shares acquired from all equity awards after deducting shares sold to cover the exercise price and/or taxes until the applicable guideline is reached. As of April 20, 2018, all of our directors and executive officers were either exceeding the minimum stock ownership requirements or were on track to comply in the relevant timeframe.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 20, 2018 for (i) each person or group of affiliated persons who is known by the Company to beneficially own more than 5% of the Company’s common stock, (ii) each of the Company’s directors, (iii) each of the officers appearing in the “Summary Compensation Table” on Page 32 and (iv) all directors and executive officers as a group.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares that they beneficially own, subject to community property laws where applicable. To our knowledge, no person or entity except as set forth below, is the beneficial owner of more than 5% of the voting power of our common stock as of the close of business on April 20, 2018. The address of each executive officer and director is c/o Energy Recovery, Inc., 1717 Doolittle Drive, San Leandro, CA 94577.

|

Shares |

Percent of |

|||||||

|