UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

Filed by the Registrant |

☒ |

|

Filed by a party other than the Registrant |

☐ |

|

Check the appropriate box: |

|

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive additional materials |

|

☐ |

Soliciting material under Rule 14a-12 |

Energy Recovery, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transactions applies: |

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials: |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

Amount previously paid: |

|

|

(2) |

Form, Schedule or Registration Statement No. |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

Energy Recovery, Inc.

Notice of 2016 Annual Meeting of Stockholders

To Be Held On June 23, 2016

Dear Stockholders,

The 2016 Annual Meeting of Stockholders of Energy Recovery, Inc., a Delaware corporation (the “Company” or “Energy Recovery”), will be held on Thursday, June 23, 2016, at 10:00 a.m. Pacific Daylight Time. The 2016 Annual Meeting will take place at the Company’s headquarters, located at 1717 Doolittle Drive, San Leandro, CA 94577.

The purpose of the meeting is:

|

1. |

the election of Mr. Arve Hanstveit and Mr. Hans Peter Michelet as Class II directors to serve until our 2019 Annual Meeting (or until their successors are elected and qualified); |

|

2. |

the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2016; |

|

3. |

the approval of the 2016 Incentive Plan; |

|

4. |

advisory approval of the Company’s named executive officer compensation; and |

|

5. |

other business that may properly come before the meeting and any adjournment or postponement. |

These items of business are more fully described in the attached Proxy Statement, which accompanies this Notice.

Only stockholders who owned stock at the close of business on April 25, 2016 may attend and vote at the meeting or any postponement or adjournment of the meeting.

Whether or not you expect to attend the 2016 Annual Meeting of stockholders in person, we urge you to vote as promptly as possible to ensure your representation and the presence of a quorum at the 2016 Annual Meeting.

At the meeting, we will also report on our 2015 business results and other matters of potential interest to our stockholders.

By Order of the Board of Directors,

/s/ Joel Gay

Joel Gay

President, Chief Executive Officer, and Director

San Leandro, California

April 26, 2016

Stockholders of record can vote their shares by using the Internet or the telephone. Instructions for using these convenient services are set forth on the notice of availability over the Internet of the proxy materials.

If you vote your proxy and then decide to attend the annual meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures described in the Proxy Statement.

|

TABLE OF CONTENTS |

|

|

|

Page |

|

PROXY STATEMENT |

1 |

|

INFORMATION ABOUT THE MEETING |

1 |

|

1. What is the purpose of the meeting? |

1 |

|

2. How do I vote? |

1 |

|

3. How many votes do I have? |

2 |

|

4. Can I change my vote after submitting my proxy? |

2 |

|

5. What if I return a proxy card but do not make specific choices? |

2 |

|

6. Who pays for the expenses related to the preparation and mailing of the Proxy Statement? |

2 |

|

7. Who can vote at the 2016 Annual Meeting? |

2 |

|

8. Will there be any other items of business on the agenda? |

2 |

|

9. How many votes are required for the approval of each item? |

3 |

|

10. What is the quorum requirement? |

3 |

|

11. What is a record holder? |

3 |

|

12. What is a beneficial owner? |

3 |

|

13. How are votes counted? |

3 |

|

14. Who counts or tabulates the votes? |

4 |

|

15. How do I access the proxy materials and annual report via the Internet? |

4 |

|

PROPOSALS TO BE VOTED ON AT THE MEETING |

5 |

|

PROPOSAL NO. 1 — ELECTION OF DIRECTORS |

5 |

|

PROPOSAL NO. 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

6 |

|

Principal Accountant Fees and Services |

6 |

|

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm |

6 |

|

PROPOSAL NO. 3 — APPROVAL OF 2016 INCENTIVE PLAN |

7 |

|

PROPOSAL NO. 4 — ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION |

16 |

|

BOARD AND CORPORATE GOVERNANCE MATTERS |

17 |

|

Board of Directors |

17 |

|

Director Independence |

17 |

|

Relationships Among Directors or Executive Officers |

17 |

|

Committees and Meetings of the Board of Directors |

17 |

|

The Audit Committee |

17 |

|

The Compensation Committee |

18 |

|

The Nominating and Corporate Governance Committee |

18 |

|

Board Leadership Structure and Role in Risk Management |

19 |

|

Compensation Committee Interlocks and Insider Participation |

20 |

|

Communication between Stockholders and Directors |

20 |

|

Director Compensation |

20 |

|

Director Compensation for the Year Ended December 31, 2015 |

21 |

|

Stock Ownership Guidelines |

22 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

23 |

|

EXECUTIVE COMPENSATION |

25 |

|

Compensation Discussion and Analysis |

25 |

|

Executive Compensation Process |

26 |

|

Independent Compensation Consultant for Compensation Committee |

27 |

|

Consideration of “Say on Pay” Results |

27 |

|

Competitive Positioning |

28 |

|

Base Salaries of Named Executive Officers |

28 |

|

Annual Cash Incentive Compensation |

28 |

|

Equity-Based Incentive Compensation |

29 |

|

2015 Equity-Based Incentive Awards |

30 |

|

Benefits |

30 |

|

Change in Control Severance Plan |

30 |

|

Severance and Termination Compensation |

31 |

|

Tax Deductibility |

31 |

|

Compensation Policies and Practices as They Relate to Risk Management |

31 |

| TABLE OF CONTENTS | |

| Page | |

|

Report of the Compensation Committee |

31 |

|

Summary Compensation Table |

32 |

|

Grants of Plan-Based Awards in 2015 |

34 |

|

Employment Arrangements with Named Executive Officers |

34 |

|

Outstanding Equity Awards as of December 31, 2015 |

37 |

|

Option Exercises and Stock Vested in 2015 |

38 |

|

Potential Payments Upon Termination or Change in Control |

39 |

|

Key Defined Terms of the Change in Control Plan |

40 |

|

Benefits under the Change in Control Plan |

41 |

|

REPORT OF THE AUDIT COMMITTEE |

42 |

|

DIRECTORS AND MANAGEMENT |

43 |

|

RELATED PERSON POLICIES AND TRANSACTIONS |

47 |

|

CODE OF BUSINESS CONDUCT AND ETHICS |

47 |

|

STOCKHOLDER PROPOSALS |

47 |

|

OTHER MATTERS |

48 |

|

Section 16(a) Beneficial Ownership Reporting Compliance |

48 |

|

Other Matters |

48 |

|

Form 10-K ANNUAL REPORT |

48 |

ENERGY RECOVERY, INC.

PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 23, 2016

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of Energy Recovery, Inc. for use at the 2016 Annual Meeting of Stockholders to be held on Thursday, June 23, 2016 at 10:00 a.m. Pacific Daylight Time. The 2016 Annual Meeting will take place at the Company’s headquarters, located at 1717 Doolittle Drive, San Leandro, CA 94577. The telephone number at that location is (510) 746-7370.

The Company is furnishing proxy materials to many of its stockholders on the Internet rather than mailing printed copies of those materials to each stockholder. If you received a notice of availability over the Internet of the proxy materials (“Notice”) by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice will instruct you as to how you may access and review the proxy materials on the Internet. If you received a Notice by mail and would like to receive a printed copy of the proxy materials, please follow the instructions included in the Notice. The Notice is being sent to stockholders of record as of April 25, 2016 on or about May 11, 2016. Proxy materials, which include the Notice of the 2016 Annual Meeting of Stockholders, this Proxy Statement, and the Annual Report to Stockholders for the year ended December 31, 2015, which includes financial statements and other information with respect to the Company (the “Annual Report”), are first being made available to stockholders of record as of April 25, 2016, on or about May 11, 2016. Additional copies of the Annual Report may be obtained by writing to the Company at the address noted above.

INFORMATION ABOUT THE MEETING

|

1. |

What is the purpose of the meeting? |

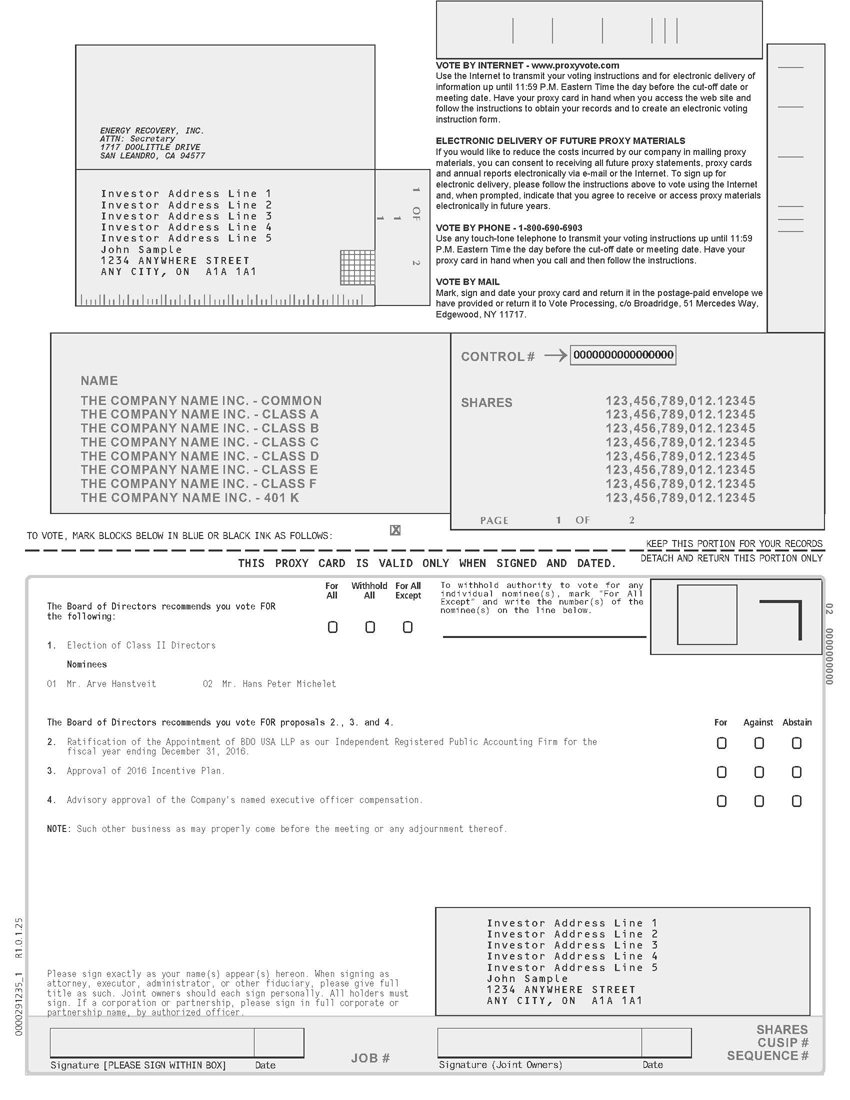

All holders of shares of common stock of record at the close of business on April 25, 2016, (the “Record Date”) are entitled to notice of and to vote at the 2016 Annual Meeting and all adjournments or postponements thereof. At the meeting, our stockholders will vote on:

|

1. |

the election of Mr. Arve Hanstveit and Mr. Hans Peter Michelet as Class II directors to serve until our 2019 Annual Meeting (or until their successors are elected and qualified); |

|

2. |

the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2015; |

|

3. |

approval of the 2016 Incentive Plan; |

|

4. |

advisory approval of the Company’s named executive officer compensation; and |

|

5. |

other business that may properly come before the meeting and any adjournment or postponement. |

|

2. |

How do I vote? |

If you are a record holder of our common shares as of the Record Date, you can vote as follows:

|

|

● |

Electronically via the Internet, following the instructions on the Notice; |

|

● |

In person at the meeting; |

|

● |

By proxy at the meeting; or |

|

● |

By telephone, following the instructions on the Notice. |

To ensure that your vote is counted, please submit your vote by June 22, 2016.

If your shares are held for you in an account with a broker or other nominee, you will receive voting instructions from your nominee rather than a proxy card. To vote, please follow the voting instructions sent by your broker or other nominee. If you return your voting instructions timely, your broker or other nominee will then include your vote in the appropriate proxy card held by the record holder. If your shares are held in the name of a broker or other nominee, you cannot vote in person at the 2016 Annual Meeting unless you first obtain a legal proxy from your nominee and present it at the 2016 Annual Meeting.

|

3. |

How many votes do I have? |

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

|

4. |

Can I change my vote after submitting my proxy? |

If you are the record holder of your shares, you can withdraw or revoke your proxy at any time before the final vote at our 2016 Annual Meeting by:

|

|

● |

delivering to the Company to the attention of the Company’s Secretary a written notice of revocation or delivery of a duly executed proxy bearing a later date; |

|

● |

submitting a new proxy via the Internet or telephone in accordance with the instructions on your original form of proxy; or |

|

● |

attending the 2016 Annual Meeting and voting in person. Attending the 2016 Annual Meeting in person will not by itself revoke any prior proxy. |

|

5. |

What if I return a proxy card but do not make specific choices? |

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” our director nominees and “FOR” the other proposals made in this Proxy Statement. If any other matter is properly presented at the meeting, the Company representative authorized to vote on your behalf as your proxy will vote your shares using his or her best judgment.

|

6. |

Who pays for the expenses related to the preparation and mailing of the Proxy Statement? |

The Company will bear the costs of soliciting proxies, including the costs for the preparation, assembly, printing, and mailing of the Proxy Statement and related proxy materials. In addition, the Company will reimburse brokerage firms and other nominees representing beneficial owners of shares for their expenses in forwarding solicitation materials to beneficial owners of those shares. We have retained Alliance Advisors as our proxy solicitors, and proxies may be solicited by a representative of that firm. For its services, we will pay Alliance Advisors a fee of $5,000, plus reasonable expenses. Proxies may also be solicited by certain of the Company’s directors, officers, and regular employees, without additional compensation, either personally, by telephone, facsimile, or mail.

|

7. |

Who can vote at the 2016 Annual Meeting? |

Only stockholders of record at the close of business on April 25, 2016, the Record Date, will be entitled to notice of, and to vote at, our 2016 Annual Meeting. On the Record Date, the Company had 52,222,871 shares of common stock outstanding.

|

8. |

Will there be any other items of business on the agenda? |

We do not know of any business to be considered at the meeting other than the proposals described in this Proxy Statement; however, the proxy holders (who are the management representatives named on the proxy card) may vote using their discretion with respect to any other matters properly presented for a vote at the meeting.

|

9. |

How many votes are required for the approval of each item? |

|

|

● |

Proposal No. 1 (election of directors): The candidates who receive the greatest number of votes cast at the 2016 Annual Meeting will be elected, provided that a quorum is present. The Board recommends a vote “FOR” all nominees. |

|

● |

Proposal No. 2 (ratification of BDO USA, LLP as our independent registered public accounting firm), Proposal No. 3 (approval of 2016 Incentive Plan), and Proposal No. 4 (advisory approval of the Company’s executive compensation): An affirmative vote of a majority of the shares of the Company’s common stock present and entitled to vote is required to approve Proposals No. 2, No. 3, and No. 4, provided that a quorum is present. The Board recommends a vote “FOR” each of the Proposals No. 2, No. 3, and No. 4. |

|

10. |

What is the quorum requirement? |

A “quorum” of stockholders must be present for us to hold a valid meeting of stockholders. Stockholders representing a majority (more than 50%) of the voting power of our outstanding common stock as of the Record Date, present in person or represented by proxy, constitute a quorum for the transaction of business at the 2016 Annual Meeting.

Your shares will be counted towards the quorum only if you submit a valid proxy or if you vote in person at the meeting. Stockholders who submit signed and dated proxies without specifying their votes and broker “non-votes” described below will be counted towards the quorum requirement. If there is no quorum, the chairperson of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

|

11. |

What is a record holder? |

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered a “record holder” of those shares. If you are a record holder, you will receive a Notice on how you may access and review the proxy materials on the Internet.

|

12. |

What is a beneficial owner? |

If your shares are held in a stock brokerage account, by a bank, or by another nominee, those shares are registered with American Stock Transfer & Trust Company in the “street name” of the brokerage account, bank, or other nominee, and you are considered the “beneficial owner” of those shares. If you are a beneficial owner, your broker or other nominee will send you a form of voting instructions along with instructions on how to access proxy materials.

As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote your shares by using the voting instruction form included in the mailing or by following the instructions on the voting instruction card for voting via the Internet or telephone.

If there are multiple beneficial owners in the same household, your broker or other nominee may send only one set of voting instructions or copy of the proxy materials to your household. If you are receiving multiple copies of these materials and would like to receive a single copy in the future, please contact your broker, bank, or other nominee to request a single copy in the future.

|

13. |

How are votes counted? |

All shares of common stock represented by valid proxies will be voted in accordance with their instructions. In the absence of instructions, proxies will be voted “FOR” Proposals 1, 2, 3, and 4.

Brokers, banks, and other nominees may submit a proxy card for shares of common stock that they hold for a beneficial owner, but may decline to vote on certain items because they have not received instructions from the beneficial owner. These are called “Broker Non-Votes” and are not included in the tabulation of the voting results for the election of directors or for purposes of determining the number of votes cast with respect to a particular proposal. Consequently, Broker Non-Votes do not have an effect on the vote.

Brokers have the discretion to vote such shares for which they have not received voting instructions from the beneficial owners on routine matters but not on non-routine matters. The only routine matter up for vote this year is the ratification of the independent registered public accounting firm (Proposal No. 2).

A broker is prohibited from voting on a non-routine matter unless the broker receives specific voting instructions from the beneficial owner of the shares. The election of directors (Proposal No. 1), the approval of the 2016 Incentive Plan (Proposal No. 3), and the advisory vote on executive compensation for 2015 (Proposal No. 4) are non-routine matters, and your broker cannot vote your shares on these proposals unless you have timely returned applicable voting instructions to your broker.

Abstentions have no effect on the outcome of voting for Proposal No. 1, election of directors. Abstentions are treated as shares present or represented and voting regarding Proposals No. 2, No. 3, and No. 4, so abstentions have the same effect as negative votes on those proposals.

|

14. |

Who counts or tabulates the votes? |

The votes of stockholders attending the 2016 Annual Meeting and voting in person will be counted or tabulated by an independent inspector of election. For our meeting, a representative of Broadridge Investor Communications Solutions, Inc. will tabulate votes cast by proxy and in person.

|

15. |

How do I access the proxy materials and annual report via the Internet? |

A Notice will be mailed or emailed with instructions on how to access proxy materials via the Internet. This proxy statement, the 2015 Annual Report, and related proxy materials for the 2016 Annual Meeting of Stockholders to be Held on June 23, 2016 will also be available electronically at http://ir.energyrecovery.com.

If you have previously chosen to receive the proxy materials via the Internet, you will be receiving an e-mail on or about May 11, 2016 with information on how to access stockholder information and instructions for voting over the Internet. Stockholders of record may vote via the Internet until 11:59 p.m. Eastern Daylight Time on June 22, 2016.

If your shares are registered in the name of a brokerage firm and you have not elected to receive proxy materials over the Internet, you may still be eligible to vote shares electronically over the Internet. Many brokerage firms participate in programs that provide eligible stockholders who receive a paper copy of the Proxy Statement and Annual Report the opportunity to vote via the Internet. If your brokerage firm participates in such a program, a form from the broker will provide voting instructions.

Stockholders can elect to view future Proxy Statements and Annual Reports over the Internet instead of receiving paper copies. Stockholders of record wishing to receive future stockholder materials electronically can elect this option by following the instructions provided when voting over the Internet at www.proxyvote.com.

Upon electing to view future Proxy Statements and Annual Reports over the Internet, you will receive an e-mail notification next year with instructions containing the Internet address of those materials. The choice to view future Proxy Statements and Annual Reports over the Internet will remain in effect until you contact your broker or the Company to rescind the instructions. Internet access does not have to be elected each year.

Stockholders who elected to receive this Proxy Statement electronically over the Internet and who would now like to receive a paper copy of this Proxy Statement so that they may submit a paper proxy in lieu of an electronic proxy should contact either their broker or the Company.

PROPOSALs to be voted on at the meeting

Proposal NO. 1

ELECTION OF DIRECTORS

As set by the Board of Directors under the Bylaws of the Company, the authorized number of directors of the Company will be eight as of the date of the 2016 Annual Meeting.

The Nominating and Corporate Governance Committee of the Board of Directors has recommended, and the Board of Directors has nominated, the nominees listed below for election as Class II directors at the 2016 Annual Meeting. If elected, each newly elected director will serve until the 2019 Annual Meeting of Stockholders, until each director’s successor is duly elected and qualified, or until the director’s earlier removal or resignation.

Each of the nominees are currently directors of the Company and each of the nominees named below has consented, if elected as a director of the Company, to serve until his term expires.

In the event that any nominee of the Company is unable or declines to serve as a director at the time of the 2016 Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of as many of the nominees listed below as possible. In such event, the specific nominees to be voted for will be determined by the proxy holders. The Board has no reason to believe that any of the persons named below will be unable or unwilling to serve as a director, if elected. Each of the two nominees for director who receives the greatest number of votes will be elected.

Set forth below are the names, ages, and certain biographical information relating to the Class II director nominees as of April 30, 2016.

|

Name of Nominee |

Age |

Position with Company |

Director Since |

|

Mr. Arve Hanstveit |

61 |

Director |

1995 |

|

Mr. Hans Peter Michelet |

56 |

Director and Chairman of the Board |

1995 |

Arve Hanstveit has served as a member of our Board of Directors since 1995. Between August 1997 and November 2010, Mr. Hanstveit served as Partner and Vice President of ABG Sundal Collier, a Scandinavian investment bank, where he was responsible for advising U.S. institutional investors on equity investments in Nordic companies. Prior to joining ABG Sundal Collier, Mr. Hanstveit worked as a securities analyst and as a portfolio manager for TIAA-Cref, a large U.S. institutional investor. From February 2007 to January 2010, Mr. Hanstveit served on the Board of Directors of Kezzler AS, a privately held Norwegian company, which delivers secure track and trace solutions. He is also a member of the Norwegian American Chamber of Commerce and the New York Angels, an independent consortium of individual accredited angel investors that provide equity capital for early-stage companies in the New York City area. Mr. Hanstveit holds a B.A. in Business from the Norwegian School of Management and an M.B.A. from the University of Wisconsin, Madison. The Board selected Mr. Hanstveit as a Director because of his early investment in the Company, his years of experience as a portfolio manager and securities analyst, his detailed understanding of global financial markets, and his extensive knowledge of the Company, its products, and markets.

Hans Peter Michelet joined the Board of Directors in August 1995 and was appointed Chairman of the Board in September 2004 and Executive Chairman in March 2008. From January 2005 to November 2007, Mr. Michelet served as our Interim Chief Financial Officer. Before joining our Board, Mr. Michelet was a senior manager with Delphi Asset Management, an asset management firm based in Norway and served as Chief Executive Officer of Fiba Nordic Securities, a Scandinavian investment bank. He also held management positions with Finanshuset and Storebrand Insurance Corporation. Mr. Michelet has been a member of the Board of Directors of SynchroNet Logistics Inc., a maritime technology service provider since June 2000 and a Director of Profunda AS, a commercial salmon farm. Mr. Michelet serves on the Board of IRIS Forskningsinvest AS as well as being the Chairman of the Board of Active Club Solutions Inc. Mr. Michelet holds a B.A. in Finance from the University of Oregon. The Board selected Mr. Michelet as a Director and its Chairman because of his experience as an investor and entrepreneur, his senior management experience in multi-cultural financial institutions, his strong organizational and leadership skills, and his knowledge of company operations and markets.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

BDO USA, LLP has been appointed by the Audit Committee to continue as the Company’s independent registered public accounting firm for the year ending December 31, 2016. Although the Company is not required to seek stockholder approval for its selection of independent registered public accounting firm, the Board believes that the practice constitutes sound corporate governance. If the appointment is not ratified, the Audit Committee will investigate the reasons for stockholder rejection and will reconsider its selection of independent registered public accounting firm.

A representative of BDO USA, LLP is expected to be present at the 2016 Annual Meeting. The representative will have an opportunity to make a statement and to respond to any questions.

Principal Accountant Fees and Services

The following table summarizes total fees that BDO USA, LLP, our independent registered public accounting firm, billed to us for its work in connection with fiscal years ended December 31, 2015 and 2014.

|

2015 |

2014 |

|||||||

|

Audit Fees (1) |

$ | 750,681 | $ | 741,668 | ||||

|

Total |

$ | 750,681 | $ | 741,668 | ||||

|

(1) |

Audit fees represent fees for professional services related to the performance of the integrated audit of our annual financial statements and internal control over financial reporting, review of our quarterly financial statements, and consents on SEC filings. |

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee pre-approves audit, audit-related, tax, and non-audit services provided by our independent registered public accounting firm, BDO USA, LLP and will not approve services that are impermissible under applicable laws and regulations. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision of that member to pre-approve specific services must be reported to the full Audit Committee at its next scheduled meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION

OF THE APPOINTMENT OF BDO USA, LLP AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

THE YEAR ENDING DECEMBER 31, 2016

PROPOSAL NO. 3

APPROVAL OF THE ENERGY RECOVERY, INC.

2016 INCENTIVE PLAN

The Board of Directors is asking our stockholders to approve the Energy Recovery, Inc. 2016 Incentive Plan (the “2016 Plan”). The 2016 Plan was approved by the Board of Directors on April 25, 2016 and will become effective upon receipt of stockholder approval at the Annual Meeting. The 2016 Plan will replace our Amended and Restated 2008 Equity Incentive Plan (the “2008 Equity Incentive Plan”), which was originally approved by stockholders in 2008 and subsequently approved by stockholders as amended and restated in 2012.

Background and Reasons for the Proposal

The Board of Directors believes that equity awards under the 2008 Equity Incentive Plan have contributed to strengthening the incentive of participating employees to achieve the objectives of the Company and its stockholders by encouraging employees to acquire a greater proprietary interest in the Company. The Board believes that the number of shares of common stock currently available under the 2008 Equity Incentive Plan is insufficient to meet our current and future equity compensation needs. Stockholder approval of the 2016 Plan is intended to ensure that we have sufficient shares available to attract and retain employees and to further our growth and development. For a discussion of equity awards as components of our executive compensation program, please refer to the “Compensation Discussion and Analysis” section below.

In setting the number of shares authorized for issuance under the 2016 Plan, the Compensation Committee and the Board of Directors considered a number of factors, including the number of outstanding equity awards, the number of shares available for grant under the 2008 Equity Incentive Plan, our historical granting practices, and the level of potential dilution that will result from adoption of the 2016 Plan.

In fiscal years 2013 to 2015, the Company used 5,635,771 of the shares authorized under the 2008 Equity Incentive Plan to make equity awards. The approximate annual “run rate” for fiscal years 2013 to 2015 was on average 3.6% per year, based on the number of shares subject to all equity awards granted under the 2008 Equity Incentive Plan during each of the three fiscal year periods divided by the average number of shares of common stock outstanding as reported in the Form 10-Ks for each of the three fiscal year periods.

Based on 52,215,481 shares outstanding as of March 31, 2016, if all 7,637,010 shares subject to outstanding awards under existing equity plans and all 677,076 shares available for future awards under the 2008 Equity Incentive Plan are ultimately issued, the stockholder dilution would be 13.7%. If all 3,830,000 shares authorized by the 2016 Plan are also ultimately issued, the stockholder dilution would be 18.9%. On the effective date of the 2016 Plan, all shares previously available for future awards under the 2008 Equity Incentive Plan as of that date will become available for issuance under the 2016 Plan, and no further awards will be made under the 2008 Equity Incentive Plan.

Based on a review of the Company’s historical practice, the recent trading price of our common stock, and advice from the Compensation Committee’s independent compensation consultant, Compensia, the Compensation Committee and the Board of Directors currently believe that the amounts authorized for issuance under the 2016 Plan will be sufficient to cover awards for up to three years. Our future share usage will depend on a number of factors, including the number of participants in the 2016 Plan, the price per share of our common stock, any changes to our compensation strategy, changes in business practices or industry standards, changes in the compensation practices of our competitors, changes in compensation practices in the market generally, and the methodology used to establish the equity award mix.

The closing sale price of a share of our common stock on the NASDAQ Global Select Market on March 31, 2016 was $10.34 per share.

Highlights of the 2016 Plan and Key Governance Provisions

The 2016 Plan includes several features that are consistent with the interests of our stockholders and sound corporate governance practices, including the following:

|

● |

Independent Compensation Committee. Awards under the 2016 Plan, as under the 2008 Equity Incentive Plan, will be administered by our Compensation Committee, which is composed entirely of independent directors who meet NASDAQ independence standards. | |

|

● |

Limit on nonemployee director awards. The value of shares and cash awards to an individual nonemployee director during any fiscal year may not exceed $500,000. |

|

● |

No recycling of shares or “liberal share counting” practices. Shares tendered to us or retained by us in the exercise or settlement of an award or for tax withholding may not become available again for issuance under the 2016 Plan. In addition, the gross shares subject to a stock appreciation right (SAR) award and not the net number of shares actually issued upon exercise counts against our plan reserve. |

|

● |

No repricing without stockholder approval. Repricing or other exchanges or buyouts of stock options and SARs are prohibited without prior stockholder approval. |

|

● |

No dividends on stock options or SARs. No dividends or dividend equivalents accrue on stock options or SARs. |

|

● |

No dividends on unearned performance awards. No dividends or dividend equivalents may be paid on performance-based awards before they are earned. |

|

● |

No discounted stock options or SARs. All stock options and SARs must be issued with an exercise or grant price at fair market value. |

|

● |

Awards subject to clawback. Awards under the 2016 Plan are subject to recoupment as provided in any clawback policy adopted by the Company. |

|

● |

No tax gross-ups. The 2016 Plan does not provide for the gross-up of any excise tax liability on 2016 Plan awards. |

|

● |

Double-trigger change in control vesting. Awards assumed by a successor company in connection with a change in control will not automatically vest and pay out solely as a result of the change in control. |

Summary of the 2016 Plan

The following description is a summary of some of the key provisions of the 2016 Plan, and it is qualified in its entirety by reference to the full text of the 2016 Plan, which is attached to this proxy statement as Appendix A.

Purposes of the 2016 Plan

The 2016 Plan is intended to promote our long-term success and the creation of stockholder value by encouraging employees, officers, directors, consultants, agents, advisors, and independent contractors to focus on critical long-range objectives; encouraging the attraction and retention of employees, officers, directors, consultants, agents, advisors, and independent contractors with exceptional qualifications; and linking employees, officers, directors, consultants, agents, advisors, and independent contractors directly to stockholder interests through increased stock ownership.

Administration

The 2016 Plan will be administered by the Board of Directors or the Board’s Compensation Committee, which must be composed of directors who meet the independence requirements of NASDAQ and at least two or more of whom are “non-employee directors” within the meaning of Rule 16b-3(b)(3) under the Exchange Act, and “outside directors” within the meaning of Section 162(m) of the Code. The Board may delegate concurrent administration of the 2016 Plan to different committees consisting of one or more members of the Board in accordance with the 2016 Plan’s terms. In addition, the Board or the Compensation Committee may delegate granting authority to one or more officers of the Company in accordance with the 2016 Plan’s terms. References to the “Committee” in this summary description are, as applicable, to the Board or the Compensation Committee, or other committees or officers authorized to administer the 2016 Plan.

The Committee is authorized to select the individuals to be granted awards, the types of awards to be granted, the number of shares to be subject to awards, and the other terms, conditions, and provisions of such awards, as well as to interpret and administer the 2016 Plan and any award or agreement entered into under the 2016 Plan.

Eligibility

Awards may be granted under the 2016 Plan to employees, officers, directors, consultants, agents, advisors, and independent contractors of the Company and its related companies selected by the Committee. As of March 31, 2016, approximately120 people were eligible to receive grants under the 2016 Plan.

Number of Shares Authorized

Subject to adjustment as provided in the 2016 Plan, the number of shares of common stock initially authorized for issuance under the 2016 Plan is:

|

● |

3,830,000 shares, plus |

|

● |

Up to 670,000 shares available for issuance or subject to outstanding awards under the 2008 Equity Incentive Plan as of the date of stockholder approval of the 2016 Plan and up to 7,635,410 shares then subject to outstanding awards under the 2008 Equity Incentive Plan that subsequently cease to be subject to such awards (other than by reason of exercise or settlement of the awards in shares) will automatically become available for issuance under the 2016 Plan. |

Of the various categories of awards available for issuance under the 2016 Plan, the number of shares of common stock that may be issued upon the exercise of incentive stock options, subject to adjustment as provided in the 2016 Plan, is limited to 3,830,000 shares.

The shares of common stock issuable under the 2016 Plan will consist of authorized and unissued shares or shares now held or subsequently acquired by the Company as treasury shares.

Limitations on Director Awards

The aggregate amount of compensation granted during any fiscal year of the Company to any director who is not an employee of the Company, including any equity awards and any cash retainers or fees, may not exceed $500,000.

Share Counting

If any award lapses, expires, terminates, or is canceled prior to the issuance of shares or if shares are issued under the 2016 Plan and thereafter are forfeited to the Company, the shares subject to such awards and the forfeited shares shall again be available for issuance under the 2016 Plan. The following shares will not become available for issuance under the 2016 Plan:

|

|

• |

shares tendered by a participant as full or partial payment upon exercise of a stock option; |

|

|

• |

the gross number of shares subject to any grant of SARs; and |

|

|

• |

shares withheld by, or otherwise tendered to, the Company to satisfy a participant’s tax withholding obligations with respect to the grant, vesting, or exercise of an award. |

Awards granted in assumption of or in substitution for awards previously granted by an acquired company will not reduce the number of shares authorized for issuance under the 2016 Plan.

Types of Awards

The 2016 Plan permits the granting of any or all of the following types of awards:

Stock Options. Stock options entitle the holder to purchase a specified number of shares of common stock at a specified price, which is called the exercise price, subject to the terms and conditions of the stock option grant. The Committee may grant either incentive stock options, which must comply with Section 422 of the Code, or nonqualified stock options. The Committee sets exercise prices and terms, except that stock options must be granted with an exercise price not less than 100% of the fair market value of our common stock on the date of grant (excluding stock options granted in connection with assuming or substituting stock options in acquisition transactions). Unless the Committee determines otherwise, fair market value means, as of a given date, the closing price of our common stock. At the time of grant, the Committee determines when stock options are exercisable and what the term of the stock options will be, except that the term cannot exceed ten years.

In the event of termination of service with the Company or a related company, a participant will be able to exercise his or her stock option for the period of time and on the terms and conditions determined by the Committee and stated in the stock option agreement.

Stock Appreciation Rights (SARs). The Committee may grant SARs as a right in tandem with the number of shares underlying stock options granted under the 2016 Plan or as a freestanding award. Upon exercise, SARs entitle the holder to receive payment per share in stock or cash, or in a combination of stock and cash, equal to the excess of the share’s fair market value on the date of exercise over the grant price of the SAR. The grant price of a tandem SAR is equal to the exercise price of the related stock option, and the grant price for a freestanding SAR is determined by the Committee in accordance with the procedures described above for stock options. Exercise of an SAR issued in tandem with a stock option will reduce the number of shares underlying the related stock option to the extent of the SAR exercised. The term of a freestanding SAR cannot be more than ten years, and the term of a tandem SAR cannot exceed the term of the related stock option.

Stock Awards, Restricted Stock, and Stock Units. The Committee may grant awards of shares of common stock or awards designated in units of common stock. These awards may be made subject to repurchase or forfeiture restrictions at the Committee’s discretion. The restrictions may be based on continuous service with the Company or the achievement of specified performance criteria, as determined by the Committee. Stock units may be paid in stock or cash or a combination of stock and cash, as determined by the Committee.

Performance Awards. The Committee may grant performance awards in the form of performance shares or performance units. Performance shares are units valued by reference to a designated number of shares of common stock. Performance units are units valued by reference to a designated amount of property other than shares of common stock. Performance shares and performance units may be payable upon the attainment of performance criteria and other terms and conditions as established by the Committee. Performance awards may be payable in stock, cash or other property, or a combination thereof.

Other Stock- or Cash-Based Awards. The Committee may grant other incentives denominated in shares of common stock or in cash, which may be payable in shares of common stock or cash or a combination of both, subject to the terms of the 2016 Plan and any other terms and conditions determined by the Committee.

No Repricing Without stockholder approval, the Committee is not authorized to (a) lower the exercise or grant price of an option or SAR after it is granted, except in connection with certain adjustments to our corporate or capital structure permitted by the 2016 Plan, such as stock splits, (b) cancel a stock option or SAR at a time when its exercise or grant price exceeds the fair market value of the underlying stock, in exchange for cash, another stock option or SAR, restricted stock or other equity award, unless the cancellation and exchange occur in connection with a merger, acquisition, spin-off or similar corporate transaction, or (c) take any other action that is treated as a repricing under generally accepted accounting principles.

Performance-Based Compensation Under Section 162(m)

Performance Goals and Criteria. Under Section 162(m) of the Code, we are generally prohibited from deducting compensation paid to our principal executive officer and our three other most highly compensated executive officers (other than our principal financial officer) in excess of $1 million per person in any year. However, compensation that qualifies as “performance-based” is excluded for purposes of calculating the amount of compensation subject to the $1 million limit. If the 2016 Plan is approved by our stockholders, the Compensation Committee will have the flexibility to grant awards under the 2016 Plan that are intended to qualify as “performance-based” compensation under Section 162(m) of the Code.

For awards intended to qualify as “performance-based” compensation under Section 162(m) of the Code, the performance criteria must be set by the Compensation Committee at the start of each performance period and must be based on one or a combination of two or more of the following performance criteria as reported or calculated by the Company: cash flows (including, but not limited to, operating cash flow, free cash flow or cash flow return on capital); working capital; earnings per share; book value per share; operating income (including or excluding depreciation, amortization, items that are unusual in nature or infrequently occurring or both, restructuring charges, or other expenses); revenues; operating margins; return on assets; return on equity; debt; debt plus equity; market or economic value added; stock price appreciation; total stockholder return; cost control; strategic initiatives; market share; net income; return on invested capital; improvements in capital structure; or customer satisfaction, employee satisfaction, services performance, subscriber, cash management, or asset management metrics.

The performance goals also may be based on the achievement of specified levels of performance for the Company as a whole (or of any affiliate or business unit) under one or more of the performance criteria described above relative to the performance of other corporations.

The Compensation Committee may provide in any award of performance-based compensation that any evaluation of performance may include or exclude any of the following events that occur during a performance period: asset write-downs; litigation or claim judgments or settlements; the effect of changes in tax law or rate on deferred tax liabilities, accounting principles, or other laws or provisions affecting reported results; any reorganization and restructuring programs; items that are unusual in nature or infrequently occurring or both that the Company identifies in its audited financial statements, including notes to the financial statements, or the Management’s Discussion and Analysis section of our periodic reports; acquisitions or divestitures; foreign exchange gains and losses; gains and losses on asset sales; and impairments.

With respect to any award intended to be performance-based compensation, the Compensation Committee must establish and administer the performance criteria in a manner that satisfies the requirements of Section 162(m) of the Code.

Adjustments. Awards that are intended to qualify as “performance-based” compensation under Section 162(m) of the Code may be adjusted downwards but not upwards. In addition, achievement of the applicable performance goals related to an award may not be waived, except in the case of the participant’s death or disability. Section 162(m) of the Code requires that a qualifying committee certify that performance goals were achieved before the payment of the “performance-based” compensation.

Limitations. Subject to certain adjustment as provided in the 2016 Plan, participants who are granted equity-based awards intended to qualify as “performance-based” compensation may not be granted awards for more than 750,000 shares of common stock in any calendar year. However, additional one-time grants of such awards may be granted for up to 300,000 additional shares to newly hired or newly promoted individuals. The maximum dollar value payable to any participant with respect to performance units or any other awards denominated in cash that are intended to qualify as “performance-based” compensation cannot exceed $7,500,000 in any calendar year.

Change in Control

Effect of Change in Control. Under the 2016 Plan, the Committee may provide for the vesting acceleration of an award upon a change in control of the Company, whether or not the award is assumed by the successor corporation, or upon a termination of a participant’s employment following a change in control. A change in control includes:

|

● |

A merger, consolidation, or other reorganization of our company after which our stockholders own 50% or less of the surviving corporation or its parent company; |

|

● |

a sale of all or substantially all of our assets; |

|

● |

a change in the composition of the Board of Directors, as a result of which less than 50% of the incumbent directors either had been directors 12 months before the change in composition of the Board or were appointed or nominated by the Board by a majority of the directors who had been directors 12 months before or had been selected in this manner; or |

|

● |

an acquisition of 50% or more of our outstanding stock by any person or group other than a person related to our company, such as a holding company owned by our stockholders. |

Unless the Committee determines otherwise in the instrument evidencing an award or in a written employment, services or other agreement between a participant and the Company or a related company, in the event that we are a party to a merger or consolidation in which options or awards are not continued or assumed or substituted with comparable awards by the surviving corporation, all outstanding options or awards will be subject to the agreement of merger or consolidation, which shall provide for one or more of the following:

|

● |

The acceleration of vesting of 100% of the then unvested portion of the common stock subject to any outstanding options and stock appreciation rights. |

|

● |

The cancellation of all outstanding options and stock appreciation rights in exchange for a payment to the holders thereof equal to the excess of (i) the fair market value of the common shares subject to such options and stock appreciation rights over (ii) their exercise price. Such payment shall be made in the form of cash, cash equivalents, or securities of the surviving corporation or its parent. |

|

● |

The cancellation of all outstanding stock units and a payment to the holders thereof equal to the fair market value of the common stock subject to such stock units. Such payment shall be made in the form of cash, cash equivalents, or securities of the surviving corporation or its parent. |

Adjustments

If any change is made in the stock subject to the Plan, or subject to any award, without the receipt of consideration by us (through stock dividend, stock split, spin-off, combination or exchange of shares, recapitalization, merger, consolidation, distribution to stockholders other than a normal cash dividend or other change in our corporate or capital structure not involving the receipt of consideration by us), or in the event of an extraordinary cash dividend, then the Committee shall make proportional adjustments to (a) the maximum number and kind of securities available for issuance under the Plan, (b) the maximum number and kind of securities issuable as incentive stock options, (c) the maximum number and kind of securities issuable as “performance-based” compensation under Section 162(m) of the Code and (d) the number and kind of securities subject to any outstanding awards and/or the per share price of such securities.

Term, Termination, and Amendment

Unless earlier terminated by the Board or the Compensation Committee, the 2016 Plan will terminate, and no further awards may be granted, ten years after the date on which it is approved by stockholders. The Board or the Compensation Committee may amend, suspend, or terminate the 2016 Plan at any time, except that, if required by applicable law, regulation, or stock exchange rule, stockholder approval will be required for any amendment, and only the Board may amend the 2016 Plan if stockholder approval of the amendment is required. The amendment, suspension or termination of the 2016 Plan or the amendment of an outstanding award generally may not, without a participant’s consent, materially adversely affect any rights under an outstanding award.

Recoupment of Awards

Awards made under the 2016 Plan are subject to the requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act and any implementing rules and regulations regarding the recoupment or clawback of incentive compensation, similar rules and laws in other jurisdictions, and any compensation recoupment or clawback policies we may have in place from time to time.

U. S. Federal Income Tax Considerations

The following is a general summary of the U.S. federal income tax consequences of awards under the 2016 Plan to us and to participants in the 2016 Plan who are citizens or residents of the United States for U.S. federal tax purposes. The summary is based on the Code, applicable Treasury Regulations and administrative and judicial interpretations thereof, each as in effect on the date of this proxy statement and is, therefore, subject to future changes in the law, possibly with retroactive effect. The summary is general in nature and does not purport to be legal or tax advice. Furthermore, the summary does not address issues relating to any U.S. gift or estate tax consequences or the consequences of any state, local, or foreign tax laws.

Nonqualified Stock Options. A participant generally will not recognize taxable income upon the grant or vesting of a nonqualified stock option with an exercise price at least equal to the fair market value of our common stock on the date of grant and no additional deferral feature. Upon the exercise of a nonqualified stock option, a participant generally will recognize compensation taxable as ordinary income in an amount equal to the difference between the fair market value of the shares underlying the option on the date of exercise and the option exercise price. When a participant sells the shares acquired upon exercise, the participant will have short-term or long-term capital gain or loss, as the case may be, equal to the difference between the amount the participant received from the sale and the tax basis of the shares sold. The tax basis of the shares generally will be equal to the greater of the fair market value of the shares on the exercise date or the option exercise price.

Incentive Stock Options. A participant generally will not recognize taxable income upon the grant of an incentive stock option. If a participant exercises an incentive stock option during employment as an employee or within three months after his or her employment ends (12 months in the case of permanent and total disability), the participant will not recognize taxable income at the time of exercise for regular U.S. federal income tax purposes (although the participant generally will have taxable income for alternative minimum tax purposes at that time as if the option were a nonqualified stock option). If a participant sells or otherwise disposes of the shares acquired upon exercise of an incentive stock option after the later of (a) one year from the date the participant exercised the option and (b) two years from the grant date of the option, the participant generally will recognize long-term capital gain or loss equal to the difference between the amount the participant received in the disposition and the option exercise price. If a participant sells or otherwise disposes of shares acquired upon exercise of an incentive stock option before these holding period requirements are satisfied, the disposition will constitute a “disqualifying disposition,” and the participant generally will recognize taxable ordinary income in the year of disposition equal to the excess of the fair market value of the shares on the date of exercise over the option exercise price (or, if less, the excess of the amount realized on the disposition of the shares over the option exercise price). The balance of the participant’s gain on a disqualifying disposition, if any, will be taxed as short-term or long-term capital gain, as the case may be.

With respect to both nonqualified stock options and incentive stock options, special rules apply if a participant uses shares of our common stock already held by the participant to pay the exercise price or if the shares received upon exercise of the option are subject to a substantial risk of forfeiture by the participant.

Stock Appreciation Rights. A participant generally will not recognize taxable income upon the grant or vesting of an SAR with a specified grant price at least equal to the fair market value of our common stock on the date of grant and no additional deferral feature. Upon the exercise of an SAR, a participant generally will recognize compensation taxable as ordinary income in an amount equal to the difference between the fair market value of the shares underlying the SAR on the date of exercise and the specified grant price of the SAR. When a participant sells any shares acquired upon exercise, the participant generally will have short-term or long-term capital gain or loss, as the case may be, equal to the difference between the amount the participant received from the sale and the tax basis of the shares sold. The tax basis of the shares generally will be equal to the greater of the fair market value of the shares on the exercise date or the total base value.

Restricted Stock Awards. A recipient of a restricted stock award generally will recognize compensation taxable as ordinary income when the shares cease to be subject to restrictions in an amount equal to the excess of the fair market value of the shares on the date the restrictions lapse over the amount, if any, paid by the participant with respect to the shares.

Instead of postponing the federal income tax consequences of a restricted stock award until the restrictions lapse, the participant may elect to recognize compensation taxable as ordinary income in the year of the award in an amount equal to the fair market value of the shares at the time of receipt. This election is made under Section 83(b) of the Code. A Section 83(b) election is made by filing a written notice with the Internal Revenue Service office with which the participant files his or her federal income tax return. The notice must be filed within 30 days of the date of grant of the restricted stock award for which the election is made and must meet certain technical requirements.

The tax treatment of a subsequent disposition of restricted stock will depend upon whether the participant has made a timely and proper Section 83(b) election. If the participant makes a timely and proper Section 83(b) election, when the participant sells the restricted shares, the participant will have short-term or long-term capital gain or loss, as the case may be, equal to the difference between the amount the participant received from the sale and the tax basis of the shares sold. If no Section 83(b) election is made, any disposition after the restrictions lapse generally will result in short-term or long-term capital gain or loss, as the case may be, equal to the difference between the amount the participant received from the sale and the tax basis of the shares sold. The tax basis of the shares generally will be equal to the amount, if any, paid by the participant with respect to the shares, plus the amount of taxable ordinary income recognized by the participant either at the time the restrictions lapsed or at the time of the Section 83(b) election, as the case may be. If the participant forfeits the shares to the Company (e.g., upon the participant’s termination prior to expiration of the restriction period), the participant may not claim a deduction with respect to the income recognized as a result of making a Section 83(b) election.

Restricted Stock Units. A participant generally will not recognize income at the time a restricted stock unit is granted. When any part of a restricted stock unit is issued or paid, the participant generally will recognize compensation taxable as ordinary income at the time of such issuance or payment in an amount equal to the cash and then fair market value of any shares the participant receives.

Performance Share or Performance Unit Awards. A participant generally will not recognize income at the time a performance share or performance unit award is granted. When any part of a performance share or performance unit award is issued or paid, the participant generally will recognize compensation taxable as ordinary income at the time of such issuance or payment in an amount equal to the cash and then fair market value of any shares the participant receives.

Other Awards. The U.S. federal income tax consequences of other awards under the 2016 Plan will depend upon the specific terms of each award.

Tax Consequences to Us. In the foregoing cases, we generally will be entitled to a deduction at the same time, and in the same amount, as a participant recognizes ordinary income, subject to certain limitations imposed under the Code.

Section 409A of the Code. We intend that awards granted under the 2016 Plan comply with, or otherwise be exempt from, Section 409A of the Code, but make no representation or warranty to that effect.

Section 162(m) of the Code. Under Section 162(m) of the Code, we are generally prohibited from deducting compensation paid to our Chief Executive Officer and three other most highly compensated executive officers (other than the Chief Financial Officer) in excess of $1 million per person in any year. Compensation that qualifies as “performance-based” is excluded for purposes of calculating the amount of compensation subject to the $1 million limit. If the 2016 Plan is approved by our stockholders, the Compensation Committee will have the flexibility to grant awards under the 2016 Plan that are intended to qualify as “performance-based” compensation under Section 162(m) of the Code.

Tax Withholding. We are authorized to deduct or withhold from any award granted or payment due under the 2016 Plan, or require a participant to remit to us, the amount of any withholding taxes due in respect of the award or payment and to take such other action as may be necessary to satisfy all obligations for the payment of applicable withholding taxes. We are not required to issue any shares of our common stock or otherwise settle an award under the 2016 Plan until all tax withholding obligations are satisfied.

Plan Benefits

All awards to employees, officers, and consultants under the 2016 Plan are made at the discretion of the Compensation Committee. Therefore, the benefits and amounts that will be received or allocated to such individuals under the 2016 Plan are not determinable at this time. However, please refer to the description of grants made to our named executive officers in the last fiscal year described in the “Grants of Plan-Based Awards in 2015” table below. Grants made to our non-employee directors in the last fiscal year are described under “Director Compensation” below.

THE BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE

ENERGY RECOVERY, INC. 2016 INCENTIVE PLAN.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth equity compensation plan information as of December 31, 2015.

|

Plan Category |

|

Number of Securities to Be Issued Upon Exercise of Outstanding Options, Warrants, and Rights |

|

|

Weighted- Average Exercise Price of Outstanding Options, Warrants, and Rights |

|

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in the First Column) |

| |||

|

Equity compensation plans approved by security holders (1) |

|

|

7,198,479 |

|

|

$ |

3.97 |

|

|

|

1,536,009 |

|

|

Equity compensation plans not approved by security holders |

|

None |

|

|

Not applicable |

|

|

Not applicable |

| |||

|

|

(1) |

Represents shares of the Company’s common stock issuable upon exercise of options outstanding under the following equity compensation plans: the 2006 Stock Option/Stock Issuance Plan and the 2008 Equity Incentive Plan. Does not include shares authorized for issuance under the proposed 2016 Plan. |

PROPOSAL NO. 4

ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION

The Compensation Discussion and Analysis beginning on page 25 of this Proxy Statement describes the Company’s executive compensation program and the compensation decisions made by the Compensation Committee for our fiscal year ended December 31, 2015 with respect to the executive officers named in the Summary Compensation Table on page 32. The Board of Directors is asking our stockholders to cast a non-binding advisory vote to approve the following resolution:

“RESOLVED, that the stockholders of Energy Recovery, Inc. approve the compensation of the executive officers named in the Summary Compensation Table for 2015, as disclosed in the Company’s Proxy Statement for the 2016 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and the related footnotes and narratives accompanying the tables).”

The Board is asking our stockholders to vote “FOR” this proposal because it believes that the policies and practices described in the Compensation Discussion and Analysis section are necessary to achieve the Company’s primary objective of the executive compensation program, that of attracting, retaining, and motivating the talent we need to meet and/or exceed the strategic, operational, and financial goals of the Company. Additionally, we want to reward superior performance and align the long term interests of our executives with our stockholders.

Although your vote on this proposal is advisory and non-binding, the Compensation Committee values the views of our stockholders and will take into account the outcome of the vote when considering future compensation decisions for our named executive officers. We are providing this advisory vote pursuant to Section 14A of the Securities Exchange Act of 1934.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NO. 4

BOARD AND CORPORATE GOVERNANCE MATTERS

Board of Directors

Our Board of Directors (the “Board”) is divided into three classes, with each class serving for a staggered three-year term. As of the date of the 2016 Annual Meeting, the Board consists of:

|

Committee Memberships | |||||||

|

Director |

Class I |

Class II |

Class III |

Audit |

Compensation |

Nominating & Corporate Governance | |

|

Mr. Alexander J. Buehler |

X |

||||||

|

Mr. Olav Fjell |

X |

Member |

Member |

Member | |||

|

Mr. Joel Gay |

X |

||||||

|

Mr. Arve Hanstveit |

X |

Member |

Chairman |

||||

|

Mr. Ole Peter Lorentzen |

X |

Member |

Member | ||||

|

Mr. Robert Yu Lang Mao |

X |

Member |

|||||

|

Mr. Hans Peter Michelet |

X |

Member |

Chairman | ||||

|

Mr. Dominique Trempont |

X |

Chairman |

Member |

Member | |||

At each annual meeting of stockholders, a class of directors is elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The term of the Class I directors ends at the annual meeting in 2018. The term of the Class II directors ends at the upcoming annual meeting in June 2016, and the term of the Class II directors elected at that meeting will end at the annual meeting in 2019. The term of the Class III directors ends at the annual meeting in 2017.

Director Independence

Our Board has determined that Mr. Fjell, Mr. Hanstveit, Mr. Lorentzen, Mr. Mao, Mr. Michelet and Mr. Trempont, representing a majority of our directors, are “independent directors” as defined in the listing rules of the NASDAQ Global Market LLC. Consistent with the principles of the NASDAQ listing rules, the Board has also determined that ownership of the Company’s stock by a director is not inconsistent with a determination of independence. Mr. Buehler is not an “independent director” as he was employed by the Company within the past three years.

Relationships Among Directors or Executive Officers

There are no family relationships among any of the directors or executive officers of the Company.

Committees and Meetings of the Board of Directors

During the year ended December 31, 2015, the Board met thirteen times. The Board has three committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. During the year ended December 31, 2015, no director attended fewer than 75% of all the meetings of the Board or its committees on which he or she served after becoming a member. The Company encourages, but does not require, its directors to attend the annual meeting of stockholders. In 2015, all of our Directors attended our annual meeting.

The Audit Committee

The Audit Committee held four meetings in the year ended December 31, 2015. The Audit Committee is responsible for assisting the full Board in fulfilling its oversight responsibilities relating to:

|

|

● |

overseeing the accounting and financial reporting processes and audits of our financial statements; |

|

● |

selecting and hiring our independent registered public accounting firm and approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

|

● |

assisting the Board in monitoring the integrity of our financial statements, our internal accounting and financial controls, our compliance with legal and regulatory requirements, and the qualifications, independence, and performance of our independent registered public accounting firm; |

|

● |

providing to the Board information and materials to make the Board aware of significant financial and audit-related matters that require attention; and |

|

● |

reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and annual and quarterly reports on Forms 10-K and 10-Q. |

The Board has determined that all members of the Audit Committee are independent directors as defined in the listing rules of NASDAQ. The Board has further determined that Mr. Trempont is an “audit committee financial expert” as defined by SEC rules. The Board has adopted and approved a charter for the Audit Committee, a copy of which can be viewed on the Company’s website at www.energyrecovery.com under the Investor Relations tab.

The Compensation Committee

The Compensation Committee held five meetings in the year ended December 31, 2015. The Compensation Committee is responsible for, among other things:

|

|

● |

reviewing and approving, with respect to our Chief Executive Officer and other executive officers, annual base salaries, annual incentive bonuses, equity compensation, employment agreements, severance arrangements, change of control agreements/provisions, and any other benefits, compensation, or arrangements; |

|

● |

administering our Equity Incentive Plan and other employee benefit plans as may be adopted by us from time to time; and |

|

● |

recommending inclusion of the Compensation Discussion and Analysis in the Proxy Statement and our Annual Report on Form 10-K. |

The Board has determined that all members of the Compensation Committee are independent directors as defined in the listing rules of NASDAQ. The Board has adopted and approved a charter for the Compensation Committee, a copy of which can be viewed on the Company’s website at www.energyrecovery.com under the Investor Relations tab.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee held one meeting in the year ended December 31, 2015. The Nominating and Corporate Governance Committee is responsible for:

|

|

● |

assisting in identifying prospective director nominees and recommending to the Board nominees for each annual meeting of stockholders; |

|

● |

evaluating the performance of current members of the Board; |

|

● |

developing principles of corporate governance and recommending them to the Board; |

|

● |

recommending to the Board persons to be members of each committee; and |

|

● |

overseeing the evaluation of the Board and management. |

The Nominating and Corporate Governance Committee operated under a written charter setting forth the functions and responsibilities of the Committee. A copy of the charter can be viewed on the Company’s website at www.energyrecovery.com under the Investor Relations tab. The Board has determined that all members of the Nominating and Corporate Governance Committee are independent directors as defined in the listing rules of NASDAQ.