Exhibit 10.44

ENERGY RECOVERY INC

ANNUAL INCENTIVE PLAN (AIP)

A. SCOPE

This Annual Incentive Plan (the “Plan”) of Energy Recovery, Inc. (the “Company”) and its subsidiaries is effective as of January 1, 2012 and covers eligible employees designated by the Company and approved by the Compensation Committee of the Board of Directors (the “Compensation Committee”). The Plan shall continue until terminated in accordance with paragraph J. This Plan replaces and supersedes any and all other agreements for participants in this Plan, representations or understandings (either written or oral), with respect to incentive compensation.

B. PURPOSE

The purpose of the Plan is to encourage the performance and retention of eligible employees in recognition of individual achievement that contributes to the strategic and financial success of the Company.

Full-time, regular employees, unless otherwise required by applicable law, who do not participate in the Company’s Sales Incentive Plan, and who are employed as of October 1 of the applicable Plan Year (as defined below) are eligible to be selected as participants in the Plan (“Participants”). A committee comprised of the Company’s Chief Executive Officer, Chief Financial Officer, and Human Resources Manager the “Plan Committee”), as administrator of the Plan, shall designate among the eligible employees of the Company and its subsidiaries described in the preceding sentence who are to be participants (the “Participants”) in the Plan for the applicable fiscal year (the “Plan Year”). Participation in the Plan in one Plan Year is not a guarantee of participation in a future Plan Year.

D. INDIVIDUAL TARGETS

The Plan Committee will establish an incentive award target (“Individual Target”) for each Participant that shall be expressed as a percentage of such Participant’s annual base compensation. For exempt employees, the percentage will be of the Participant’s annual base compensation that is in effect as of the first day of the Plan Year, or if later, when an Eligible Employee becomes a Participant. For non-exempt employees, the percentage will be of the Participant’s wages for the Plan Year, inclusive of regular and overtime wages. Individual Targets will be reviewed and approved by the Plan Committee on an annual basis, and the Compensation Committee will approve Individual Targets for all executive officers of the Company.

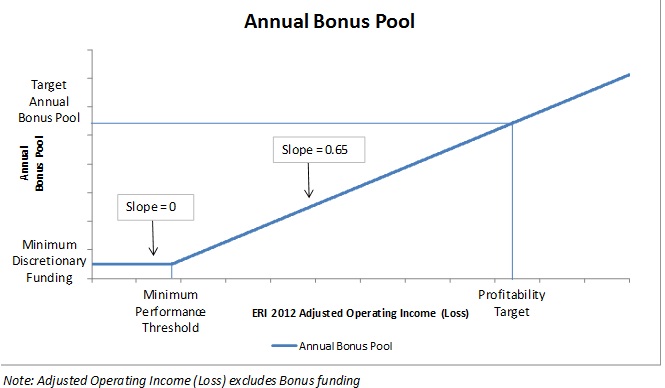

E. ANNUAL BONUS POOL

Except as may otherwise be set forth herein or as determined by the Plan Committee under certain circumstances, the aggregate amount allocated for payment of bonuses under the Plan is based on corporate performance as measured by the actual attainment level of the Adjusted Operating Income (Loss) for the associated Plan Year (the “Annual Bonus Pool”). Through the annual budgeting process, the Board of Directors of the Company (the “Board”) will approve the corporate target for Adjusted Operating Income (Loss) (the “Profitability Target”), and the Annual Bonus Pool will be determined by comparing the actual Adjusted Operating Income (Loss) achieved during the Plan Year to the Profitability Target approved by the Board. The “Target Annual Bonus Pool”, which shall be equal to the aggregate amount of the Individual Targets for the entire population of Participants designated to participate with respect to a Plan Year, will become payable upon 100% achievement of the Profitability Target specified in the approved budget for the associated Plan Year. For actual performance above or below the Profitability Target, the Annual Bonus Pool will be calculated based on the formula described in Paragraph G below. The Company shall accrue for accounting purposes for payment of awards under the Plan on a monthly basis in accordance with the Plan Committee’s assessment of interim results as compared to the comparable Profitability Target.

F. ADJUSTED OPERATING INCOME (LOSS)

For purposes of this Plan, “Adjusted Operating Income (Loss)” shall be defined as “operating income (Loss) before bonus expense and extraordinary items” of the Company for the Plan Year. Specifically, Adjusted Operating Income (Loss) shall reflect the consolidated operating income of the Company during the fiscal year, as determined by the Plan Committee in conformity with accounting principles generally accepted in the United States of America and contained in financial statements that are subject to an audit report of the Company's independent public accounting firm, but excluding:

(i) the accrued bonus expense under the provisions of this Plan;

(ii) transaction and financing costs associated with an acquisition or in anticipation thereof;

(iii) restructuring costs for an initiative approved by the Board;

(iv) losses associated with the write-down of assets of a subsidiary, business unit, or division that has been designated by the Board as a discontinued business operation or to be liquidated;

(v) gains or losses on the sale of any subsidiary, business unit or division, or the assets or business thereof;

(vi) gains or losses from the disposition of material capital assets (other than in a transaction described in subsection (iii) through (v) above;

(vii) the refinancing of indebtedness, including, among other things, any make-whole payments and prepayment fees;

(viii) losses associated with the write-down of goodwill or other intangible assets of the Company due to the determination under applicable accounting standards that the assets have been impaired;

(ix) any income statement effect resulting from a change in generally accepted accounting principles, except to the extent that the effect of such a change is already reflected in the Profitability Target;

(x) any other material income or loss item, the realization of which is not directly attributable to the actions of current senior management of the Company; and

(xi) other extraordinary or unpredicted items proposed by the Plan Committee and accepted by the Compensation Committee.

The Compensation Committee shall have final authority with respect to any determination by the Plan Committee regarding the definition of “Adjusted Operating Income (Loss)” and, in exercising such authority, may consult with the Company’s independent auditor and/or Audit Committee as it deems necessary and advisable.

G. ANNUAL BONUS POOL DETERMINATION

At the onset of each Plan Year, the Compensation Committee shall determine the Profitability Target and Target Annual Bonus Pool. The actual amount that becomes payable under the Plan shall be determined upon calculation of Adjusted Operating Income (Loss) at the end of the Plan Year, subject to any adjustments required pursuant to Section G herein.

|

|

·

|

If Adjusted Operating Income (Loss) equals the Profitability Target, 100% of the Annual Bonus Pool will become payable.

|

|

|

·

|

If Adjusted Operating Income (Loss) exceeds the Profitability Target, the Annual Bonus Pool will be calculated based on the allocation curve as illustrated in Exhibit A.

|

|

|

·

|

If Adjusted Operating Income (Loss) exceeds 75%, but is less than 100%, of the Profitability Target, the Annual Bonus Pool will be calculated based on the allocation curve as illustrated in Exhibit A.

|

|

|

·

|

If Adjusted Operating Income (Loss) is less than 75% of the Profitability Target, the Annual Bonus Pool will be equal to minimum discretionary funding established and approved by the Compensation Committee; provided, however, that such minimum amount shall only be awarded to individual Participants for extraordinary performance as determined by the Plan Committee and approved by the Compensation Committee.

|

The “Allocation Ratio,” which is defined as the Annual Bonus Pool divided by the Target Annual Bonus Pool, will be applied for computation of individual bonus payments made to Participants. To derive the Allocation Ratio for the purposes of calculating individual bonus payments, the Company will use the allocation curve depicted in Exhibit A. While there shall be no maximum allocation amount for the Annual Bonus Pool, the Compensation Committee, subject to any required approval of the Board, shall have the ability and authority to increase or decrease the amount of the Annual Bonus Pool calculated in accordance with the provisions of this Plan to reflect any extraordinary or unforeseen events or occurrences during the Plan Year. In addition, amounts payable are subject to adjustment at the sole discretion of the Plan Committee, and any amounts payable may be increased or reduced, including to zero.

H. BONUS CALCULATION

A Participant’s bonus payment under this Plan shall be calculated using the following formula:

BONUS = BASE x IND TARGET x ALLOCATION RATIO x IND ACH x PRORATION

Where:

|

|

·

|

BASE represents the Participant’s compensation as defined in Paragraph D;

|

|

|

·

|

IND TARGET represents the Participant’s Individual Target as defined in Paragraph D;

|

|

|

·

|

ALLOCATION RATIO equals the Annual Bonus Pool divided by the Target Annual Bonus Pool and derived from the allocation curve in Exhibit A;

|

|

|

·

|

IND ACH represents the individual achievement for the Participant in question and is calculated from the supervisor’s assessment of the Participant’s performance against Measurable Business Objectives (“MBOs”) as documented in the Plan Year and approved by the Plan Committee; and

|

|

|

·

|

PRORATION represents the amount of time (in months) that the Participant worked for the Company during the Plan Year in an eligible position divided by twelve months.

|

For example, consider a Participant, hired on July 1, with a base salary of $100,000 and an Individual Target of 10%. During the Plan Year, the Company achieves Adjusted Operating Income (Loss) just below the Profitability Target, and the allocation curve depicted in Exhibit A yields an Allocation Ratio of 75%. Moreover, the Participant’s supervisor determines that the Participant achieved 90% of the targeted performance specified in his/her MBOs for the respective Plan Year. The bonus payment is calculated as follows:

BONUS = $100,000 x 0.10 x 0.75 x 0.90 x 0.50 = $3,375

To the extent permitted by applicable law, rules and regulations, the Company reserves the right to prorate the bonus award of any Participant who was not in an eligible position for the entire applicable Plan Year, or was not actively working full-time throughout the applicable Plan Year. Plan bonus awards, if any, will generally be prorated based on the number of full months (rounded to the nearest full month) that a Participant is working in an eligible position; however, the Company reserves the right, in its sole discretion, to prorate bonuses based on hours of service, days, or on any other basis. For example, the proration factor for a Participant who is eligible for the entire applicable Plan Year will be 1.00; for a Participant who is eligible to participate in the Plan for one-half of the Plan Year, the proration factor will be 0.50. In summary, Participants in the following situations may have a proration factor that is less than 1.00, to the extent permissible by applicable law: (a) new hires and individuals who transfer into an eligible position during the applicable Plan Year; (b) individuals who transfer between an eligible position and a non-eligible position within the Company; (c) Participants who work less than the applicable full-time standard work week; and (d) Participants who take a leave of absence, as described more fully below.

To the extent permitted by applicable law, rules and regulations, Participants who take unpaid days off or leaves of absence that are not protected by statute or other applicable law will have their bonus awards, if any, prorated based by the number of full months that such Participant is actively working in an eligible position.

I. TIMING OF AWARDS

Eligible Employees must be designated as Participants as of October 1 in a Plan Year to be eligible to participate in, and receive payment of an award, under the Plan for that same year, unless otherwise required by applicable law. A Participant who is employed after January 1 but prior to October 1 of a Plan Year shall only be eligible to receive an award prorated for the amount of time the Participant was employed by the Company in an eligible position during the Plan Year. Awards for a Plan Year are payable annually in cash and shall be earned and paid in the first quarter of the calendar year following the end of the corresponding Plan Year. Participants must be an employee in good standing at the time of the bonus payment to earn or receive the same; except where prohibited by applicable law, participants who involuntarily or voluntarily resign or otherwise terminate employment for any reason before the time the awards are paid will not be eligible to earn or receive payment of the bonus, prorated or otherwise.

J. NATURE OF PLAN

This Plan is a statement of intent and is not a contract. Moreover, it is not a guarantee of employment. U.S. Participants’ employment with the Company remains “at will.” This Plan may be modified, suspended, or terminated at any time, and all awards are at the discretion of the Board or the Compensation Committee, subject to applicable law. This Plan may be changed during a Plan Year or prior to bonus payments without any obligation of the Company to pay for the elapsed part of the Plan Year in the manner described in the Plan, subject to applicable law. The decisions of Company management, the Plan Committee, the Compensation Committee, and/or the Board in administering and interpreting the Plan are final and binding on all Participants. Information regarding an employee’s annual incentive payment will be part of the employee’s personnel record.

K. WITHHOLDING TAXES

Whenever the payment of an award is made, such payment shall be net of an amount sufficient to satisfy federal, state and local income and employment tax withholding requirements and authorized deductions as determined by the Plan Committee in its sole discretion.

L. NONASSIGNMENT; PARTICIPANTS ARE GENERAL CREDITORS

Except as otherwise provided by the Plan Committee in its sole discretion, the interest of any Participant under the Plan shall not be assignable or transferable either by voluntary or involuntary assignment or by operation of law and any attempted assignment shall be null, void, and of no effect.

Amounts paid under the Plan shall be paid from the general funds of the Company, and each Participant shall be no more than an unsecured general creditor of the Company with no special or prior right to any assets of the Company for payment of any obligations hereunder. Nothing contained in the Plan shall be deemed to create a trust of any kind for the benefit of any Participant or create any fiduciary relationship between the Company and any Participant with respect to any assets of the Company.

M. SUCCESSORS AND ASSIGNS

This Plan shall be binding on the Company and Participant and their respective successors, permitted assigns, executors, administrators, and legal representatives.

N. CODE SECTION 409A

The Plan and all Awards made hereunder shall be interpreted, construed and operated to reflect the intent of the Company that all aspects of the Plan and the Awards shall be interpreted to be exempt from the provisions of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and any regulations and other guidance thereunder. This Plan may be amended at any time, without the consent of any party, to avoid the application of Section 409A of the Code in a particular circumstance or that is necessary or desirable to satisfy any of the requirements under Section 409A of the Code, but the Company shall not be under any obligation to make any such amendment. Nothing in the Plan shall provide a basis for any person to take action against the Company or any affiliate based on matters covered by Section 409A of the Code, including the tax treatment of any amount paid or Award made under the Plan, and neither the Company nor any of its affiliates shall under any circumstances have any liability to any Participant or his estate or any other party for any taxes, penalties, or interest due on amounts paid or payable under the Plan, including taxes, penalties, or interest imposed under Section 409A of the Code.

O. INTERPRETATION AND SEVERABILITY

In case any one or more of the provisions contained in the Plan shall for any reason be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provision of the Plan, but the Plan shall be construed as if such invalid, illegal, or unenforceable provisions had never been contained herein.

P. GOVERNING LAW

This Plan and all awards made and actions taken hereunder shall be governed by and construed in accordance with the laws of California excluding any conflicts or choice of law rule or principle that might otherwise refer construction or interpretation of the Plan to the substantive law of another jurisdiction. Participants are deemed to submit to the exclusive jurisdiction and venue of the Federal or state courts of California, to resolve any and all issues that may arise out of or relate to the Plan or any related award.

Exhibit A

AIP Funding Curve

|

|

·

|

Profitability Target = 2012 Budgeted Adjusted Operating Income (Loss) + Stretch Target

|

|

|

·

|

Minimum Performance Threshold = 75% of 2012 Budgeted Adjusted Operating Income (Loss)

|

|

|

·

|

Minimum Discretionary Funding = To be determined by the Compensation Committee

|

|

|

·

|

Target Annual Bonus Pool = Dollar sum of the aggregate target percentage of base salaries for all Participants as of February 16, 2012

|

|

|

·

|

If Adjusted Operating Income (Loss) = Profitability Target, then Annual Bonus Pool = Target Annual Bonus Pool

|

|

|

·

|

If Adjusted Operating Income (Loss) <= Minimum Performance Threshold, then Annual Bonus Pool = Minimum Discretionary Funding

|

|

|

·

|

If Adjusted Operating Income (Loss) > Minimum Performance Threshold, then Annual Bonus Pool = 0.65*(Adjusted Operating Income (Loss) - Minimum Performance Threshold) + Minimum Discretionary Funding

|

Page 7