Stockholder nominations must also include the information required by the Bylaws.

Under the Bylaws, information as to each person whom the stockholder proposes to nominate

for election as a director must include (i) the name, age, business address and residence

address of the person, (ii) the principal occupation or employment of the person, (iii) the class

or series and number of shares of the Company’s capital stock that are owned beneficially or of

record by the person, (iv) whether and the extent to which any derivative instrument, swap,

option, warrant, short interest, hedge or profit interest or other transaction has been entered

into by or on behalf of the person, or any affiliates or associates of such person, with respect to

stock of the corporation, (v) whether and the extent to which any other transaction,

agreement, arrangement or understanding (including any short position or any borrowing or

lending of shares of the Company’s capital stock) has been made by or on behalf of the person,

or any affiliates or associates of such person, the effect or intent of any of the foregoing being

to mitigate loss to, or to manage risk or benefit of stock price changes for, such person, or any

affiliates or associates of such person, or to increase or decrease the voting power or pecuniary

or economic interest of such person, or any affiliates or associates of such person, with respect

to the Company’s capital stock, (vi) a description of all arrangements or understandings

between the stockholder and each nominee and any other person or persons (naming such

person or persons) pursuant to which the nominations are to be made by the stockholder,

(vii) the written consent of such person to being named as a nominee and to serving as a

director, if elected, (viii) the written representation and agreement of such person required by

Section 2.15 of the Bylaws, and (ix) any other information relating to such person that is

required to be disclosed in solicitations of proxies for elections of directors, or is otherwise

required, in each case pursuant SEC regulations. The stockholder giving notice must also

provide certain other information required under the Bylaws. In addition to satisfying the

foregoing requirements under the Bylaws, to comply with the universal proxy rules,

shareholders who intend to solicit proxies in support of director nominees other than the

Company’s nominees must provide notice that sets forth the information required by

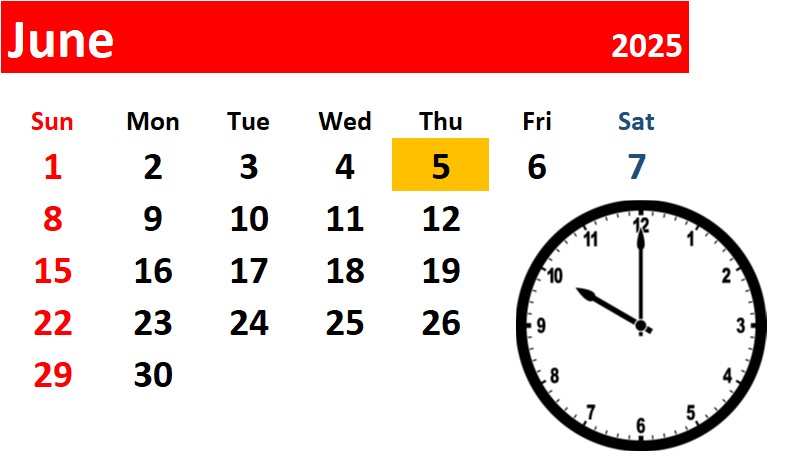

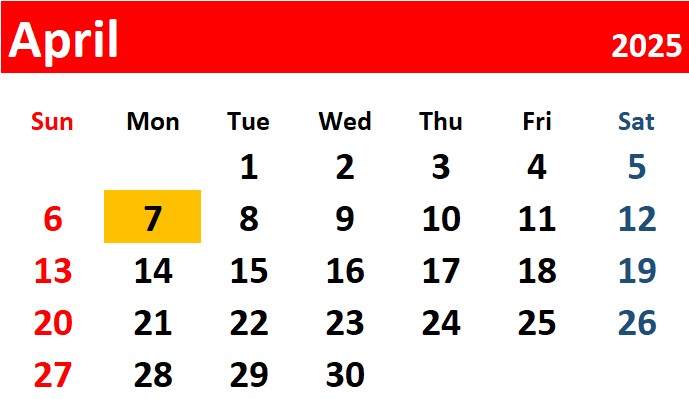

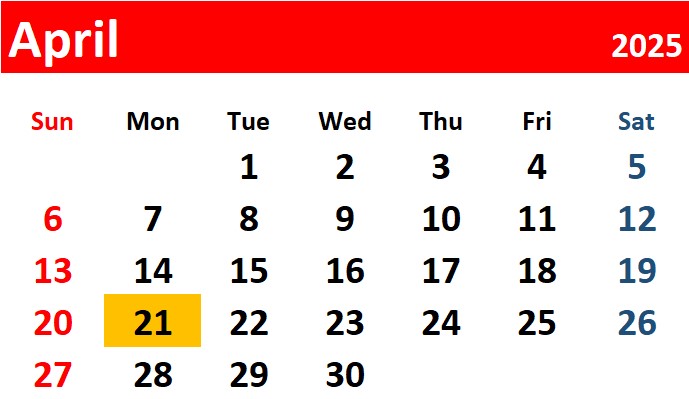

Rule 14a-19 under the Exchange Act no later than 60 days before the one-year anniversary of

the 2025 Annual Meeting.

In addition, the Nominating and Corporate Governance Committee considers and makes

recommendations to the Board regarding any stockholder recommendations for candidates to

serve on the Board. If a stockholder wishes to recommend a candidate to serve on the Board, it

must provide the same information about such recommended candidate as would be required

for a direct nomination discussed in the paragraph above.

A stockholder who wishes to nominate or recommend a candidate to serve on the Board

should carefully review the applicable provisions of the Bylaws. Any such nomination must be

made in accordance with the procedures outlined in, and include the information required by,

the Bylaws. The nomination must be addressed to the Company’s Corporate Secretary (at

Energy Recovery, Inc., Attn: Corporate Secretary, 1717 Doolittle Drive, San Leandro, California

94577). You can also obtain a copy of the Bylaws by writing to the Company’s Corporate

Secretary at this address.