NASDAQ: ERII Driving Industrial Sustainability Delivering Value in Fluid‐Flow Processes Energy Recovery Investor Presentation – March 2021

Confidential & Proprietary FORWARD LOOKING STATEMENT This presentation contains forward‐looking statements within the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward‐looking statements in this report include, but are not limited to, statements about our expectations, objectives, anticipations, plans, hopes, beliefs, intentions, or strategies regarding the future. Forward‐looking statements that represent our current expectations about future events are based on assumptions and involve risks and uncertainties. If the risks or uncertainties occur or the assumptions prove incorrect, then our results may differ materially from those set forth or implied by the forward‐looking statements. Our forward‐looking statements are not guarantees of future performance or events. Words such as “expects,” “anticipates,” “believes,” “estimates,” variations of such words, and similar expressions are also intended to identify such forward‐looking statements. These forward‐looking statements are subject to risks, uncertainties, and assumptions that are difficult to predict; therefore, actual results may differ materially and adversely from those expressed in any forward‐looking statements. You should not place undue reliance on these forward‐looking statements, which reflect management’s opinions only as of the date of this presentation. All forward‐looking statements included in this presentation are subject to certain risks and uncertainties, which could cause actual results to differ materially from those projected in the forward‐looking statements, as disclosed from time to time in our reports on Forms 10‐K, 10‐Q, and 8‐K as well as in our Annual Reports to Stockholders and, if necessary, updated in our quarterly reports on Form 10 Q or in other filings. We assume no obligation to update any such forward‐looking statements. It is important to note that our actual results could differ materially from the results set forth or implied by our forward‐looking statements. 2

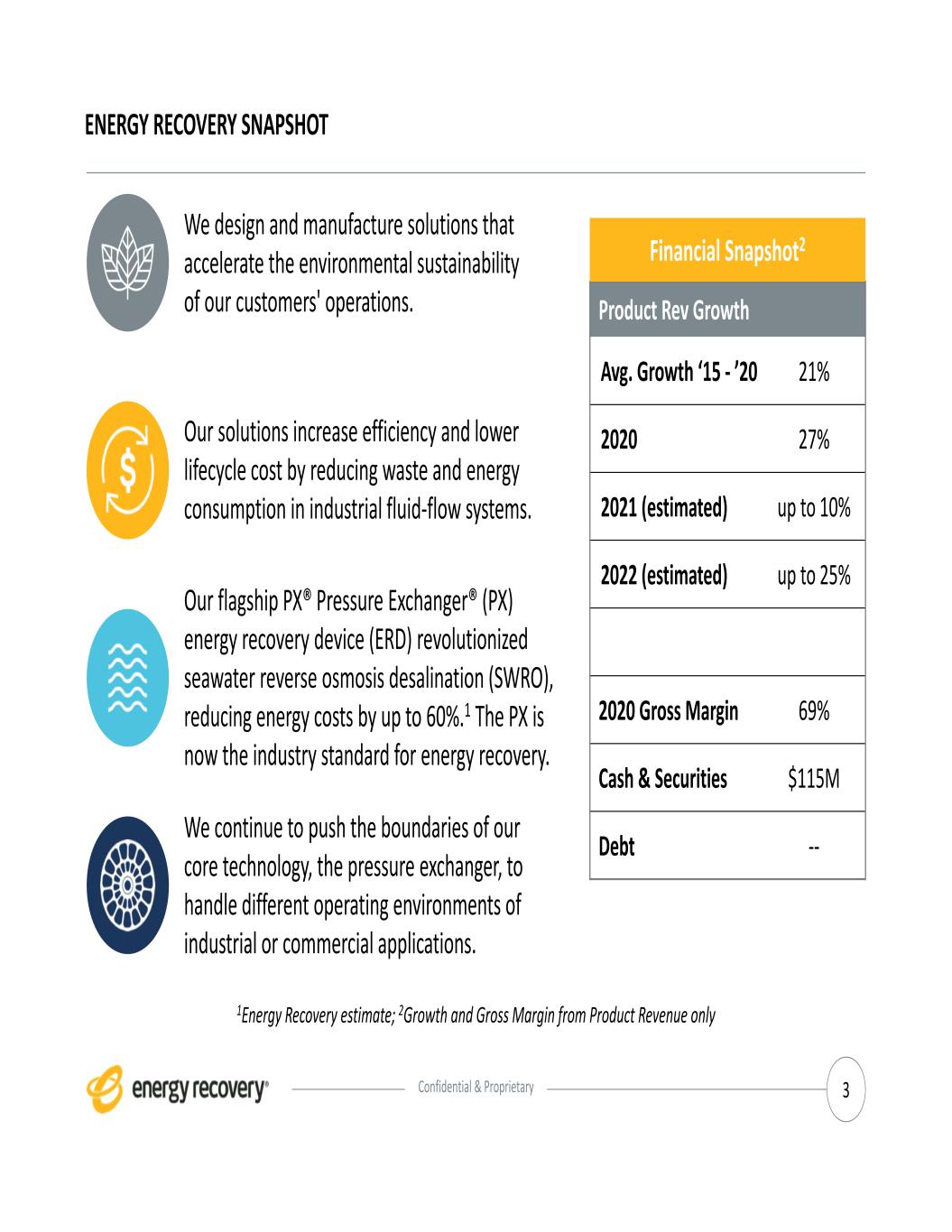

Confidential & Proprietary Product Rev Growth Avg. Growth ‘15 ‐ ’20 21% 2020 27% 2021 (estimated) up to 10% 2022 (estimated) up to 25% 2020 Gross Margin 69% Cash & Securities $115M Debt ‐‐ ENERGY RECOVERY SNAPSHOT 3 Financial Snapshot2 1Energy Recovery estimate; 2Growth and Gross Margin from Product Revenue only Our solutions increase efficiency and lower lifecycle cost by reducing waste and energy consumption in industrial fluid‐flow systems. Our flagship PX® Pressure Exchanger® (PX) energy recovery device (ERD) revolutionized seawater reverse osmosis desalination (SWRO), reducing energy costs by up to 60%.1 The PX is now the industry standard for energy recovery. We continue to push the boundaries of our core technology, the pressure exchanger, to handle different operating environments of industrial or commercial applications. We design and manufacture solutions that accelerate the environmental sustainability of our customers' operations.

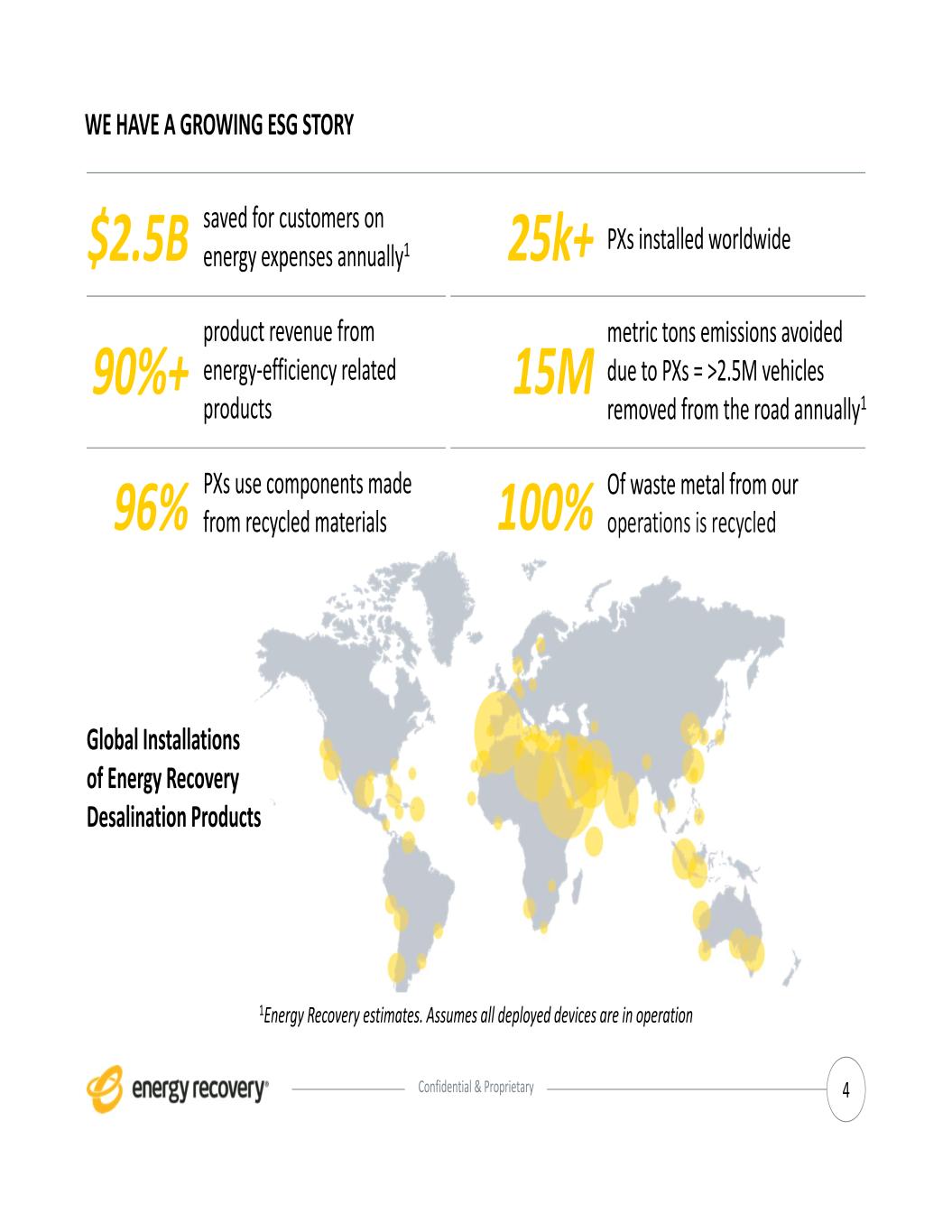

Confidential & Proprietary PXs installed worldwide metric tons emissions avoided due to PXs = >2.5M vehicles removed from the road annually1 Of waste metal from our operations is recycled WE HAVE A GROWING ESG STORY saved for customers on energy expenses annually1 product revenue from energy‐efficiency related products PXs use components made from recycled materials 4 Global Installations of Energy Recovery Desalination Products $2.5B 90%+ 96% 15M 25k+ 100% 1Energy Recovery estimates. Assumes all deployed devices are in operation

Confidential & Proprietary ESG AT ENERGY RECOVERY o First Environmental, Social, Governance (ESG) report issued Sept 2020 Aligned with SASB and GRI sustainability reporting frameworks; select United Nations Sustainable Development Goals o Our products address climate change, sustainable industrialization, energy efficiency, water scarcity o Reflects our ongoing commitment to becoming a more sustainable, resilient business 5 To download the full report, please visit bit.ly/ERI‐ESG THE USE BY ENERGY RECOVERY OF ANY MSCI ESG RESEARCH LLC OR ITS AFFILIATES (“MSCI”) DATA, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT, RECOMMENDATION, OR PROMOTION OF ENERGY RECOVERY BY MSCI. MSCI SERVICES AND DATA ARE THE PROPERTY OF MSCI OR ITS INFORMATION PROVIDERS, AND ARE PROVIDED ‘AS‐IS’ AND WITHOUT WARRANTY. MSCI NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI.

Confidential & Proprietary INDUSTRIES SERVED Industry Markets Customer Type Key Benefits Provided o Seawater Desalination o Brackish Water Desalination o International EPC Firms o Desalination OEMs o Plant Owners and/or Operators o Less Energy Consumption o Lower Emissions o Reduced Costs o Industrial Wastewater Treatment o International EPC Firms o Industrial Plant Owners and/or Operators o Less Energy Consumption o Lower Emissions o Reduced Costs o Natural Gas Processing o EPC Firms o Plant Owners and/or Operators o Less Energy Consumption o Lower Emissions o Reduced Costs 6 Commercial products across multiple sectors

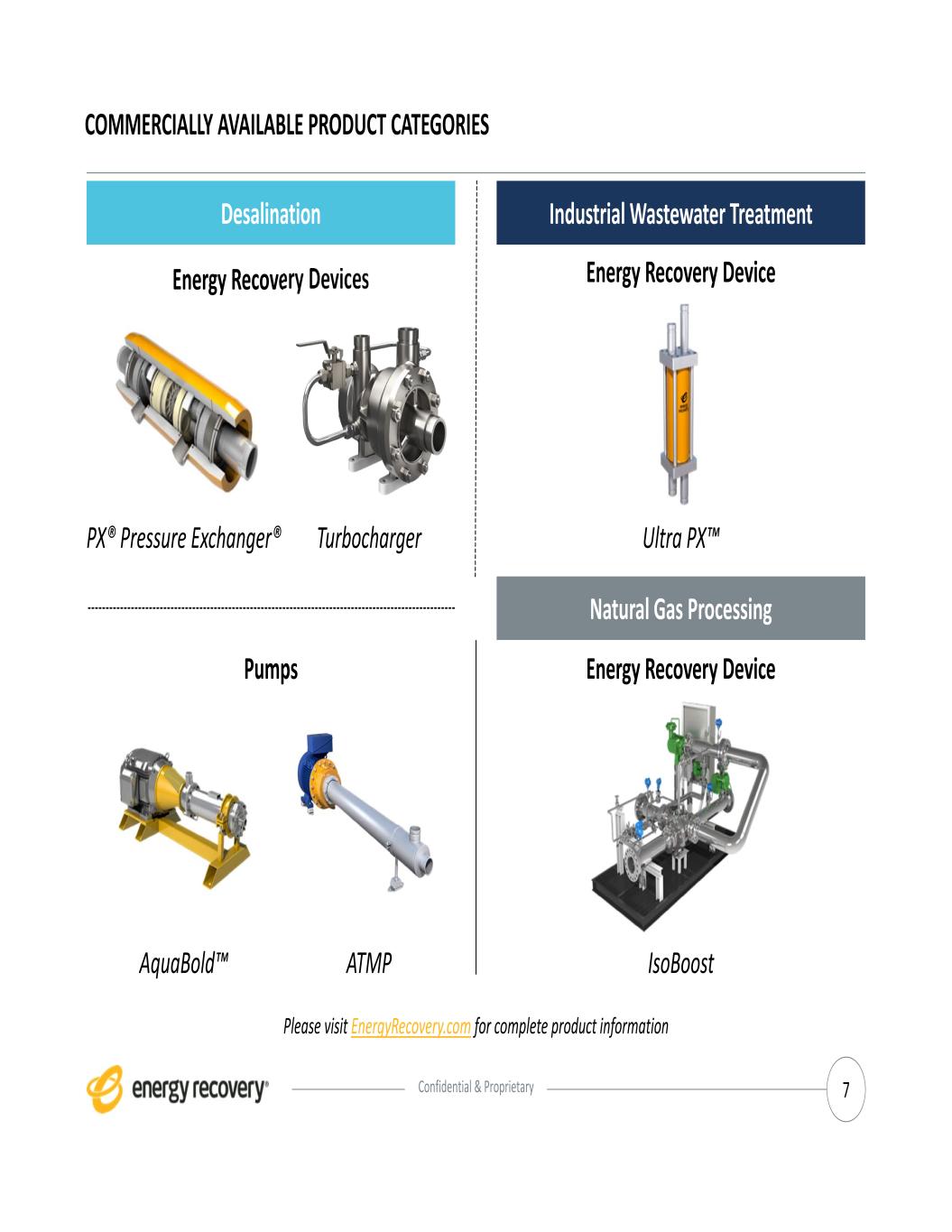

Confidential & Proprietary Energy Recovery Devices PX® Pressure Exchanger® COMMERCIALLY AVAILABLE PRODUCT CATEGORIES Pumps 7 Desalination Natural Gas Processing ATMP IsoBoostAquaBold™ Energy Recovery Device Ultra PX™ Industrial Wastewater Treatment Energy Recovery Device Turbocharger Please visit EnergyRecovery.com for complete product information

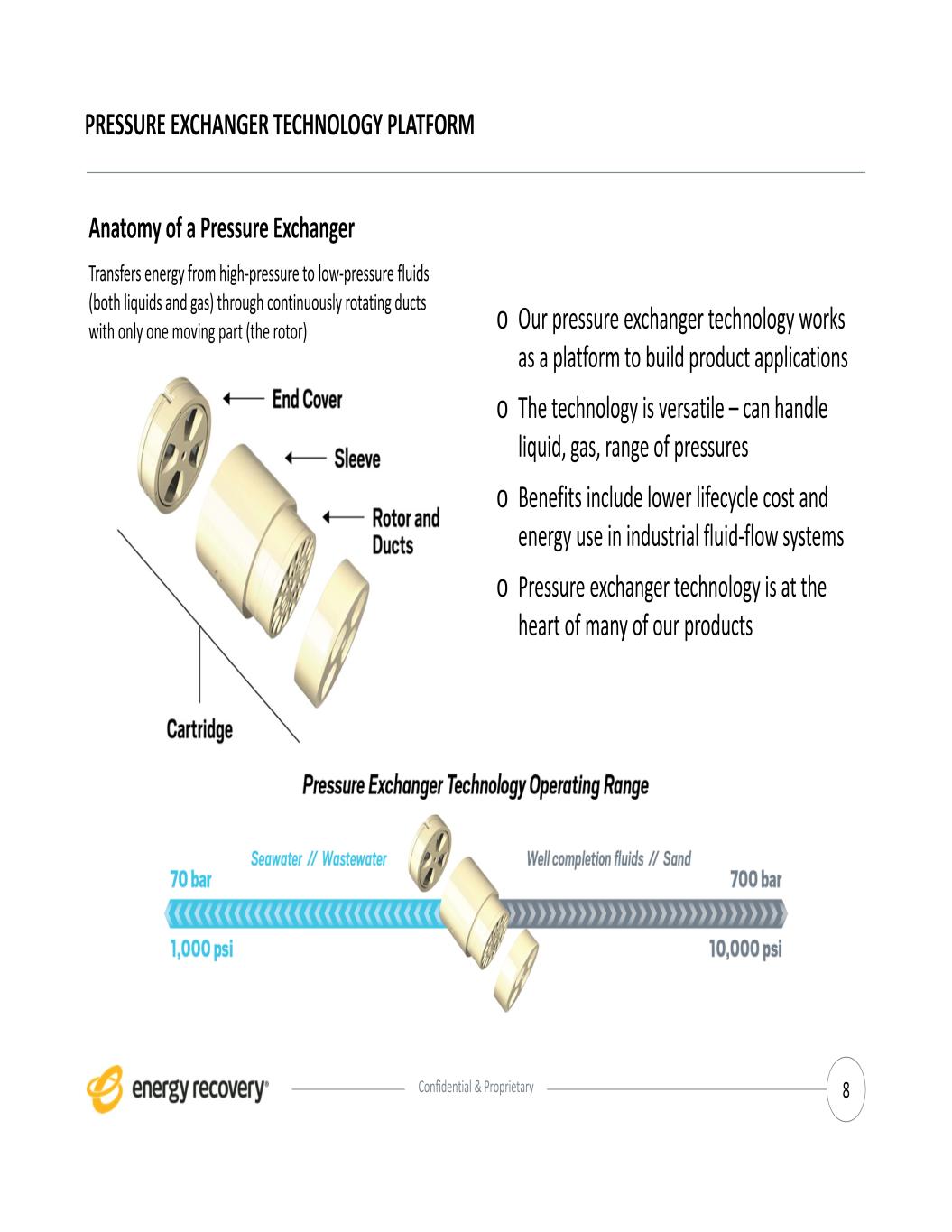

Confidential & Proprietary PRESSURE EXCHANGER TECHNOLOGY PLATFORM Anatomy of a Pressure Exchanger Transfers energy from high‐pressure to low‐pressure fluids (both liquids and gas) through continuously rotating ducts with only one moving part (the rotor) o Our pressure exchanger technology works as a platform to build product applications o The technology is versatile – can handle liquid, gas, range of pressures o Benefits include lower lifecycle cost and energy use in industrial fluid‐flow systems o Pressure exchanger technology is at the heart of many of our products 8

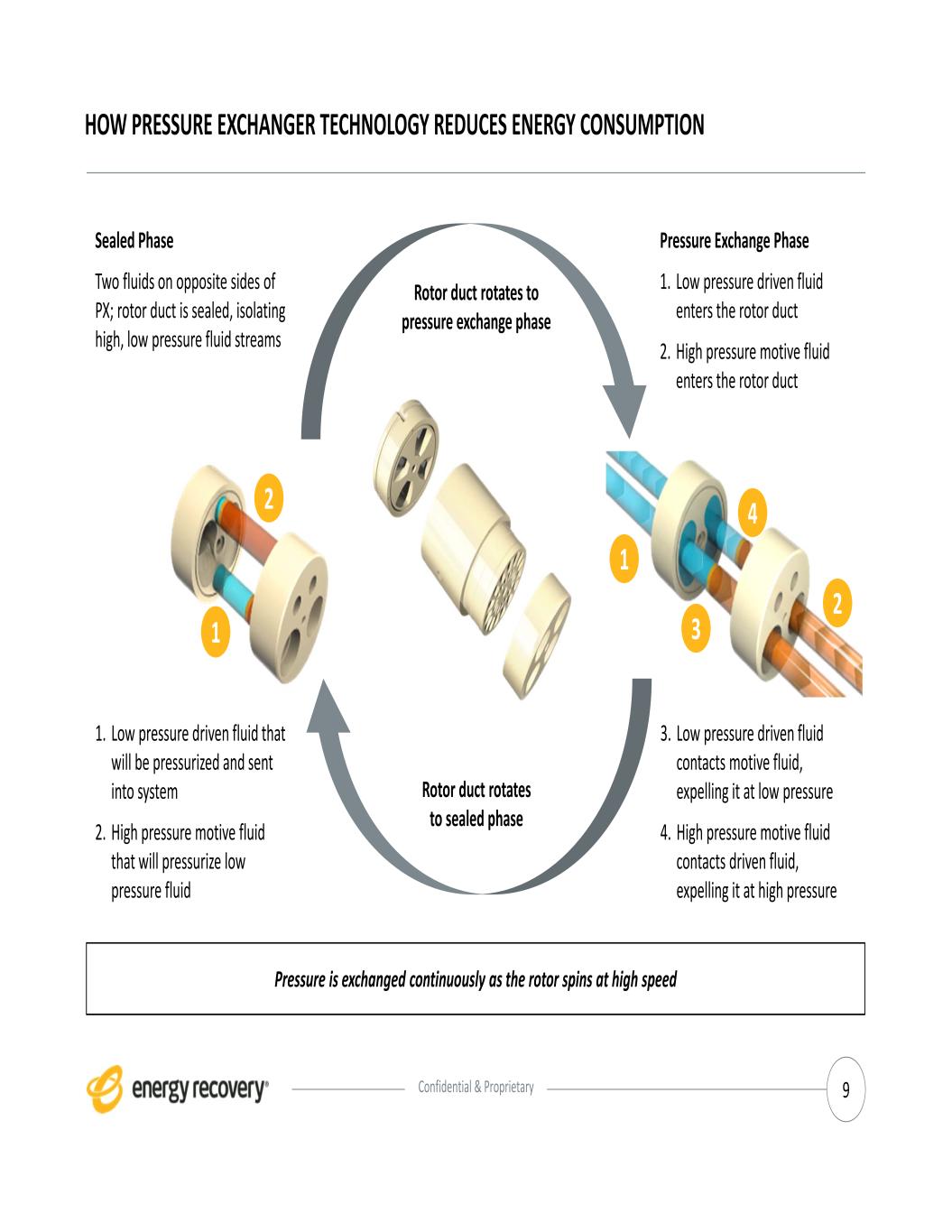

Confidential & Proprietary HOW PRESSURE EXCHANGER TECHNOLOGY REDUCES ENERGY CONSUMPTION 9 Sealed Phase Two fluids on opposite sides of PX; rotor duct is sealed, isolating high, low pressure fluid streams 1 2 1 4 2 3 Rotor duct rotates to pressure exchange phase Rotor duct rotates to sealed phase Pressure Exchange Phase 1. Low pressure driven fluid enters the rotor duct 2. High pressure motive fluid enters the rotor duct Pressure is exchanged continuously as the rotor spins at high speed 3. Low pressure driven fluid contacts motive fluid, expelling it at low pressure 4. High pressure motive fluid contacts driven fluid, expelling it at high pressure 1. Low pressure driven fluid that will be pressurized and sent into system 2. High pressure motive fluid that will pressurize low pressure fluid

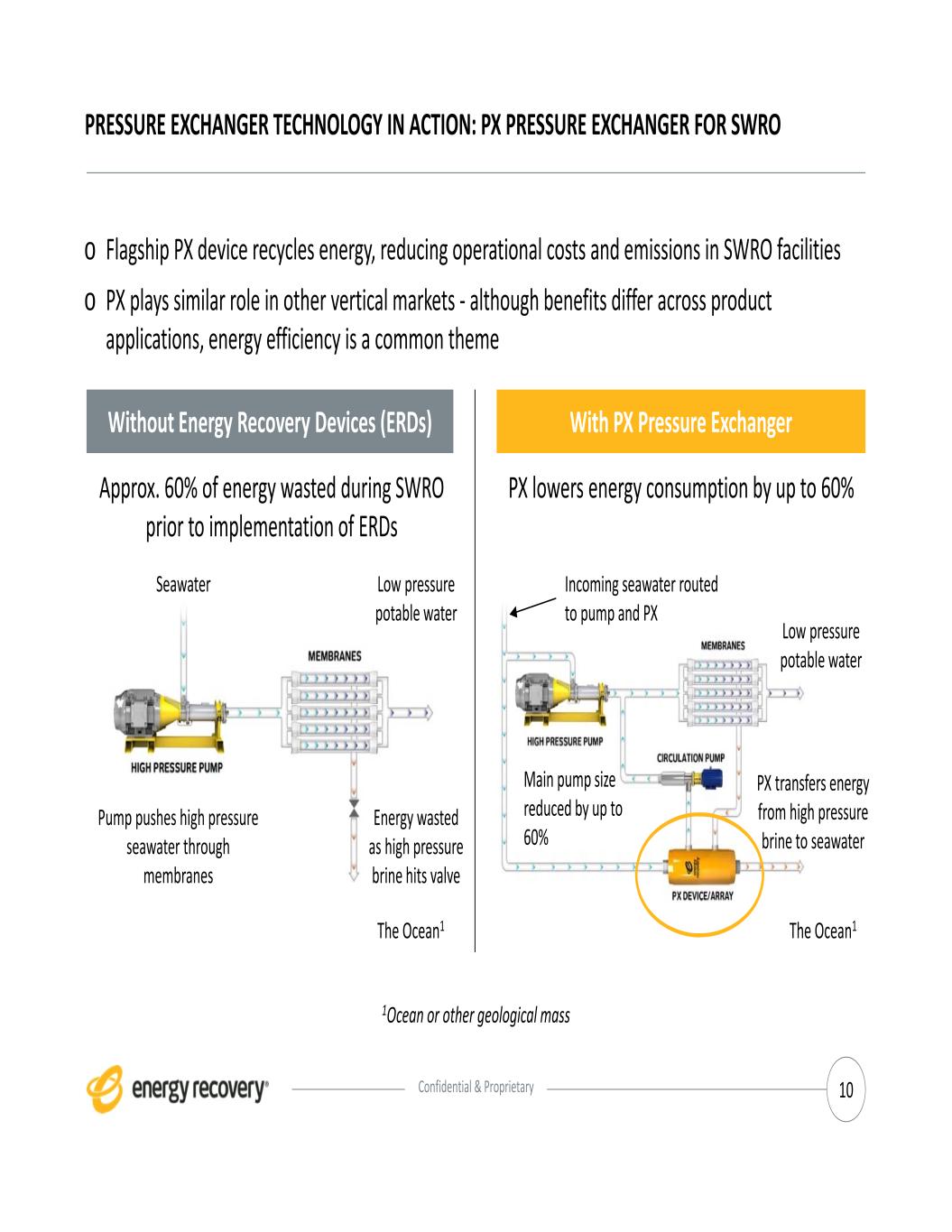

Confidential & Proprietary 1Ocean or other geological mass PRESSURE EXCHANGER TECHNOLOGY IN ACTION: PX PRESSURE EXCHANGER FOR SWRO Approx. 60% of energy wasted during SWRO prior to implementation of ERDs PX lowers energy consumption by up to 60% 10 Without Energy Recovery Devices (ERDs) With PX Pressure Exchanger The Ocean1 The Ocean1 Energy wasted as high pressure brine hits valve Seawater Low pressure potable water Pump pushes high pressure seawater through membranes PX transfers energy from high pressure brine to seawater Incoming seawater routed to pump and PX Main pump size reduced by up to 60% Low pressure potable water o Flagship PX device recycles energy, reducing operational costs and emissions in SWRO facilities o PX plays similar role in other vertical markets ‐ although benefits differ across product applications, energy efficiency is a common theme

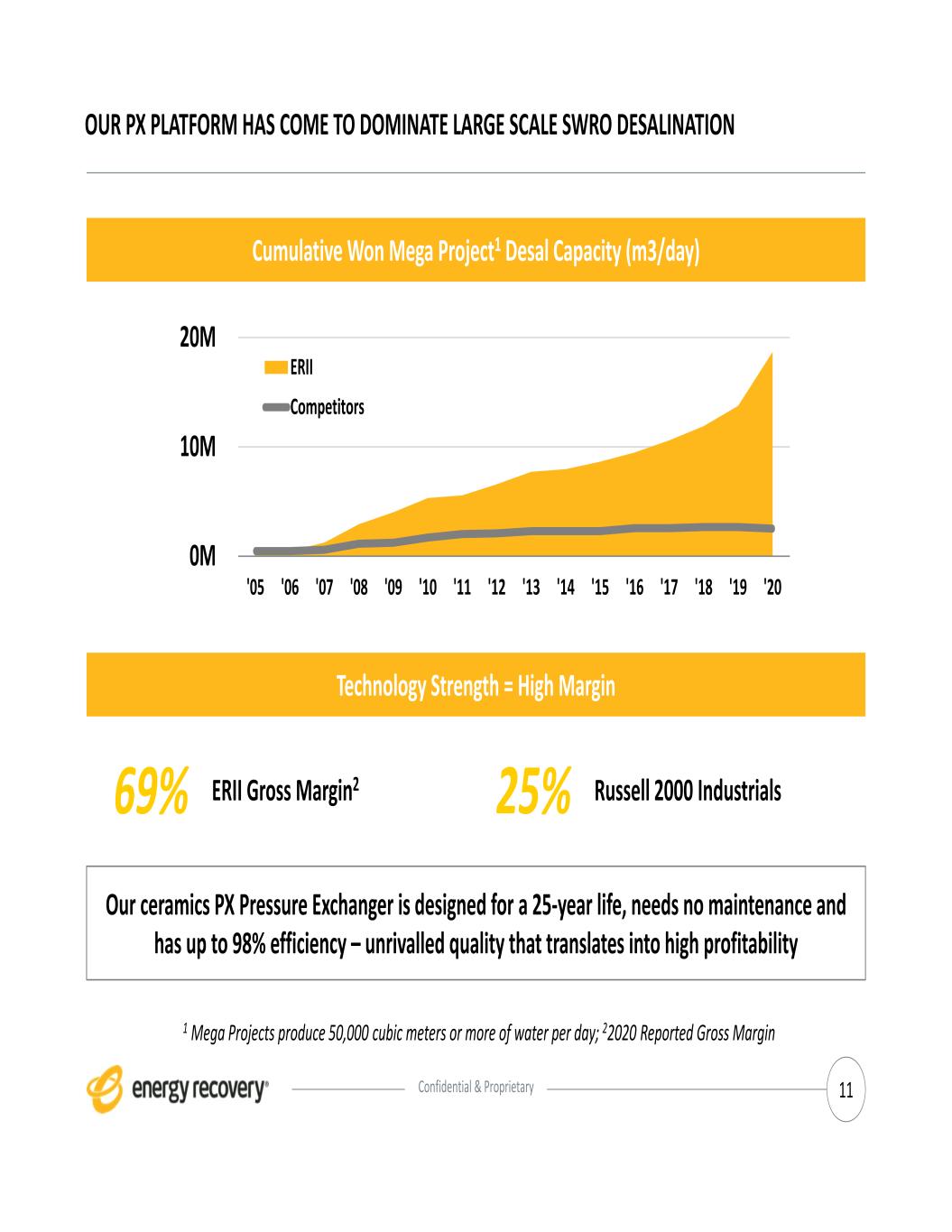

Confidential & Proprietary Our ceramics PX Pressure Exchanger is designed for a 25‐year life, needs no maintenance and has up to 98% efficiency – unrivalled quality that translates into high profitability 0M 10M 20M '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 ERII Competitors OUR PX PLATFORM HAS COME TO DOMINATE LARGE SCALE SWRO DESALINATION 11 Technology Strength = High Margin Cumulative Won Mega Project1 Desal Capacity (m3/day) 1 Mega Projects produce 50,000 cubic meters or more of water per day; 22020 Reported Gross Margin ERII Gross Margin269% Russell 2000 Industrials25%

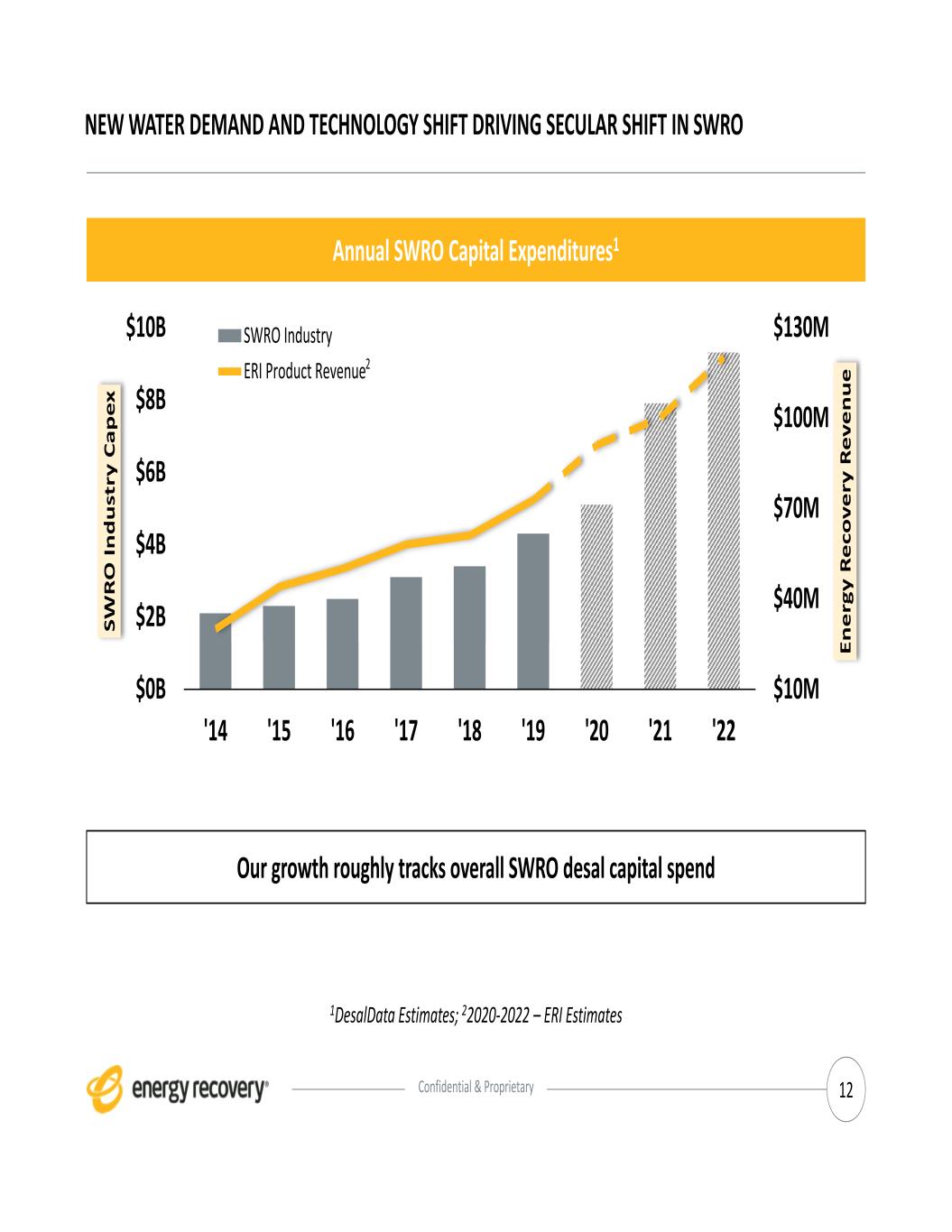

Confidential & Proprietary Our growth roughly tracks overall SWRO desal capital spend $10M $40M $70M $100M $130M $0B $2B $4B $6B $8B $10B '14 '15 '16 '17 '18 '19 '20 '21 '22 En er gy R ec ov er y Re ve nu e SW RO In du st ry C ap ex SWRO Industry ERI Product Revenue2 NEW WATER DEMAND AND TECHNOLOGY SHIFT DRIVING SECULAR SHIFT IN SWRO 12 Annual SWRO Capital Expenditures1 1DesalData Estimates; 22020‐2022 – ERI Estimates

Confidential & Proprietary THE WORLD NEEDS MORE WATER 13 Saudi Water Partnership Company has released its Seven‐Year Statement for 2020‐26 Africa’s largest dam powers dreams of prosperity in Ethiopia – and fears of hunger in Egypt Alaska Villages Run Dry and Residents Worry About a ‘Future of No Water’

Confidential & Proprietary EXISTING FRESH WATER SUPPLIES WILL LIKELY NOT MEET FUTURE DEMAND 14 The world will only have 60% of the water it needs by 2030 1/4 of all people live in high water‐stress territories Potable water demand expected to increase 30% by 2050 Global population is expected to grow from 7.7B to 9.7B in 2050 60% >2B People 30% 26% All statistics – United Nations

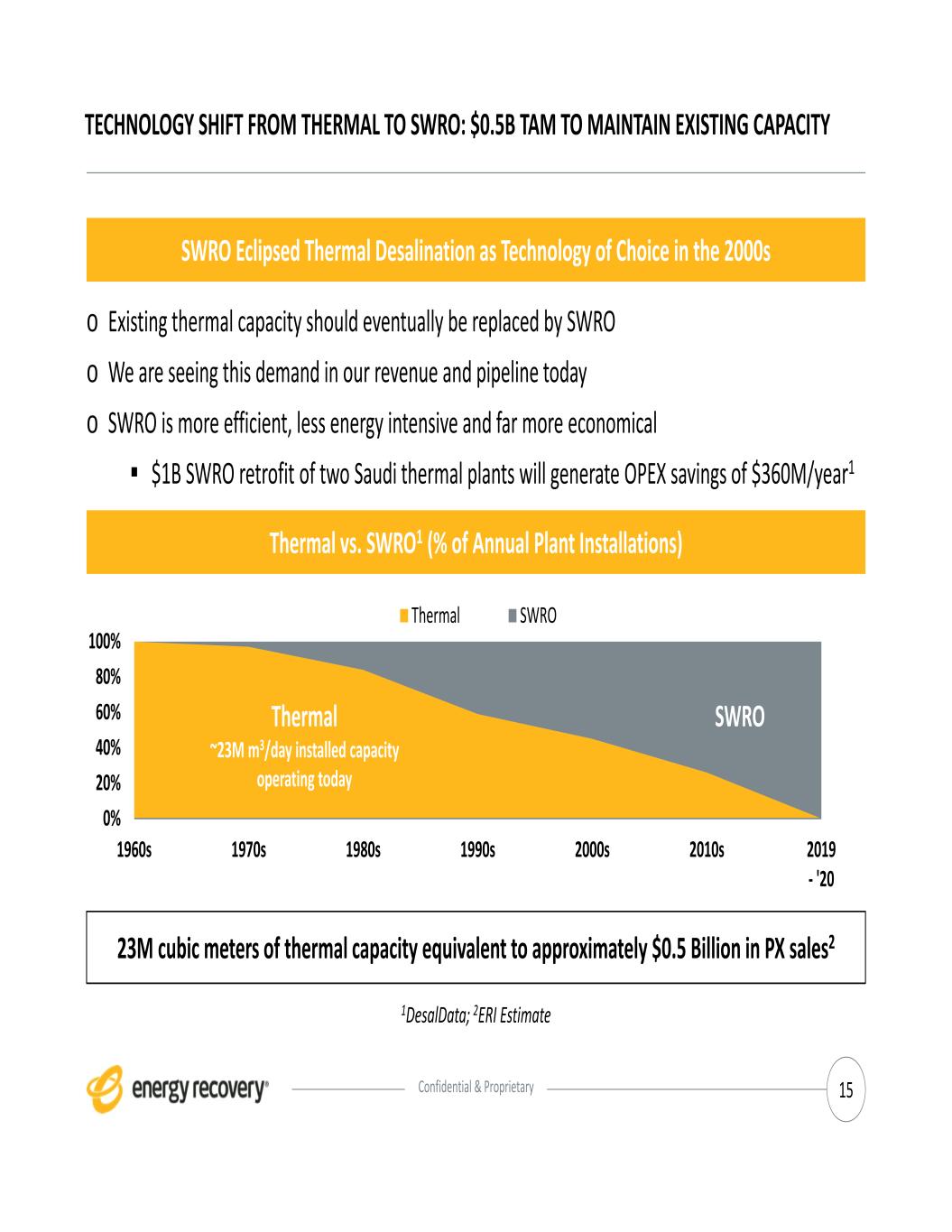

Confidential & Proprietary 23M cubic meters of thermal capacity equivalent to approximately $0.5 Billion in PX sales2 0% 20% 40% 60% 80% 100% 1960s 1970s 1980s 1990s 2000s 2010s 2019 ‐ '20 Thermal vs. SWRO1 (% of Annual Plant Installations) Thermal SWRO o Existing thermal capacity should eventually be replaced by SWRO o We are seeing this demand in our revenue and pipeline today o SWRO is more efficient, less energy intensive and far more economical $1B SWRO retrofit of two Saudi thermal plants will generate OPEX savings of $360M/year1 TECHNOLOGY SHIFT FROM THERMAL TO SWRO: $0.5B TAM TO MAINTAIN EXISTING CAPACITY 15 Thermal vs. SWRO1 (% of Annual Plant Installations) SWRO Eclipsed Thermal Desalination as Technology of Choice in the 2000s 1DesalData; 2ERI Estimate Thermal ~23M m3/day installed capacity operating today SWRO

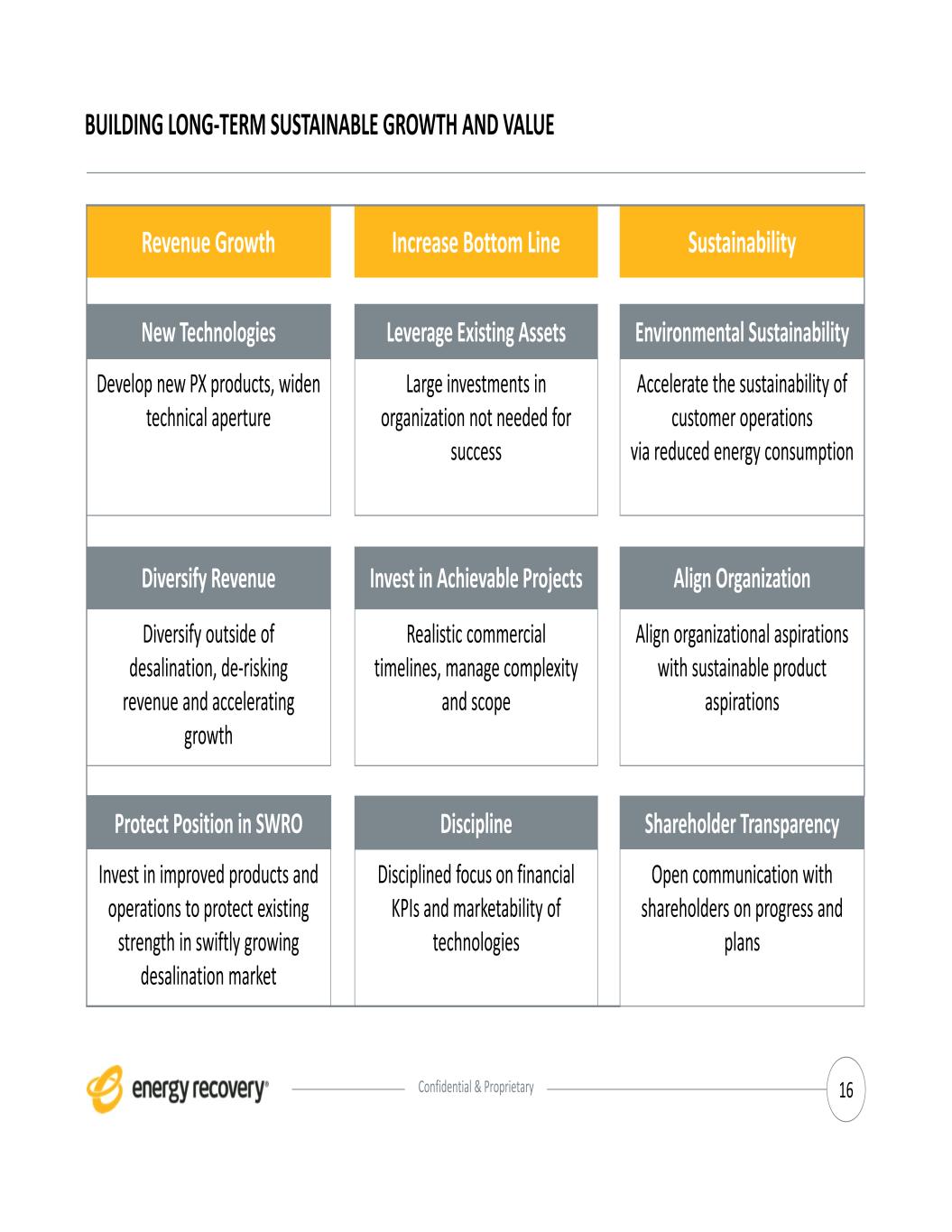

Confidential & Proprietary BUILDING LONG‐TERM SUSTAINABLE GROWTH AND VALUE 16 Revenue Growth Increase Bottom Line Sustainability New Technologies Leverage Existing Assets Environmental Sustainability Develop new PX products, widen technical aperture Large investments in organization not needed for success Accelerate the sustainability of customer operations via reduced energy consumption Diversify Revenue Invest in Achievable Projects Align Organization Diversify outside of desalination, de‐risking revenue and accelerating growth Realistic commercial timelines, manage complexity and scope Align organizational aspirations with sustainable product aspirations Protect Position in SWRO Discipline Shareholder Transparency Invest in improved products and operations to protect existing strength in swiftly growing desalination market Disciplined focus on financial KPIs and marketability of technologies Open communication with shareholders on progress and plans

Confidential & Proprietary LEVERAGING PX TECHNOLOGY FOR SUSTAINABLE DIVERSIFIED GROWTH BEYOND DESALINATION 17 → Cap R&D Expense to limit size and scope of R&D projects: 15‐20% of revenue in 2021 → Discipline: Maintain rigorous commercial hurdles for ROI, Gross Margin, and Timelines Fluids o Manage pressure energy between fluid flows o Relatively clean seawater to caustic pressure pumping proppant; CO2 gas Technology o PX Platform – focus on reducing energy consumption o 1,000 ‐ 10,000+ PSI (70 – 700 bar) o Build off what we know – we are not inventing new markets o Industrial / Commercial applications o Maintain first‐in‐class reliability KPIs Financial KPIs o 20%+ ROI o 50%+ Gross Margin 3 Year Timeline 1 year: prove technical validity 2 years: commercial product 3 years: cash flow positive run rate

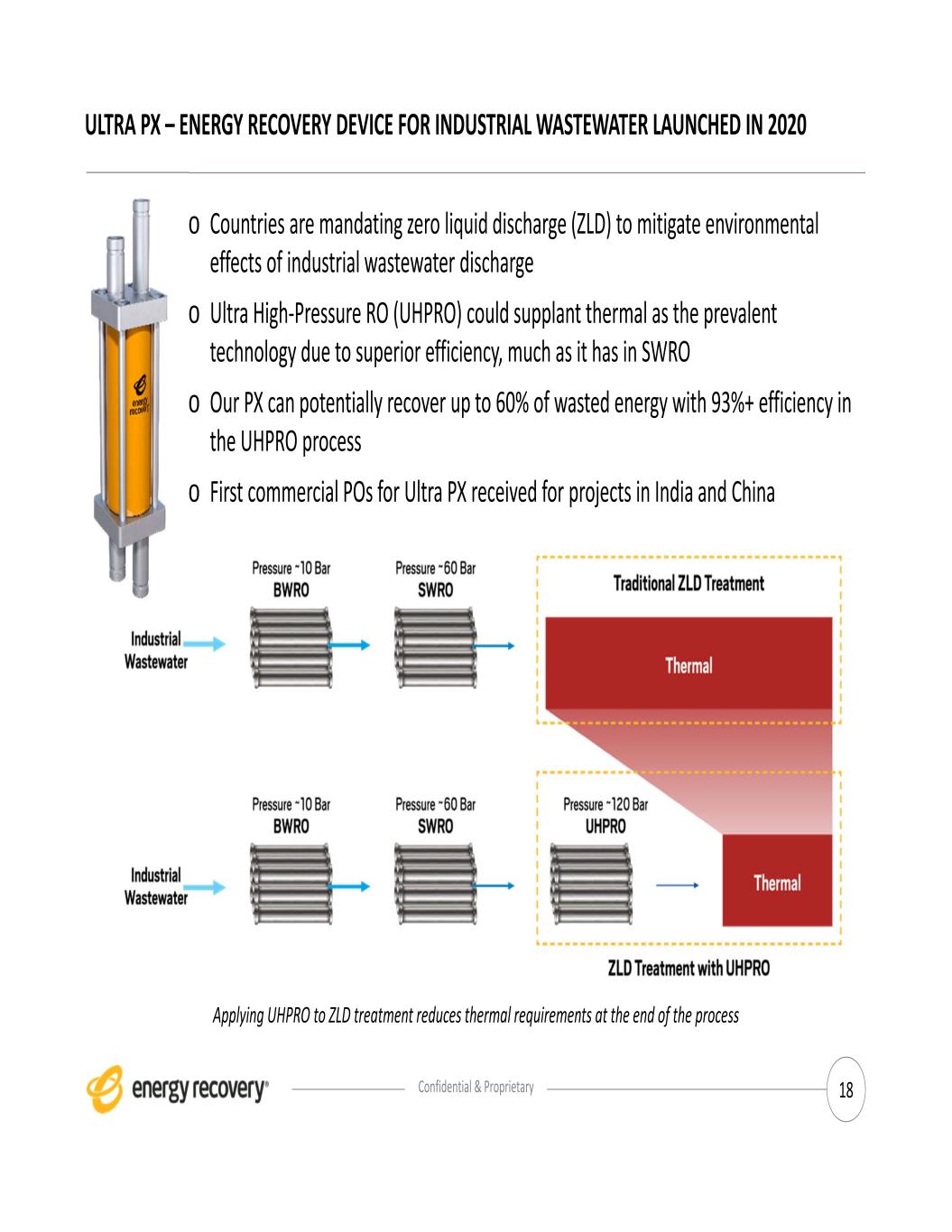

Confidential & Proprietary o Countries are mandating zero liquid discharge (ZLD) to mitigate environmental effects of industrial wastewater discharge o Ultra High‐Pressure RO (UHPRO) could supplant thermal as the prevalent technology due to superior efficiency, much as it has in SWRO o Our PX can potentially recover up to 60% of wasted energy with 93%+ efficiency in the UHPRO process o First commercial POs for Ultra PX received for projects in India and China ULTRA PX – ENERGY RECOVERY DEVICE FOR INDUSTRIAL WASTEWATER LAUNCHED IN 2020 18 Applying UHPRO to ZLD treatment reduces thermal requirements at the end of the process

Confidential & Proprietary VorTeq seeks to protect pumps from abrasive proppant o Increase safety of operations o Reduce emissions, energy intensity of pump operations o Decrease pump failures o Lower maintenance, capital costs Status of Commercialization o Completed multiple frac stages at live wells in Q1 o Two critical hurdles remain Validate customer value proposition Optimize cartridge life before repairs or replacement Highest operational cost to ERI o Must make decision to commercialize by June 2021, or cease investing o Spend has decreased roughly 50% since mid 2020 as engineering efforts wind down VORTEQ – 2 MAJOR HURDLES REMAIN TO COMMERCIALIZE 19

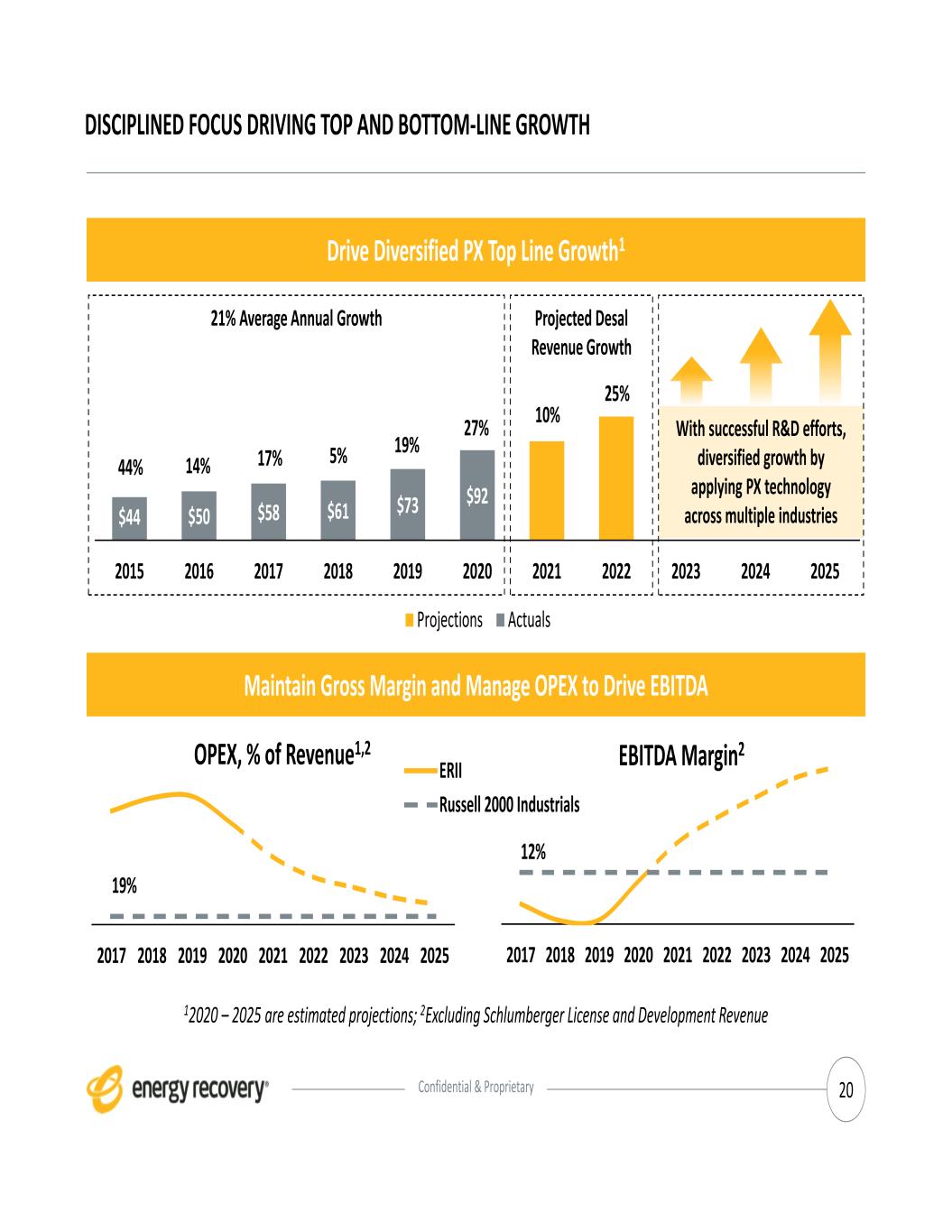

Confidential & Proprietary $44 $50 $58 $61 $73 $92 44% 14% 17% 5% 19% 27% 10% 25% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Projections Actuals z DISCIPLINED FOCUS DRIVING TOP AND BOTTOM‐LINE GROWTH 20 Maintain Gross Margin and Manage OPEX to Drive EBITDA Drive Diversified PX Top Line Growth1 12020 – 2025 are estimated projections; 2Excluding Schlumberger License and Development Revenue 21% Average Annual Growth Projected Desal Revenue Growth With successful R&D efforts, diversified growth by applying PX technology across multiple industries 12% 2017 2018 2019 2020 2021 2022 2023 2024 2025 EBITDA Margin2 19% 2017 2018 2019 2020 2021 2022 2023 2024 2025 OPEX, % of Revenue1,2 ERII Russell 2000 Industrials

Thank You

Confidential & Proprietary CONTACT US 22 James Siccardi, VP, Investor Relations +1.832.474.7628 | Mobile jsiccardi@energyrecovery.com ESG@energyrecovery.com (for ESG inquiries) Energy Recovery, Inc. 1717 Doolittle Drive San Leandro, CA 94577, USA energyrecovery.com