Exhibit 99.1 Energy Recovery Investor Presentation August 2020 NASDAQ: ERII

FORWARD LOOKING STATEMENT This presentation contains forward‐looking statements within the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward‐looking statements in this report include, but are not limited to, statements about our expectations, objectives, anticipations, plans, hopes, beliefs, intentions, or strategies regarding the future. Forward‐looking statements that represent our current expectations about future events are based on assumptions and involve risks and uncertainties. If the risks or uncertainties occur or the assumptions prove incorrect, then our results may differ materially from those set forth or implied by the forward‐looking statements. Our forward‐looking statements are not guarantees of future performance or events. Words such as “expects,” “anticipates,” “believes,” “estimates,” variations of such words, and similar expressions are also intended to identify such forward‐looking statements. These forward‐looking statements are subject to risks, uncertainties, and assumptions that are difficult to predict; therefore, actual results may differ materially and adversely from those expressed in any forward‐looking statements. You should not place undue reliance on these forward‐looking statements, which reflect management’s opinions only as of the date of this presentation. All forward‐looking statements included in this presentation are subject to certain risks and uncertainties, which could cause actual results to differ materially from those projected in the forward‐looking statements, as disclosed from time to time in our reports on Forms 10‐K, 10‐Q, and 8‐K as well as in our Annual Reports to Stockholders and, if necessary, updated in our quarterly reports on Form 10 Q or in other filings. We assume no obligation to update any such forward‐ looking statements. It is important to note that our actual results could differ materially from the results set forth or implied by our forward‐looking statements. Confidential & Proprietary 2

About Energy Recovery

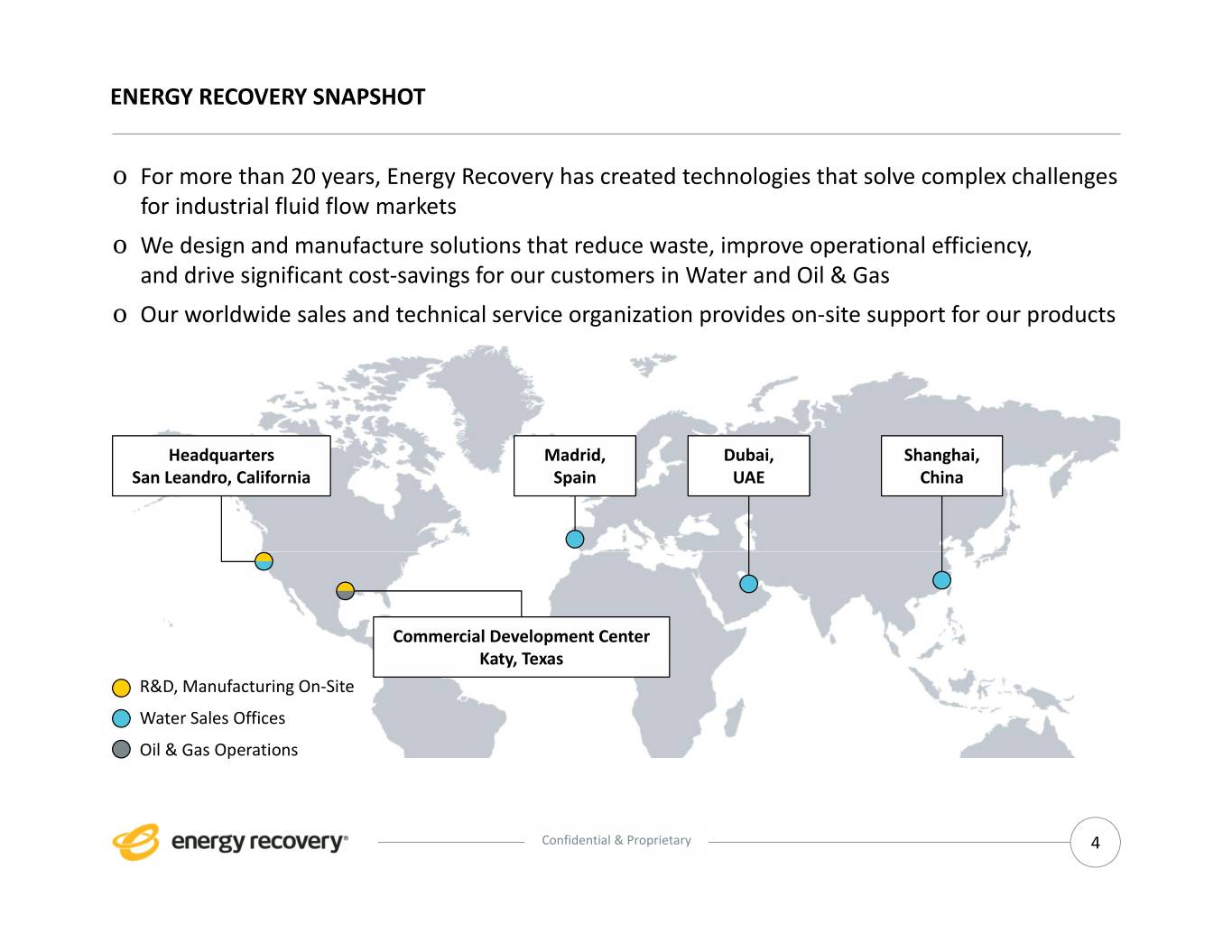

ENERGY RECOVERY SNAPSHOT o For more than 20 years, Energy Recovery has created technologies that solve complex challenges for industrial fluid flow markets o We design and manufacture solutions that reduce waste, improve operational efficiency, and drive significant cost‐savings for our customers in Water and Oil & Gas o Our worldwide sales and technical service organization provides on‐site support for our products Headquarters Madrid, Dubai, Shanghai, San Leandro, California Spain UAE China Commercial Development Center Katy, Texas R&D, Manufacturing On‐Site Water Sales Offices Oil & Gas Operations Confidential & Proprietary 4

WHY ENERGY RECOVERY? Our technologies lower production costs of clean water and oil & gas, enabling more affordable access to these critical resources Our Water solutions are in desalination facilities on seven continents, reducing carbon emissions and helping to combat water scarcity around the globe The PX® Pressure Exchanger® energy recovery device revolutionized seawater reverse osmosis desalination, reducing energy costs by up to 60%* In‐development VorTeq™ technology can reduce emissions and energy intensity of oil & gas production while lowering costs – fewer pump failures, smaller site footprint *Energy Recovery estimate Confidential & Proprietary 5

OUR PRODUCT CATEGORIES Water Energy Recovery Devices Pumps PX® Pressure Exchanger® Oil & Gas Hydraulic Fracturing Solution *in development Confidential & Proprietary 6

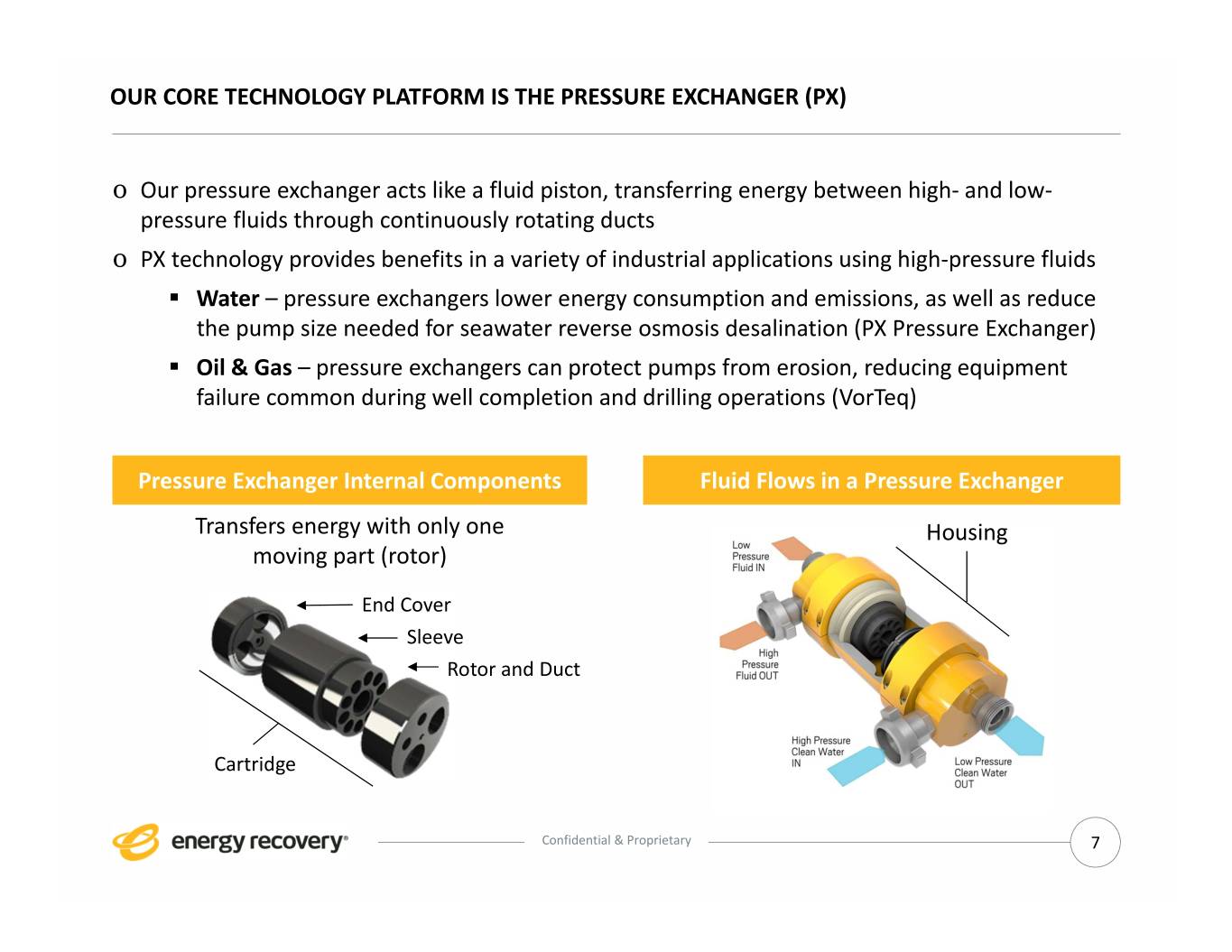

OUR CORE TECHNOLOGY PLATFORM IS THE PRESSURE EXCHANGER (PX) o Our pressure exchanger acts like a fluid piston, transferring energy between high‐ and low‐ pressure fluids through continuously rotating ducts o PX technology provides benefits in a variety of industrial applications using high‐pressure fluids . Water – pressure exchangers lower energy consumption and emissions, as well as reduce the pump size needed for seawater reverse osmosis desalination (PX Pressure Exchanger) . Oil & Gas – pressure exchangers can protect pumps from erosion, reducing equipment failure common during well completion and drilling operations (VorTeq) Pressure Exchanger Internal Components Fluid Flows in a Pressure Exchanger Transfers energy with only one Housing moving part (rotor) End Cover Sleeve Rotor and Duct Cartridge Confidential & Proprietary 7

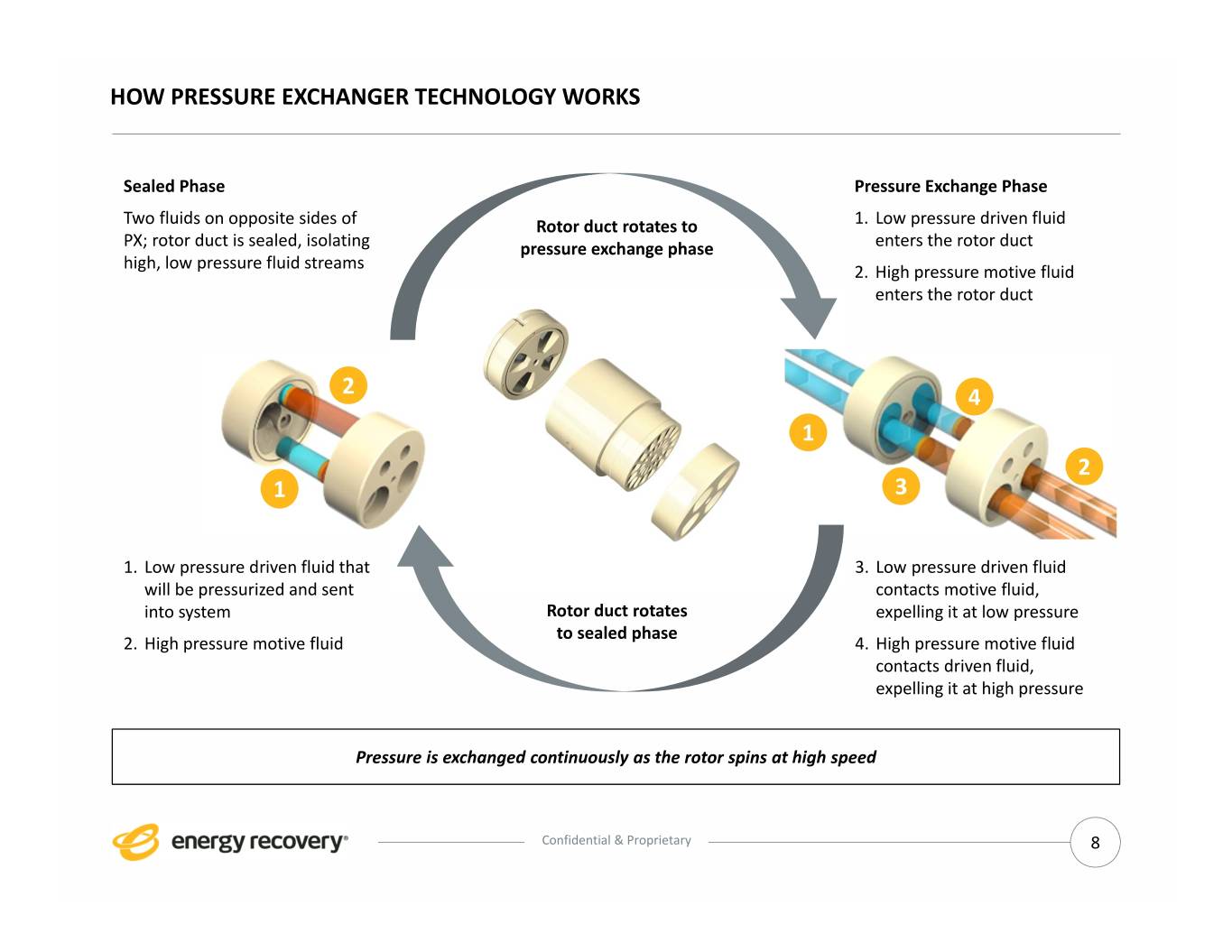

HOW PRESSURE EXCHANGER TECHNOLOGY WORKS Sealed Phase Pressure Exchange Phase Two fluids on opposite sides of Rotor duct rotates to 1. Low pressure driven fluid PX; rotor duct is sealed, isolating pressure exchange phase enters the rotor duct high, low pressure fluid streams 2. High pressure motive fluid enters the rotor duct 2 4 1 2 1 3 1. Low pressure driven fluid that 3. Low pressure driven fluid will be pressurized and sent contacts motive fluid, into system Rotor duct rotates expelling it at low pressure to sealed phase 2. High pressure motive fluid 4. High pressure motive fluid contacts driven fluid, expelling it at high pressure Pressure is exchanged continuously as the rotor spins at high speed Confidential & Proprietary 8

INVESTING IN MULTI‐DISCIPLINARY ENGINEERING TALENT Significant investments in R&D team in recent years to strengthen our capabilities o Over 5x increase in R&D headcount since 2013 – one‐third of ERI holds engineering degrees o Expertise in critical disciplines to incubate and commercialize new industrial fluid‐flow solutions Team focused on incubation of new products with clear commercialization objectives and returns o Late 2019 reorganization provided further transparency and accountability Fluid Mechanics Acoustics & & Aerodynamics Vibrations Hydrodynamic Pumps and Bearings Turbines Solid Mechanics Tribology Multi‐Phase Turbomachinery Flow Material Science CFD & FEA & Coatings Dynamics & Rotating Controls Equipment Confidential & Proprietary 9

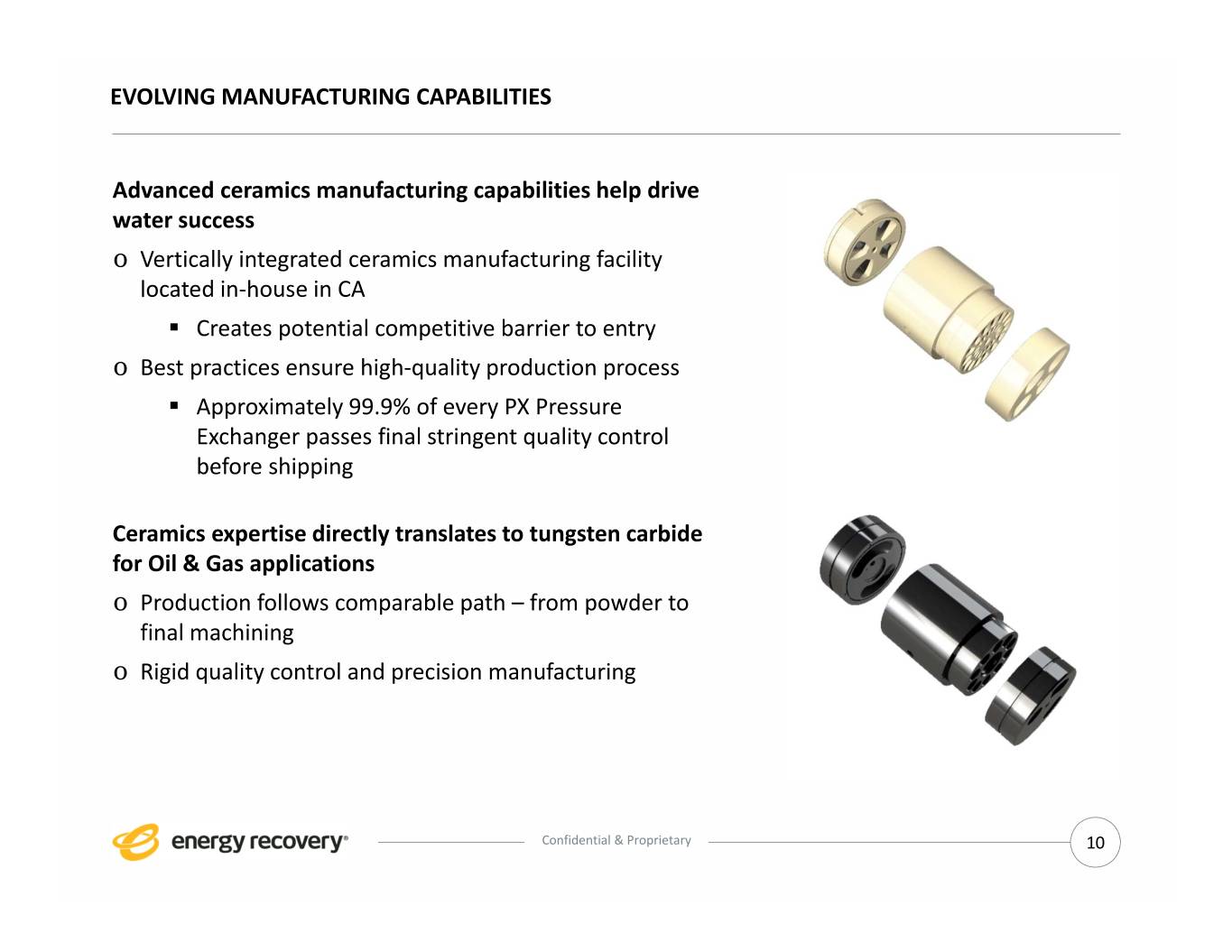

EVOLVING MANUFACTURING CAPABILITIES Advanced ceramics manufacturing capabilities help drive water success o Vertically integrated ceramics manufacturing facility located in‐house in CA . Creates potential competitive barrier to entry o Best practices ensure high‐quality production process . Approximately 99.9% of every PX Pressure Exchanger passes final stringent quality control before shipping Ceramics expertise directly translates to tungsten carbide for Oil & Gas applications o Production follows comparable path – from powder to final machining o Rigid quality control and precision manufacturing Confidential & Proprietary 10

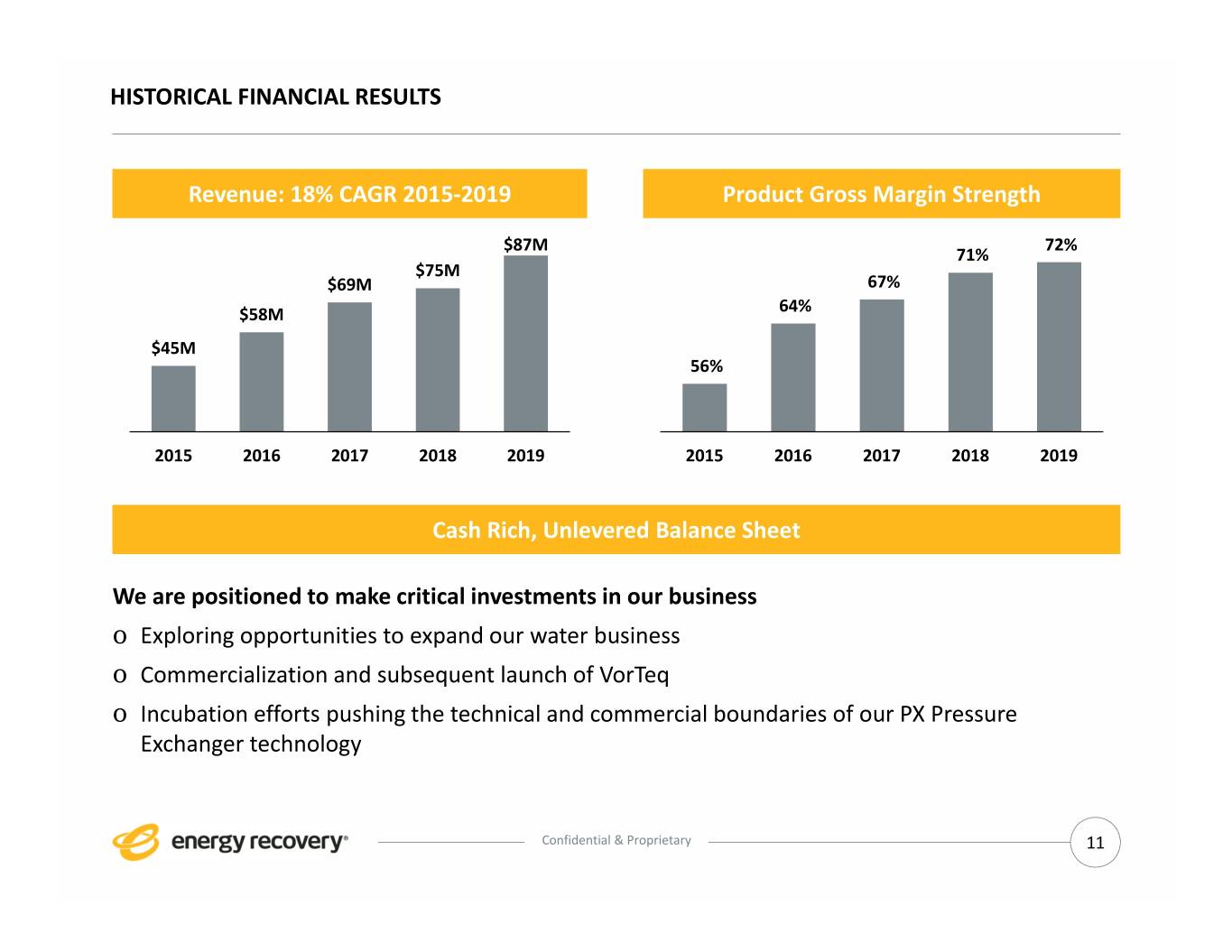

HISTORICAL FINANCIAL RESULTS Revenue: 18% CAGR 2015‐2019 Product Gross Margin Strength $87M 72% 71% $75M $69M 67% $58M 64% $45M 56% 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Cash Rich, Unlevered Balance Sheet We are positioned to make critical investments in our business o Exploring opportunities to expand our water business o Commercialization and subsequent launch of VorTeq o Incubation efforts pushing the technical and commercial boundaries of our PX Pressure Exchanger technology Confidential & Proprietary 11

Water – Global Demand Trends Driving Robust Future Outlook for Energy Recovery

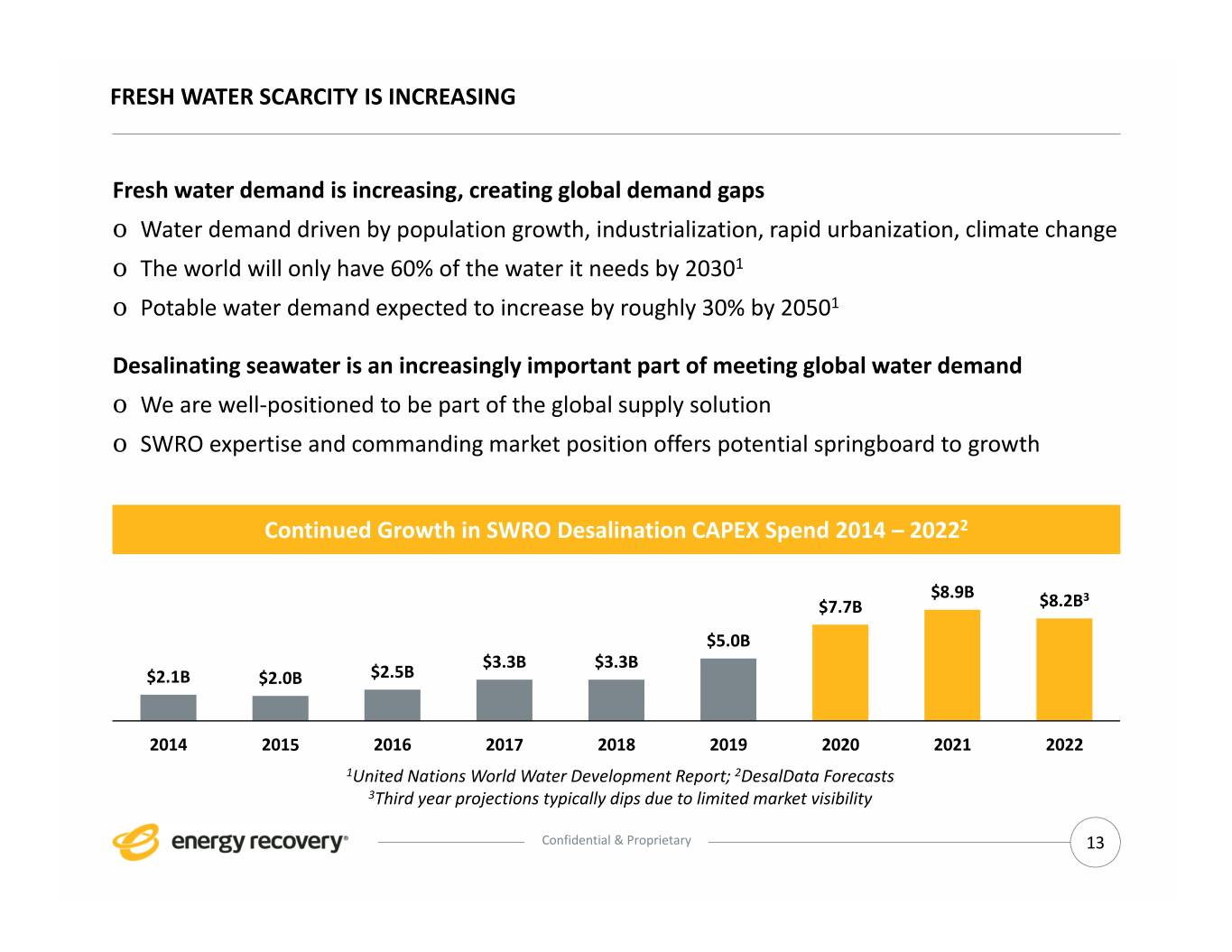

FRESH WATER SCARCITY IS INCREASING Fresh water demand is increasing, creating global demand gaps o Water demand driven by population growth, industrialization, rapid urbanization, climate change o The world will only have 60% of the water it needs by 20301 o Potable water demand expected to increase by roughly 30% by 20501 Desalinating seawater is an increasingly important part of meeting global water demand o We are well‐positioned to be part of the global supply solution o SWRO expertise and commanding market position offers potential springboard to growth Continued Growth in SWRO Desalination CAPEX Spend 2014 – 20222 $8.9B 3 $7.7B $8.2B $5.0B $3.3B $3.3B $2.1B $2.0B $2.5B 2014 2015 2016 2017 2018 2019 2020 2021 2022 1United Nations World Water Development Report; 2DesalData Forecasts 3Third year projections typically dips due to limited market visibility Confidential & Proprietary 13

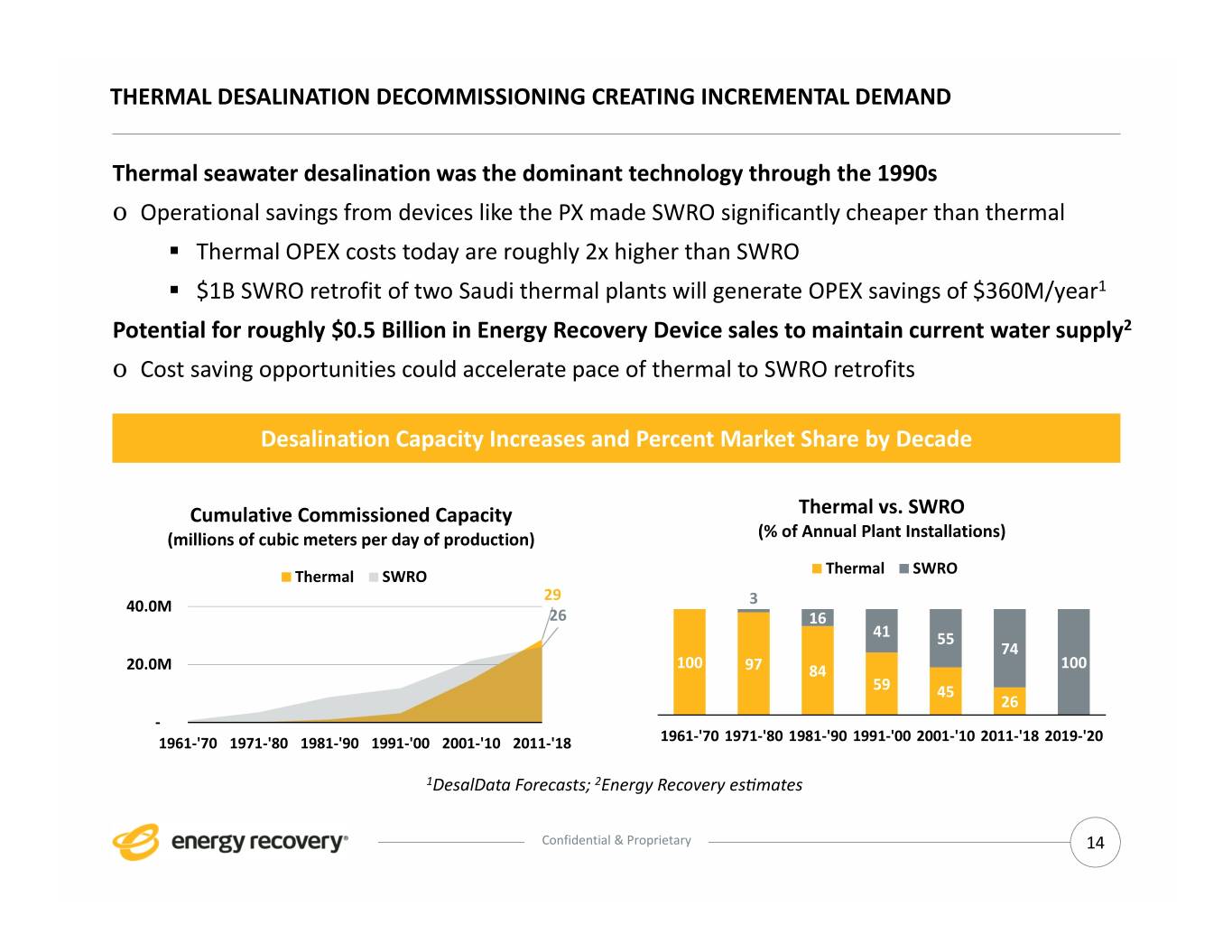

THERMAL DESALINATION DECOMMISSIONING CREATING INCREMENTAL DEMAND Thermal seawater desalination was the dominant technology through the 1990s o Operational savings from devices like the PX made SWRO significantly cheaper than thermal . Thermal OPEX costs today are roughly 2x higher than SWRO . $1B SWRO retrofit of two Saudi thermal plants will generate OPEX savings of $360M/year1 Potential for roughly $0.5 Billion in Energy Recovery Device sales to maintain current water supply2 o Cost saving opportunities could accelerate pace of thermal to SWRO retrofits Desalination Capacity Increases and Percent Market Share by Decade Cumulative Commissioned Capacity Thermal vs. SWRO (millions of cubic meters per day of production) (% of Annual Plant Installations) Thermal SWRO Thermal SWRO 29 40.0M 3 26 16 41 55 74 20.0M 100 97 84 100 59 45 26 ‐ 1961‐'70 1971‐'80 1981‐'90 1991‐'00 2001‐'10 2011‐'18 1961‐'70 1971‐'80 1981‐'90 1991‐'00 2001‐'10 2011‐'18 2019‐'20 1DesalData Forecasts; 2Energy Recovery es�mates Confidential & Proprietary 14

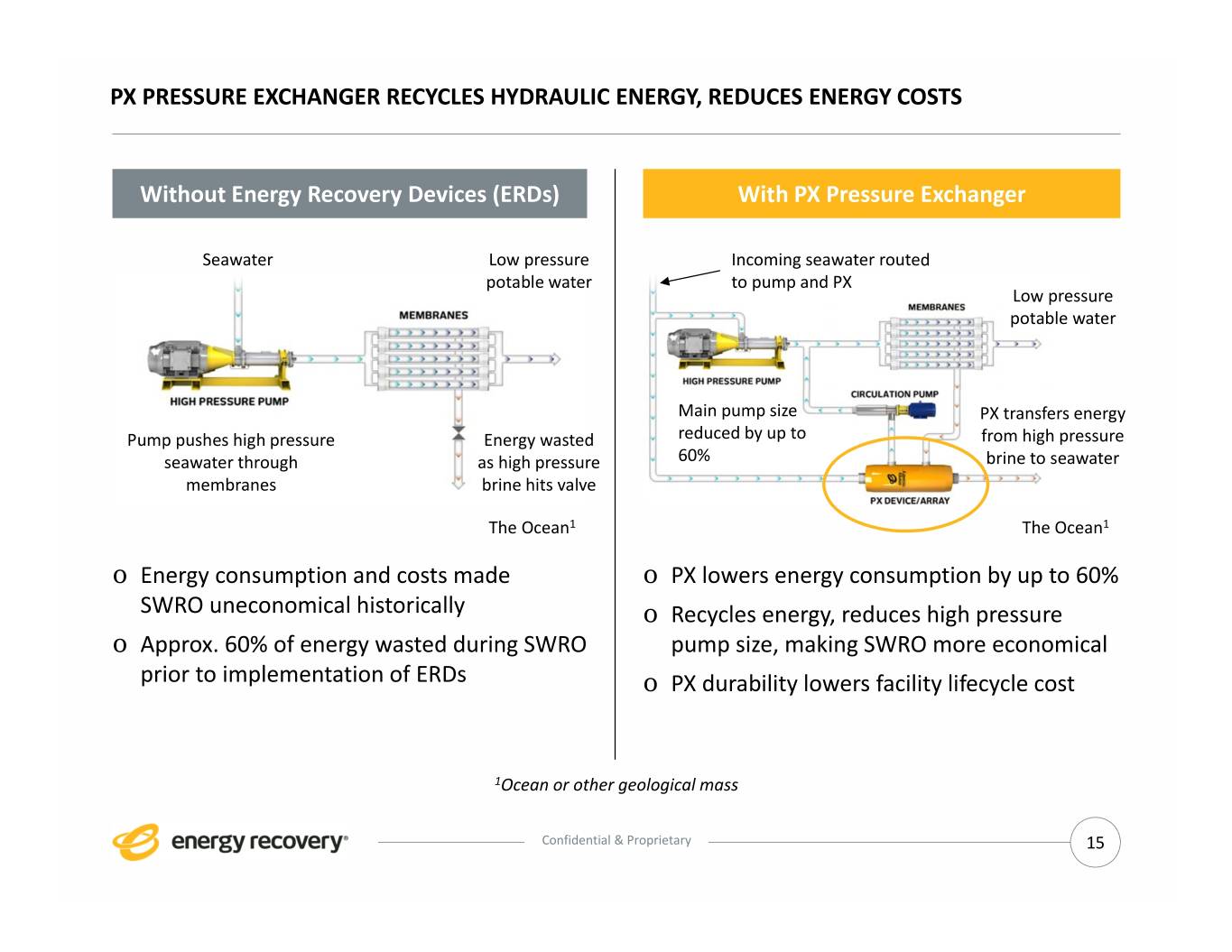

PX PRESSURE EXCHANGER RECYCLES HYDRAULIC ENERGY, REDUCES ENERGY COSTS Without Energy Recovery Devices (ERDs) With PX Pressure Exchanger Seawater Low pressure Incoming seawater routed potable water to pump and PX Low pressure potable water Main pump size PX transfers energy Pump pushes high pressure Energy wasted reduced by up to from high pressure seawater through as high pressure 60% brine to seawater membranes brine hits valve The Ocean1 The Ocean1 o Energy consumption and costs made o PX lowers energy consumption by up to 60% SWRO uneconomical historically o Recycles energy, reduces high pressure o Approx. 60% of energy wasted during SWRO pump size, making SWRO more economical prior to implementation of ERDs o PX durability lowers facility lifecycle cost 1Ocean or other geological mass Confidential & Proprietary 15

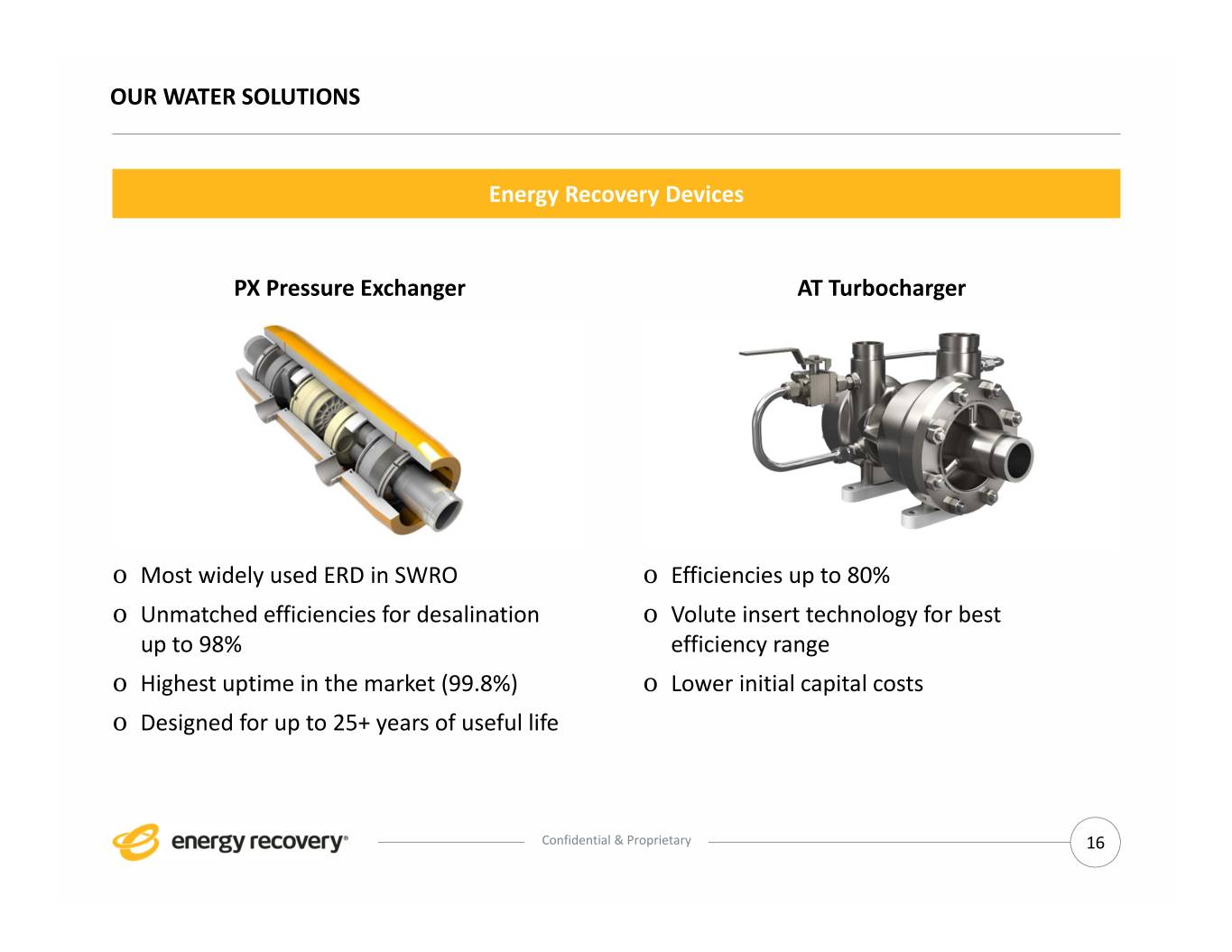

OUR WATER SOLUTIONS Energy Recovery Devices PX Pressure Exchanger AT Turbocharger o Most widely used ERD in SWRO o Efficiencies up to 80% o Unmatched efficiencies for desalination o Volute insert technology for best up to 98% efficiency range o Highest uptime in the market (99.8%) o Lower initial capital costs o Designed for up to 25+ years of useful life Confidential & Proprietary 16

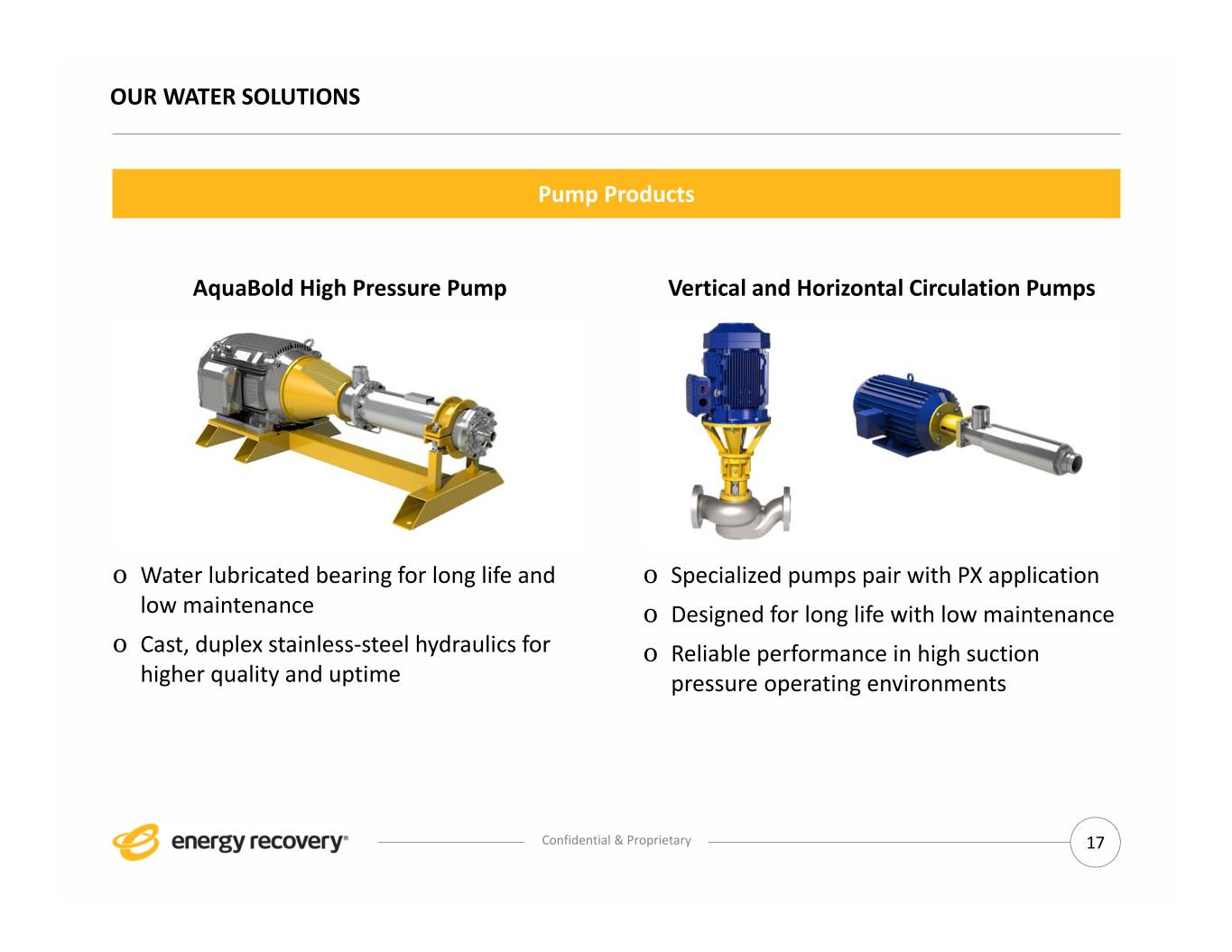

OUR WATER SOLUTIONS Pump Products AquaBold High Pressure Pump Vertical and Horizontal Circulation Pumps o Water lubricated bearing for long life and o Specialized pumps pair with PX application low maintenance o Designed for long life with low maintenance o Cast, duplex stainless‐steel hydraulics for o Reliable performance in high suction higher quality and uptime pressure operating environments Confidential & Proprietary 17

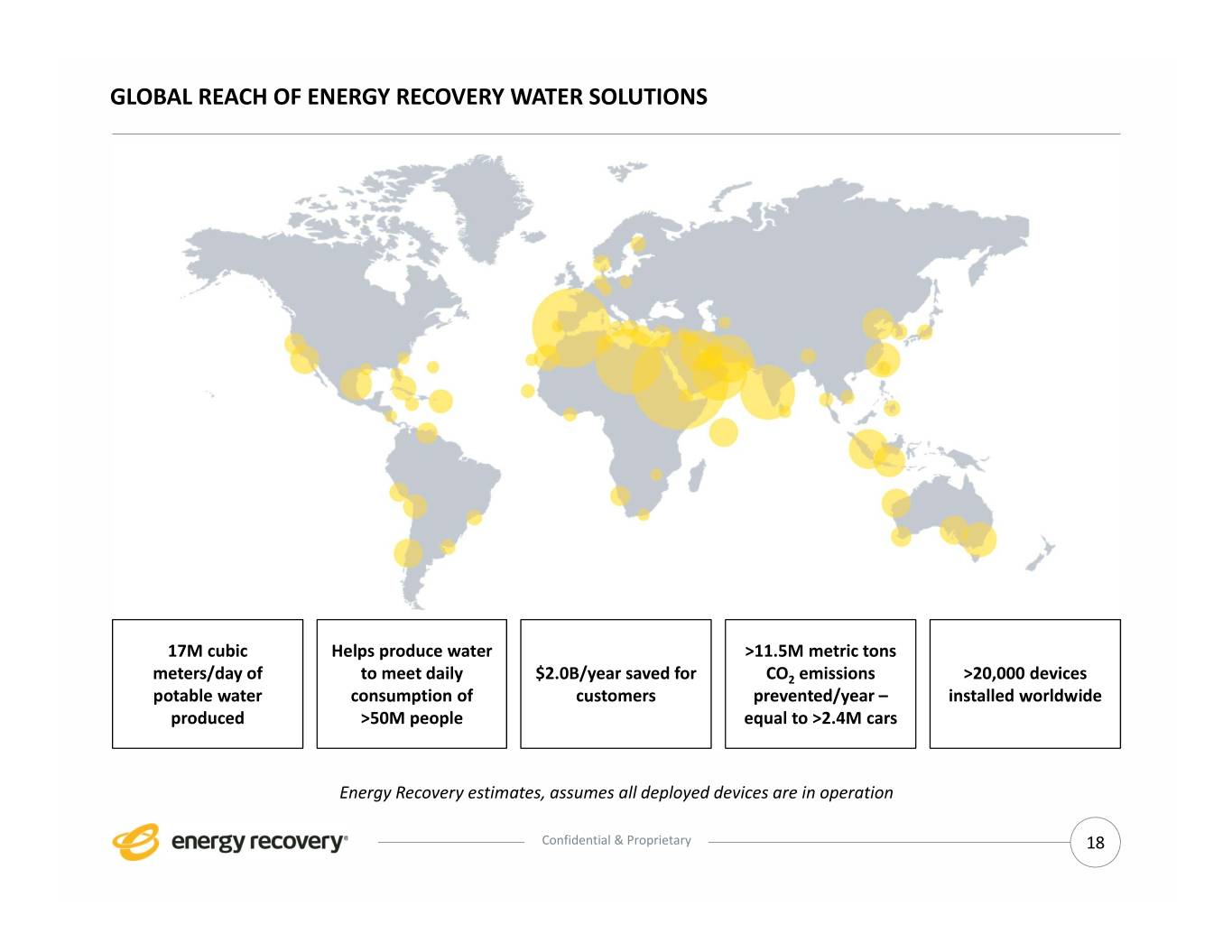

GLOBAL REACH OF ENERGY RECOVERY WATER SOLUTIONS 17M cubic Helps produce water >11.5M metric tons meters/day of to meet daily $2.0B/year saved for CO2 emissions >20,000 devices potable water consumption of customers prevented/year – installed worldwide produced >50M people equal to >2.4M cars Energy Recovery estimates, assumes all deployed devices are in operation Confidential & Proprietary 18

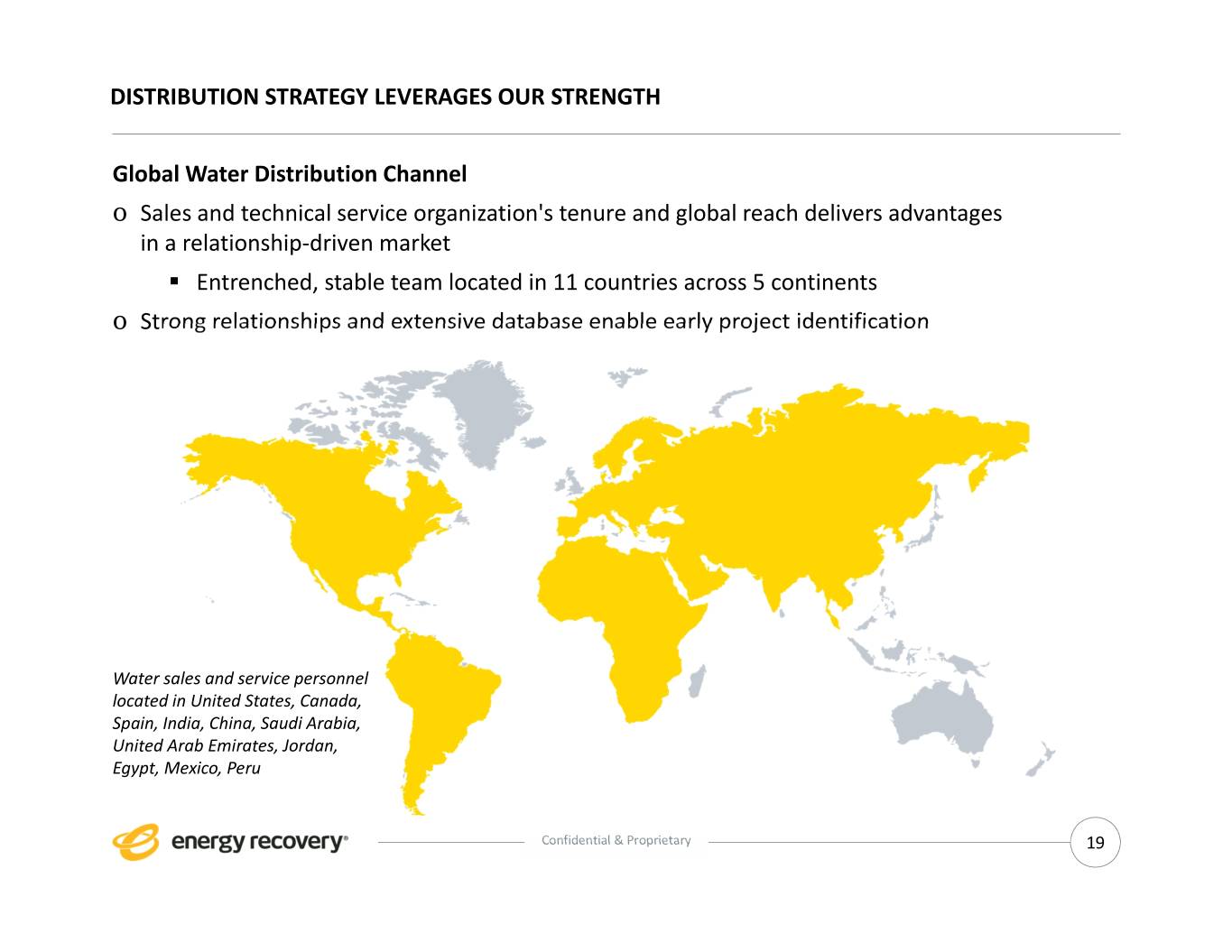

DISTRIBUTION STRATEGY LEVERAGES OUR STRENGTH Global Water Distribution Channel o Sales and technical service organization's tenure and global reach delivers advantages in a relationship‐driven market . Entrenched, stable team located in 11 countries across 5 continents o Strong relationships and extensive database enable early project identification Water sales and service personnel located in United States, Canada, Spain, India, China, Saudi Arabia, United Arab Emirates, Jordan, Egypt, Mexico, Peru Confidential & Proprietary 19

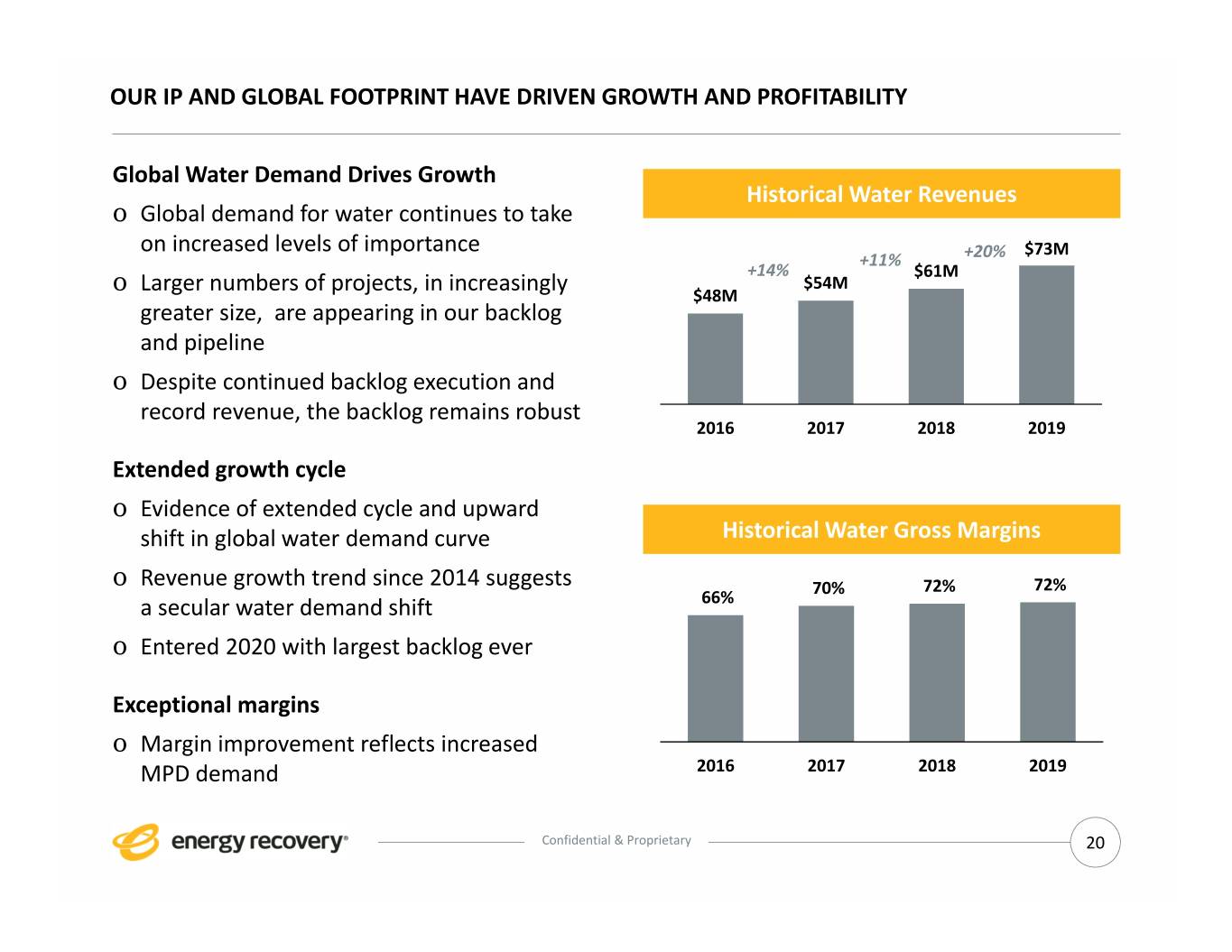

OUR IP AND GLOBAL FOOTPRINT HAVE DRIVEN GROWTH AND PROFITABILITY Global Water Demand Drives Growth Historical Water Revenues o Global demand for water continues to take on increased levels of importance $73M +11% +20% +14% $61M Larger numbers of projects, in increasingly $54M o $48M greater size, are appearing in our backlog and pipeline o Despite continued backlog execution and record revenue, the backlog remains robust 2016 2017 2018 2019 Extended growth cycle o Evidence of extended cycle and upward shift in global water demand curve Historical Water Gross Margins o Revenue growth trend since 2014 suggests 70% 72% 72% a secular water demand shift 66% o Entered 2020 with largest backlog ever Exceptional margins o Margin improvement reflects increased MPD demand 2016 2017 2018 2019 Confidential & Proprietary 20

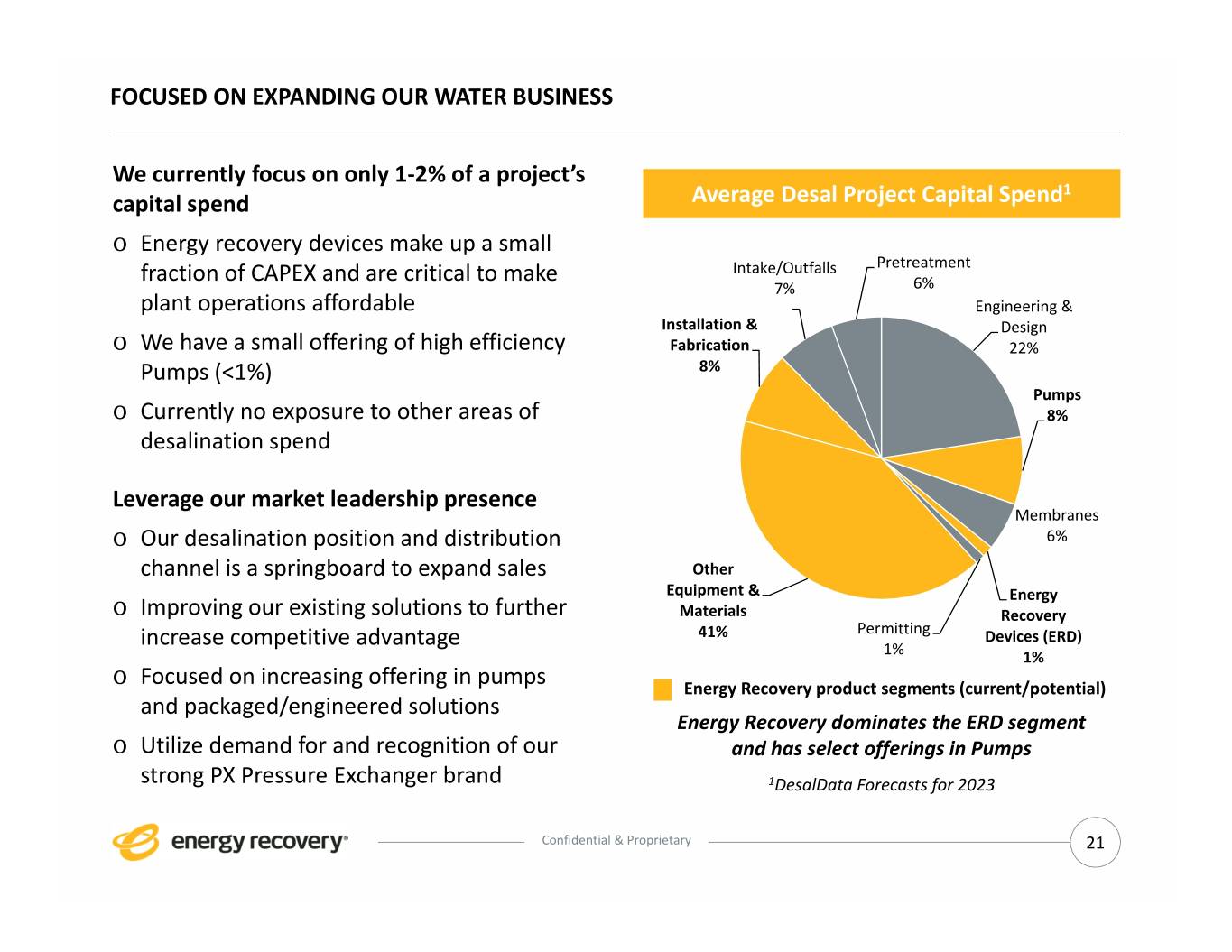

FOCUSED ON EXPANDING OUR WATER BUSINESS We currently focus on only 1‐2% of a project’s 1 capital spend Average Desal Project Capital Spend o Energy recovery devices make up a small fraction of CAPEX and are critical to make Intake/Outfalls Pretreatment 7% 6% plant operations affordable Engineering & Installation & Design o We have a small offering of high efficiency Fabrication 22% Pumps (<1%) 8% Pumps o Currently no exposure to other areas of 8% desalination spend Leverage our market leadership presence Membranes o Our desalination position and distribution 6% channel is a springboard to expand sales Other Equipment & Energy o Improving our existing solutions to further Materials Recovery increase competitive advantage 41% Permitting Devices (ERD) 1% 1% o Focused on increasing offering in pumps Energy Recovery product segments (current/potential) and packaged/engineered solutions Energy Recovery dominates the ERD segment o Utilize demand for and recognition of our and has select offerings in Pumps strong PX Pressure Exchanger brand 1DesalData Forecasts for 2023 Confidential & Proprietary 21

Oil & Gas – Material Progress Made on Path to Commercializing VorTeq Technology

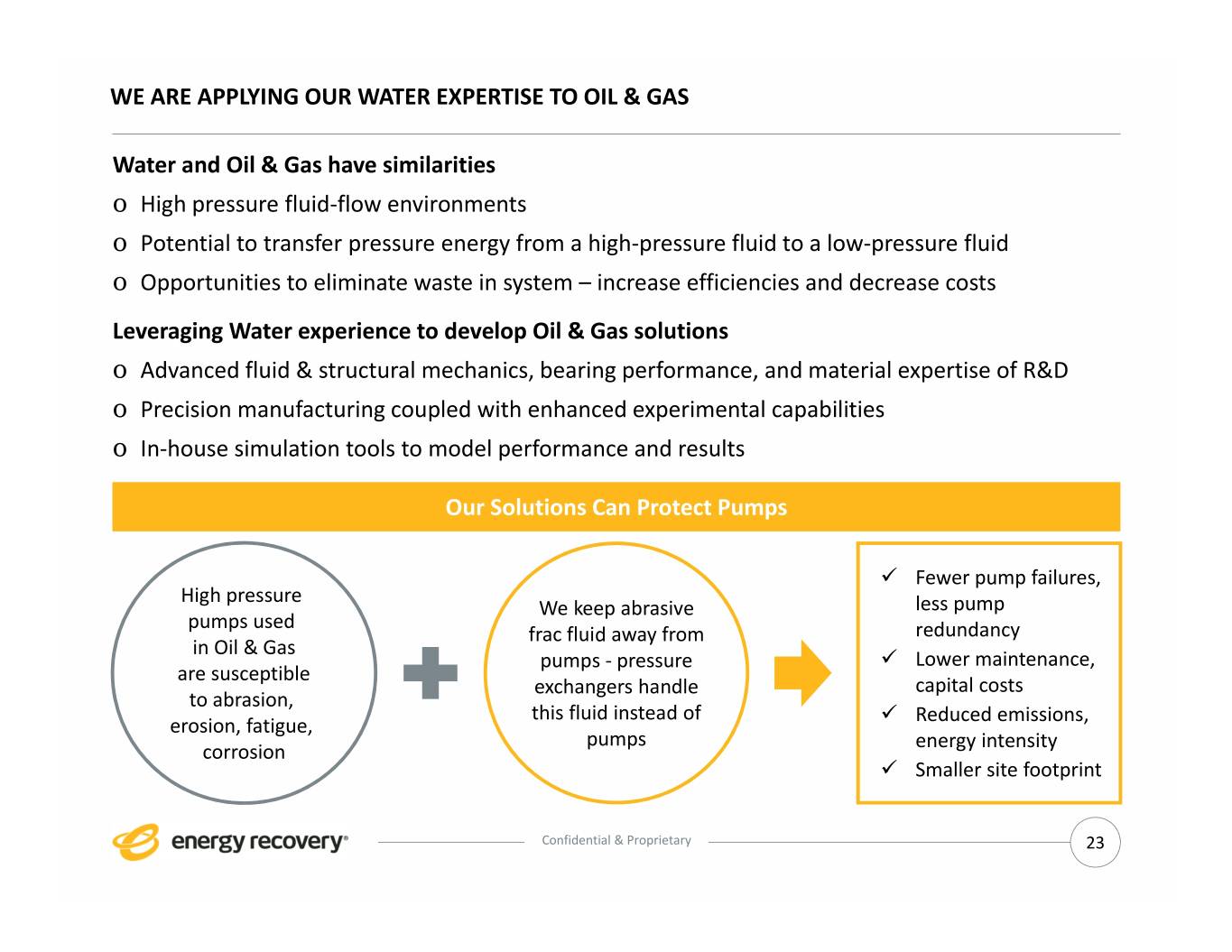

WE ARE APPLYING OUR WATER EXPERTISE TO OIL & GAS Water and Oil & Gas have similarities o High pressure fluid‐flow environments o Potential to transfer pressure energy from a high‐pressure fluid to a low‐pressure fluid o Opportunities to eliminate waste in system – increase efficiencies and decrease costs Leveraging Water experience to develop Oil & Gas solutions o Advanced fluid & structural mechanics, bearing performance, and material expertise of R&D o Precision manufacturing coupled with enhanced experimental capabilities o In‐house simulation tools to model performance and results Our Solutions Can Protect Pumps Fewer pump failures, High pressure We keep abrasive less pump pumps used frac fluid away from redundancy in Oil & Gas pumps ‐ pressure Lower maintenance, are susceptible exchangers handle capital costs to abrasion, this fluid instead of Reduced emissions, erosion, fatigue, pumps energy intensity corrosion Smaller site footprint Confidential & Proprietary 23

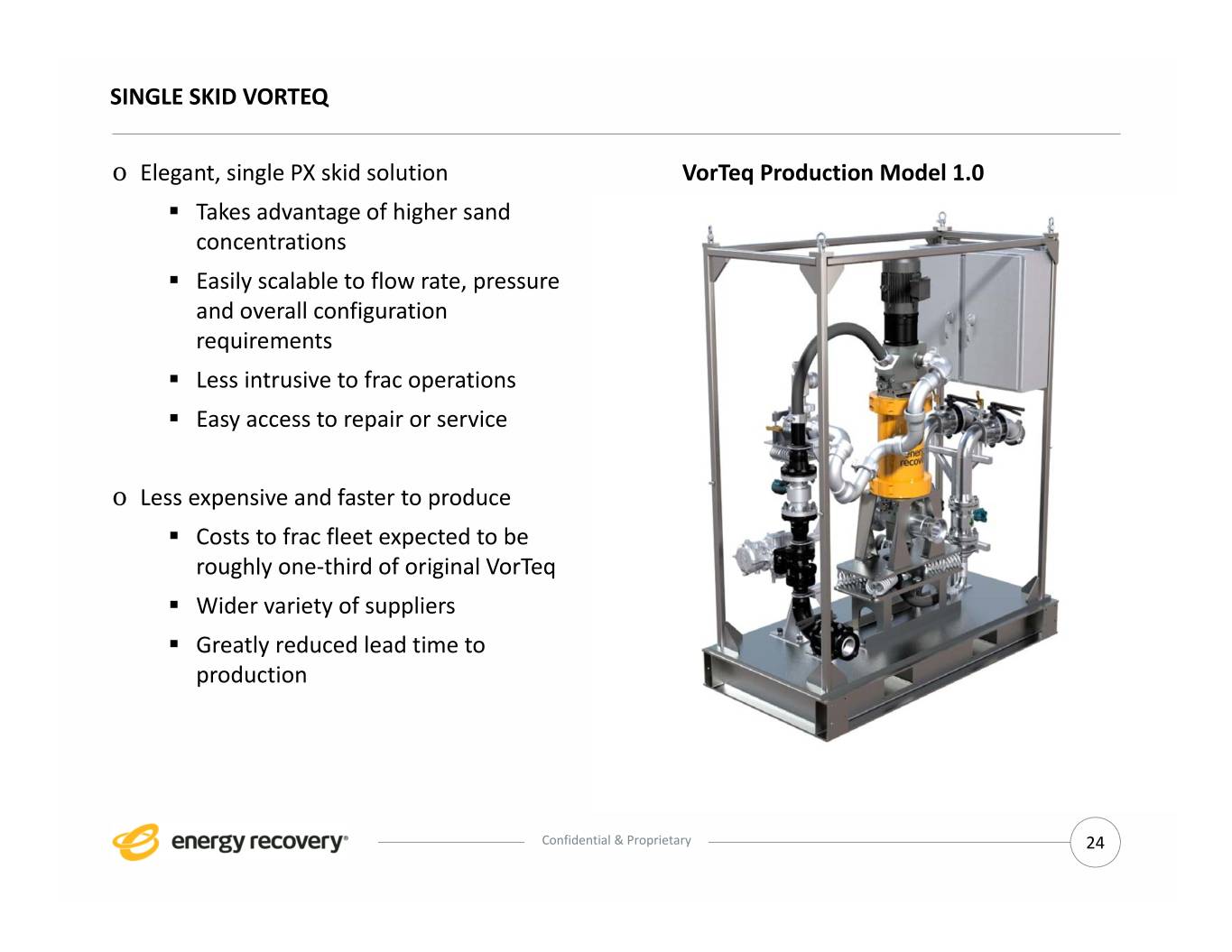

SINGLE SKID VORTEQ o Elegant, single PX skid solution VorTeq Production Model 1.0 . Takes advantage of higher sand concentrations . Easily scalable to flow rate, pressure and overall configuration requirements . Less intrusive to frac operations . Easy access to repair or service o Less expensive and faster to produce . Costs to frac fleet expected to be roughly one‐third of original VorTeq . Wider variety of suppliers . Greatly reduced lead time to production Confidential & Proprietary 24

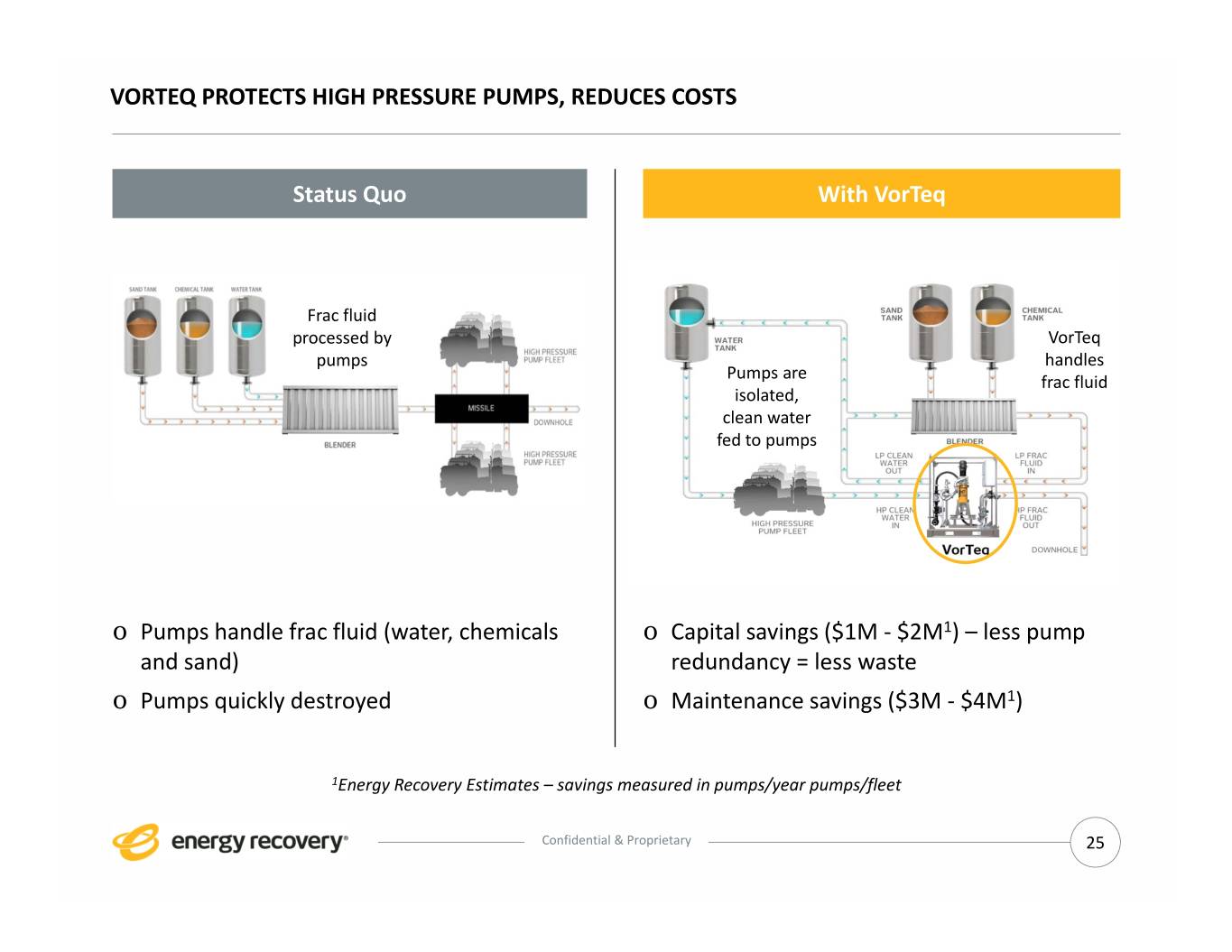

VORTEQ PROTECTS HIGH PRESSURE PUMPS, REDUCES COSTS Status Quo With VorTeq Frac fluid processed by VorTeq pumps handles Pumps are frac fluid isolated, clean water fed to pumps o Pumps handle frac fluid (water, chemicals o Capital savings ($1M ‐ $2M1) – less pump and sand) redundancy = less waste o Pumps quickly destroyed o Maintenance savings ($3M ‐ $4M1) 1Energy Recovery Estimates – savings measured in pumps/year pumps/fleet Confidential & Proprietary 25

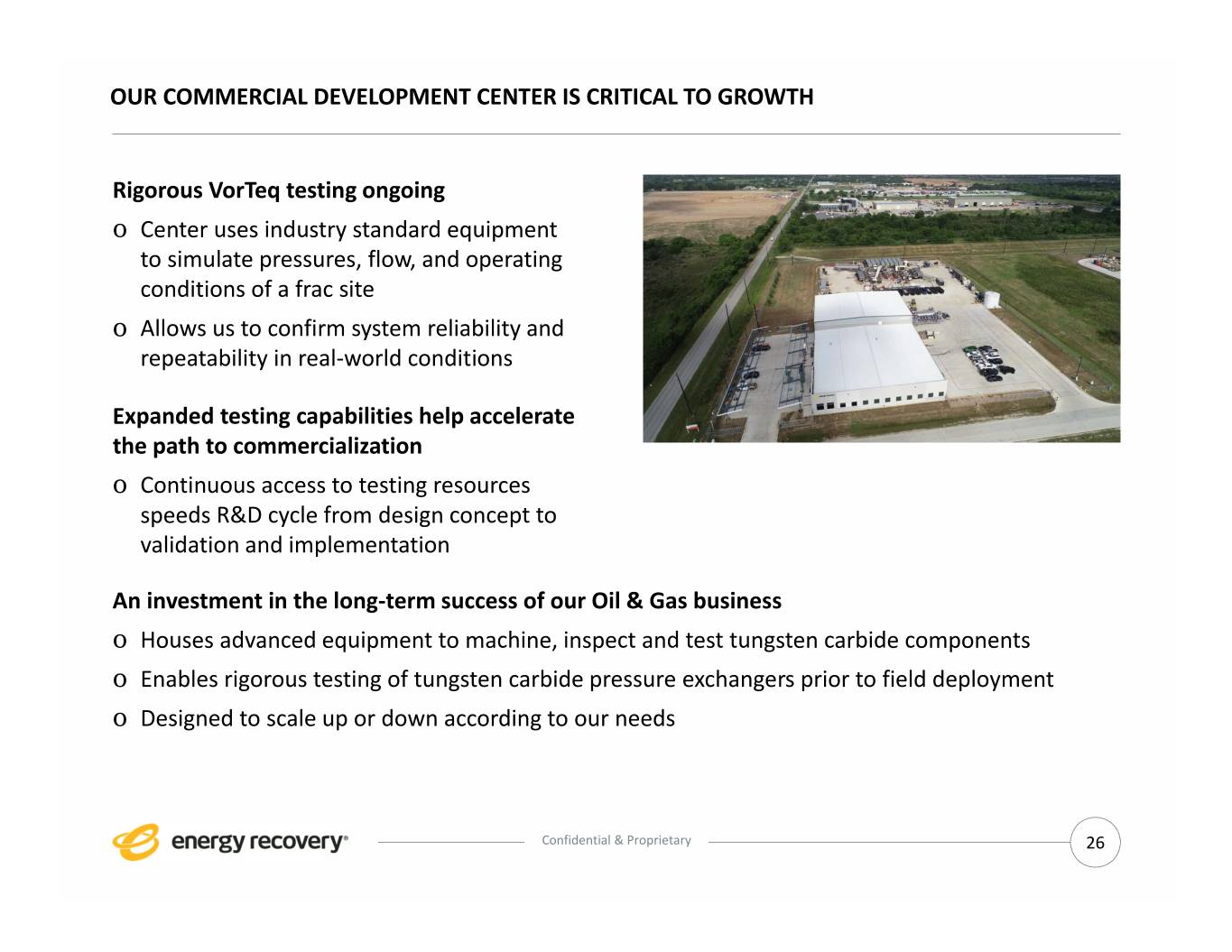

OUR COMMERCIAL DEVELOPMENT CENTER IS CRITICAL TO GROWTH Rigorous VorTeq testing ongoing o Center uses industry standard equipment to simulate pressures, flow, and operating conditions of a frac site o Allows us to confirm system reliability and repeatability in real‐world conditions Expanded testing capabilities help accelerate the path to commercialization o Continuous access to testing resources speeds R&D cycle from design concept to validation and implementation An investment in the long‐term success of our Oil & Gas business o Houses advanced equipment to machine, inspect and test tungsten carbide components o Enables rigorous testing of tungsten carbide pressure exchangers prior to field deployment o Designed to scale up or down according to our needs Confidential & Proprietary 26

Strategic Summary

ENERGY RECOVERY – A BALANCED RISK / REWARD APPROACH Water Incubation Steady, Visible Growth Refocus on new verticals in 2020 o Global water demand outlook remains o Leveraging learnings from VorTeq to robust in 2020 despite economic challenges improve R&D and commercialization globally due to COVID and falling oil prices strategies o Thermal to SWRO technology transition o Reorganization of teams to increase adds to potential long‐term demand trends accountability and transparency o Focus on ROI, size of potential investments Oil & Gas and timelines o Exploit multi‐functional aspects of PX Applying PX Expertise Beyond Water o VorTeq – Commercial Development Center Financially Flexible Balance Sheet is delivering results o Cash is king o Significant progress to commercialization made in 2019 o Solid net cash position provides strategic options amid global crises o Successful field test in June 2020 o Core business is secure o Search for live well test frac ongoing o Growth remains a focus Confidential & Proprietary 28

Thank You