ENERGY RECOVERY INVESTOR PRESENTATION (NASDAQ: ERII) February 2019

FORWARD LOOKING STATEMENT This presentation contains forward-looking statements within the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this report include, but are not limited to, statements about our expectations, objectives, anticipations, plans, hopes, beliefs, intentions, or strategies regarding the future. Forward-looking statements that represent our current expectations about future events are based on assumptions and involve risks and uncertainties. If the risks or uncertainties occur or the assumptions prove incorrect, then our results may differ materially from those set forth or implied by the forward-looking statements. Our forward-looking statements are not guarantees of future performance or events. Words such as “expects,” “anticipates,” “believes,” “estimates,” variations of such words, and similar expressions are also intended to identify such forward-looking statements. These forward-looking statements are subject to risks, uncertainties, and assumptions that are difficult to predict; therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of this presentation. All forward-looking statements included in this presentation are subject to certain risks and uncertainties, which could cause actual results to differ materially from those projected in the forward-looking statements, as disclosed from time to time in our reports on Forms 10-K, 10-Q, and 8-K as well as in our Annual Reports to Stockholders and, if necessary, updated in our quarterly reports on Form 10 Q or in other filings. We assume no obligation to update any such forward- looking statements. It is important to note that our actual results could differ materially from the results set forth or implied by our forward-looking statements. 1

STRATEGIC AND COMMERCIAL UPDATE Water o Robust pipeline and backlog driving expected water segment growth in 2019 and 2020 o Industry trends leading to longer-term optimism ▪ Pursuing organic and inorganic growth initiatives ▪ Leveraging global sales and distribution channel to support product portfolio expansion Oil & Gas o Long-term lease signed for Commercial Development Center in Houston, TX area o VorTeq ▪ Focus remains on commercialization ▪ Accelerated system-level enhancements ahead of Milestone 1 ▪ Expanding in-house full-scale testing capabilities ✓ Greater testing autonomy could shorten development cycle o MTeq ▪ Completed Round 2 testing ▪ Validated ability to run drilling fluid through system in simulated real world conditions ▪ More extensive round of endurance testing to be scheduled 2

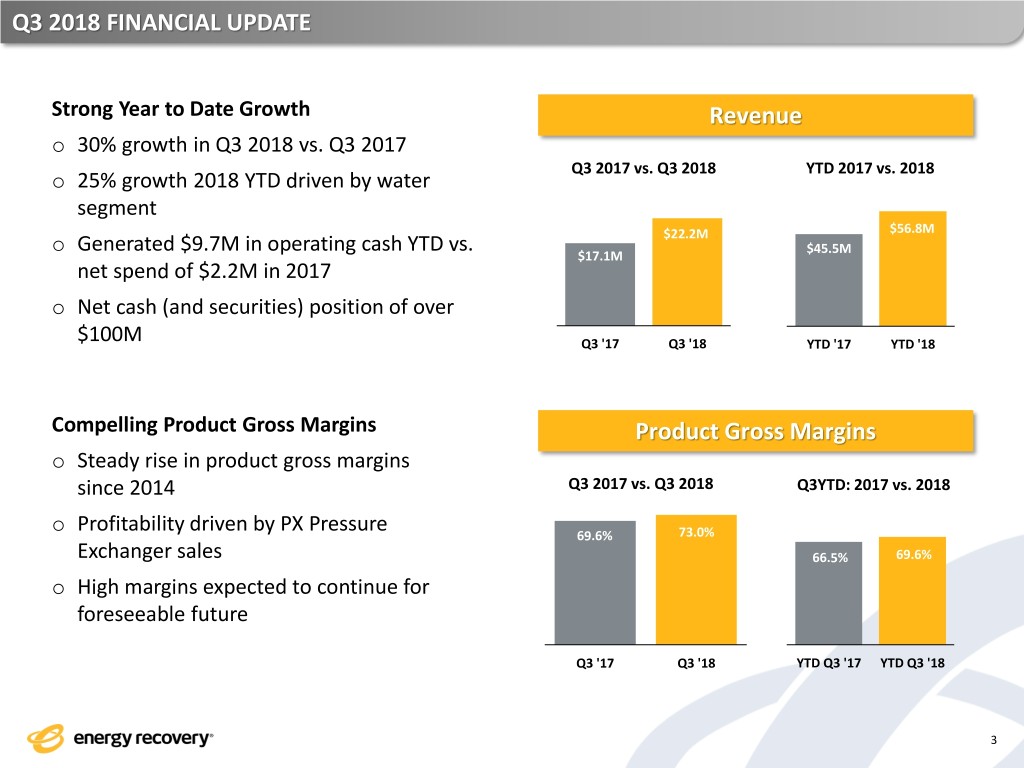

Q3 2018 FINANCIAL UPDATE Strong Year to Date Growth Revenue o 30% growth in Q3 2018 vs. Q3 2017 Q3 2017 vs. Q3 2018 YTD 2017 vs. 2018 o 25% growth 2018 YTD driven by water segment $22.2M $56.8M o Generated $9.7M in operating cash YTD vs. $45.5M $17.1M net spend of $2.2M in 2017 o Net cash (and securities) position of over $100M Q3 '17 Q3 '18 YTD '17 YTD '18 Compelling Product Gross Margins Product Gross Margins o Steady rise in product gross margins since 2014 Q3 2017 vs. Q3 2018 Q3YTD: 2017 vs. 2018 o Profitability driven by PX Pressure 69.6% 73.0% Exchanger sales 66.5% 69.6% o High margins expected to continue for foreseeable future Q3 '17 Q3 '18 YTD Q3 '17 YTD Q3 '18 3

ENERGY RECOVERY SNAPSHOT Who Are We o A global, engineering-driven technology company delivering solutions for industrial fluid flow processes o We drive meaningful, immediate cost savings and operational efficiencies for customers Our Approach o Convert wasted pressure energy into a reusable asset o Preserve or eliminate pumps that are subject to and destroyed by hostile process fluids Our Current Markets o Water o Oil & Gas 4

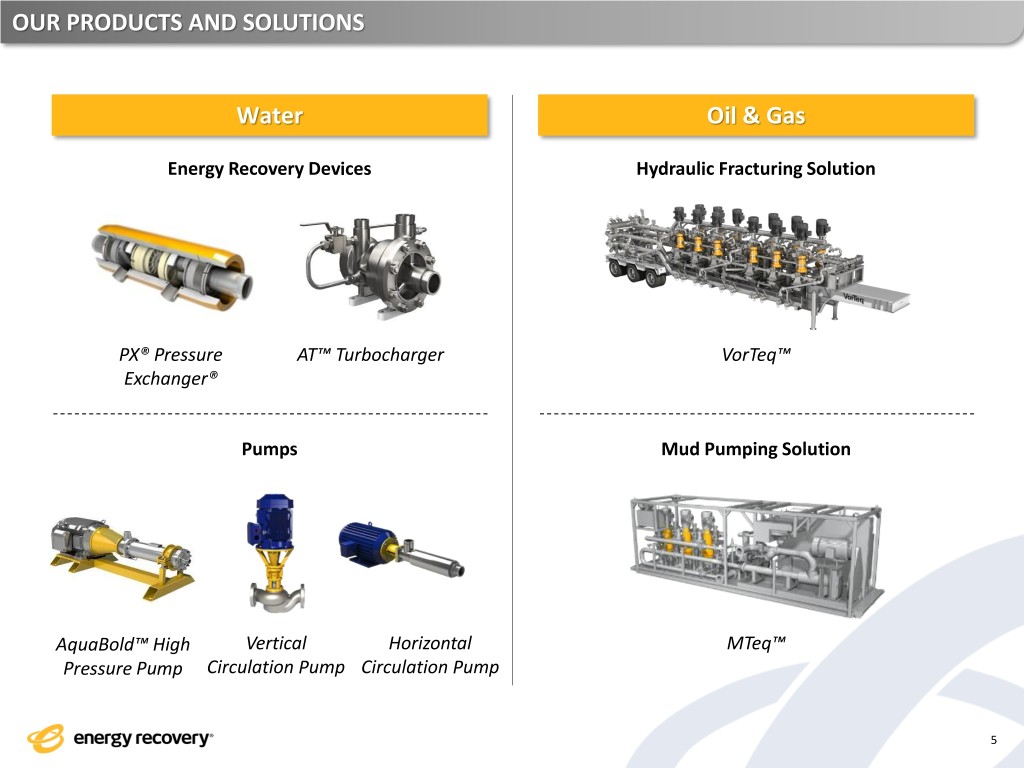

OUR PRODUCTS AND SOLUTIONS Water Oil & Gas Energy Recovery Devices Hydraulic Fracturing Solution PX® Pressure AT™ Turbocharger VorTeq™ Exchanger® Pumps Mud Pumping Solution AquaBold™ High Vertical Horizontal MTeq™ Pressure Pump Circulation Pump Circulation Pump 5

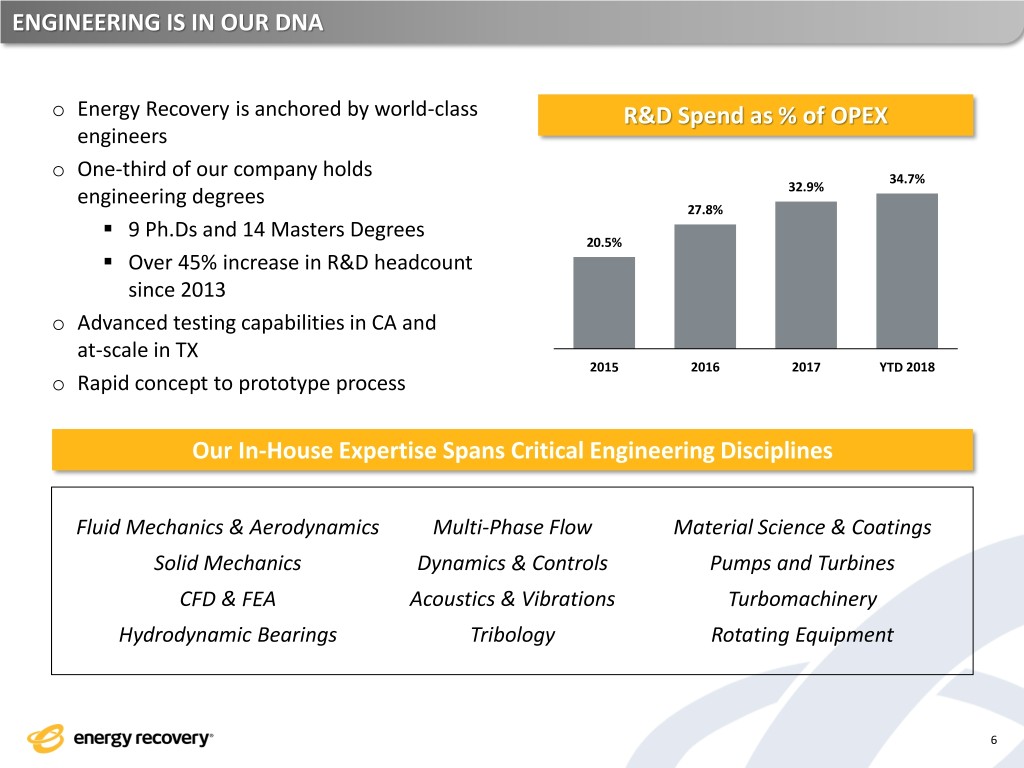

ENGINEERING IS IN OUR DNA o Energy Recovery is anchored by world-class R&D Spend as % of OPEX engineers o One-third of our company holds 34.7% engineering degrees 32.9% 27.8% ▪ 9 Ph.Ds and 14 Masters Degrees 20.5% ▪ Over 45% increase in R&D headcount since 2013 o Advanced testing capabilities in CA and at-scale in TX 2015 2016 2017 YTD 2018 o Rapid concept to prototype process Our In-House Expertise Spans Critical Engineering Disciplines Fluid Mechanics & Aerodynamics Multi-Phase Flow Material Science & Coatings Solid Mechanics Dynamics & Controls Pumps and Turbines CFD & FEA Acoustics & Vibrations Turbomachinery Hydrodynamic Bearings Tribology Rotating Equipment 6

STATE OF THE ART MANUFACTURING: A PREREQUISITE FOR INDUSTRY LEADERSHIP Advanced Ceramics Manufacturing Capabilities Help Drive Water Success o Vertically integrated ceramics manufacturing facility located in-house in CA ▪ Creates potential competitive barrier to entry o Best practices ensure high-quality production process ▪ Approximately 99.9% of every PX Pressure Exchanger passes final stringent quality control before shipping Ceramics Expertise Directly Translates to Tungsten Carbide for Oil & Gas Applications o Similar manufacturing process for tungsten carbide PX Pressure Exchanger ▪ Production follows comparable path – from powder to final machining ▪ Rigid quality control and precision manufacturing o Commercial Development Center in Houston, TX area expected to break ground in 2019 7

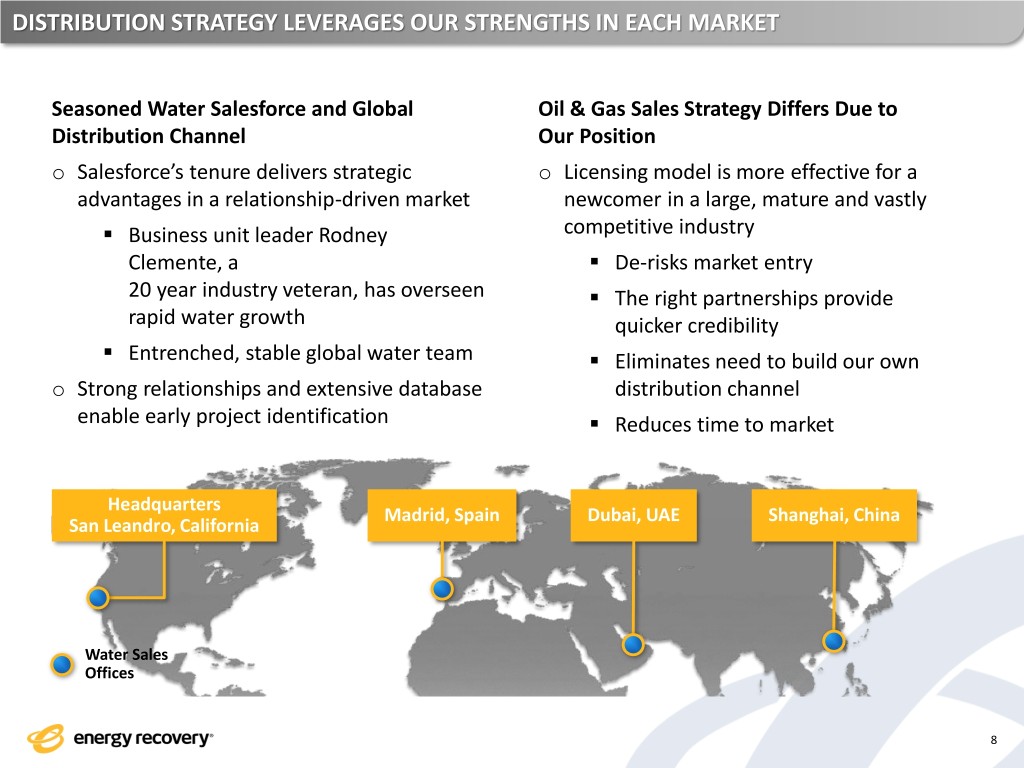

DISTRIBUTION STRATEGY LEVERAGES OUR STRENGTHS IN EACH MARKET Seasoned Water Salesforce and Global Oil & Gas Sales Strategy Differs Due to Distribution Channel Our Position o Salesforce’s tenure delivers strategic o Licensing model is more effective for a advantages in a relationship-driven market newcomer in a large, mature and vastly ▪ Business unit leader Rodney competitive industry Clemente, a ▪ De-risks market entry 20 year industry veteran, has overseen ▪ The right partnerships provide rapid water growth quicker credibility ▪ Entrenched, stable global water team ▪ Eliminates need to build our own o Strong relationships and extensive database distribution channel enable early project identification ▪ Reduces time to market Headquarters Madrid, Spain Dubai, UAE Shanghai, China San Leandro, California Water Sales Offices 8

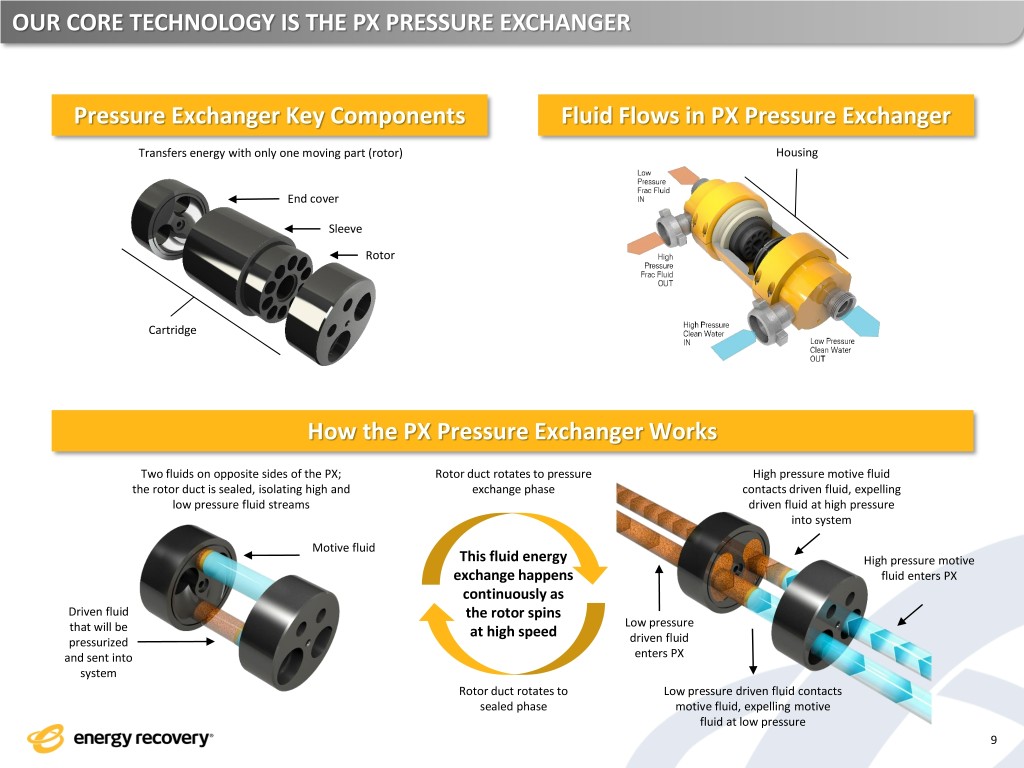

OUR CORE TECHNOLOGY IS THE PX PRESSURE EXCHANGER Pressure Exchanger Key Components Fluid Flows in PX Pressure Exchanger Transfers energy with only one moving part (rotor) Housing End cover Sleeve Rotor Cartridge How the PX Pressure Exchanger Works Two fluids on opposite sides of the PX; Rotor duct rotates to pressure High pressure motive fluid the rotor duct is sealed, isolating high and exchange phase contacts driven fluid, expelling low pressure fluid streams driven fluid at high pressure into system Motive fluid This fluid energy High pressure motive exchange happens fluid enters PX continuously as Driven fluid the rotor spins Low pressure that will be at high speed pressurized driven fluid and sent into enters PX system Rotor duct rotates to Low pressure driven fluid contacts sealed phase motive fluid, expelling motive fluid at low pressure 9

NEAR-TERM BUSINESS OBJECTIVES Further execute on two business units to make capital allocation Commission Commercial decisions based on opportunity Development Center Build infrastructure Grow and expand existing Commercialize VorTeq for growth market presence in Further Develop MTeq seawater desalination and beyond 10

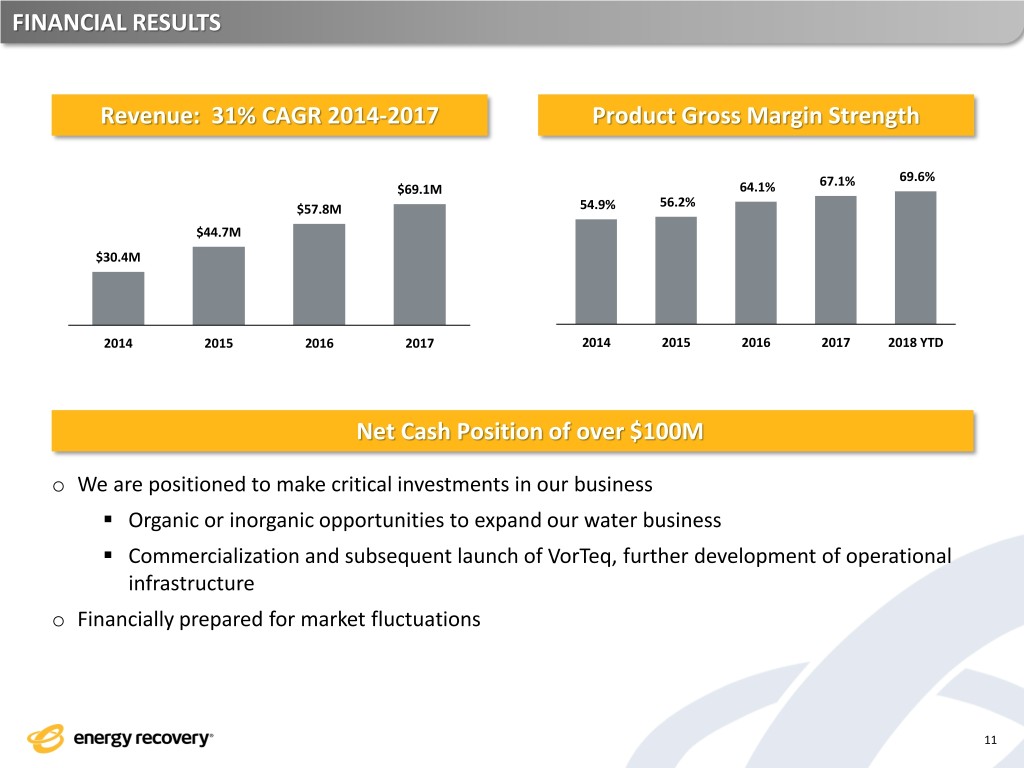

FINANCIAL RESULTS Revenue: 31% CAGR 2014-2017 Product Gross Margin Strength 67.1% 69.6% $69.1M 64.1% 56.2% $57.8M 54.9% $44.7M $30.4M 2014 2015 2016 2017 2014 2015 2016 2017 2018 YTD Net Cash Position of over $100M o We are positioned to make critical investments in our business ▪ Organic or inorganic opportunities to expand our water business ▪ Commercialization and subsequent launch of VorTeq, further development of operational infrastructure o Financially prepared for market fluctuations 11

Water – Our First Market Transformed 12

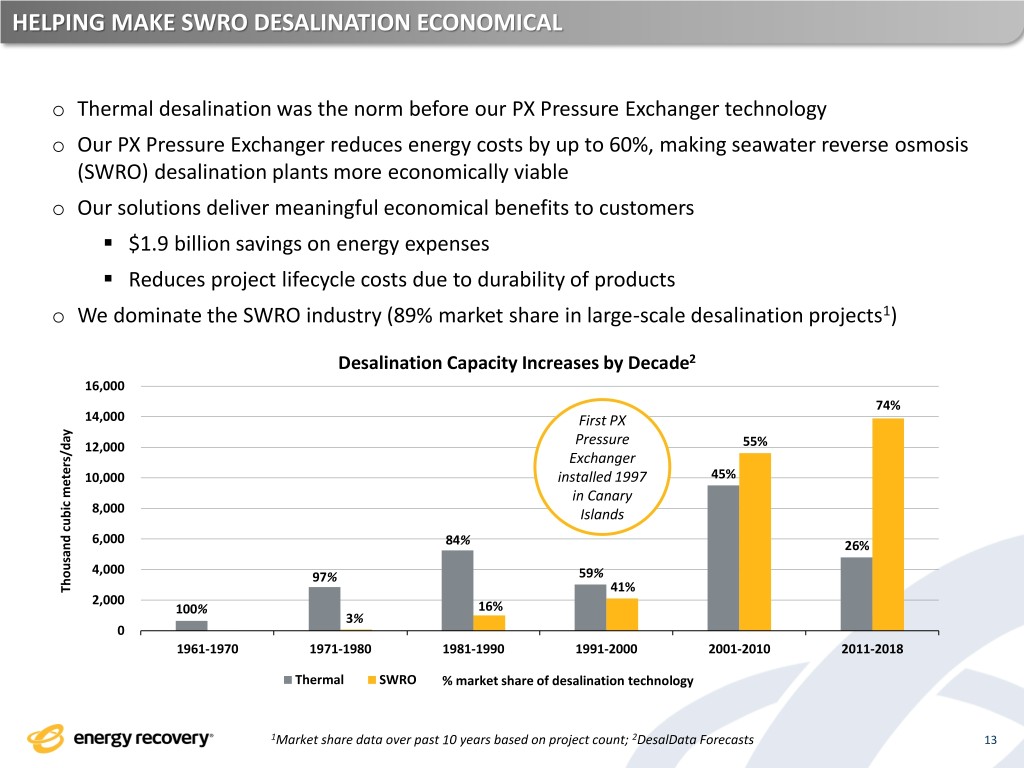

HELPING MAKE SWRO DESALINATION ECONOMICAL o Thermal desalination was the norm before our PX Pressure Exchanger technology o Our PX Pressure Exchanger reduces energy costs by up to 60%, making seawater reverse osmosis (SWRO) desalination plants more economically viable o Our solutions deliver meaningful economical benefits to customers ▪ $1.9 billion savings on energy expenses ▪ Reduces project lifecycle costs due to durability of products o We dominate the SWRO industry (89% market share in large-scale desalination projects1) Desalination Capacity Increases by Decade2 16,000 74% 14,000 First PX 12,000 Pressure 55% Exchanger 10,000 installed 1997 45% in Canary 8,000 Islands ubic meters/dayubic 6,000 84% 26% 4,000 97% 59% Thousandc 41% 2,000 100% 16% 3% 0 1961-1970 1971-1980 1981-1990 1991-2000 2001-2010 2011-2018 Thermal SWRO % market share of desalination technology 1Market share data over past 10 years based on project count; 2DesalData Forecasts 13

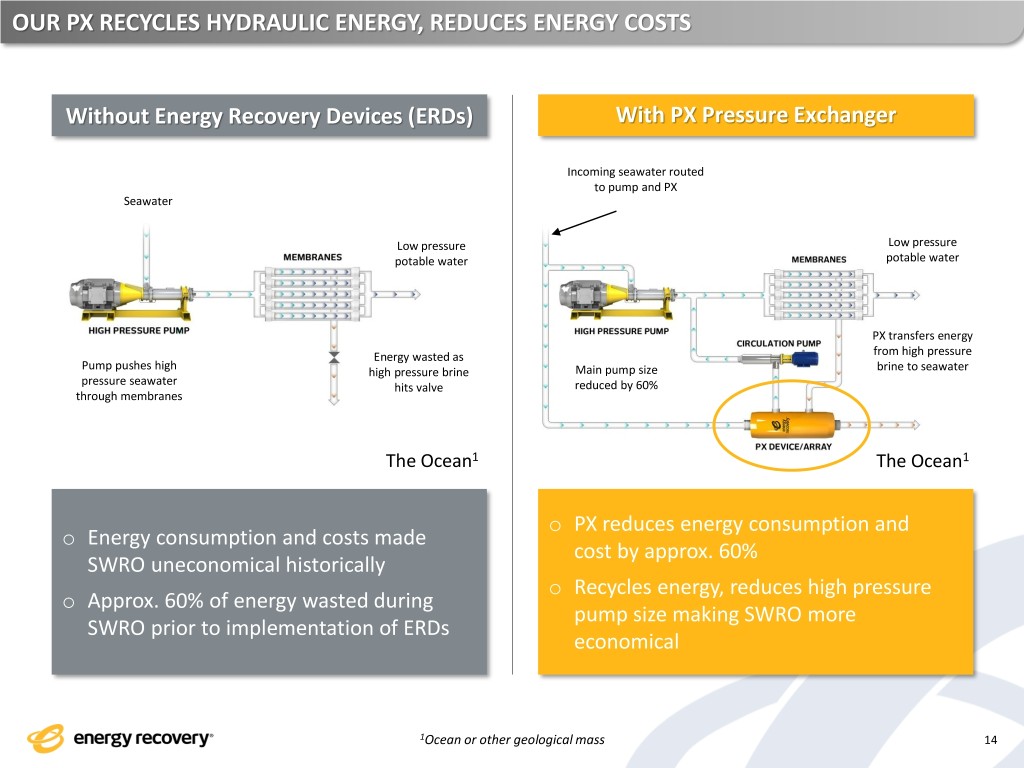

OUR PX RECYCLES HYDRAULIC ENERGY, REDUCES ENERGY COSTS Without Energy Recovery Devices (ERDs) With PX Pressure Exchanger Incoming seawater routed to pump and PX Seawater Low pressure Low pressure potable water potable water PX transfers energy Energy wasted as from high pressure Pump pushes high high pressure brine Main pump size brine to seawater pressure seawater hits valve reduced by 60% through membranes The Ocean1 The Ocean1 o PX reduces energy consumption and o Energy consumption and costs made cost by approx. 60% SWRO uneconomical historically o Recycles energy, reduces high pressure o Approx. 60% of energy wasted during pump size making SWRO more SWRO prior to implementation of ERDs economical 1Ocean or other geological mass 14

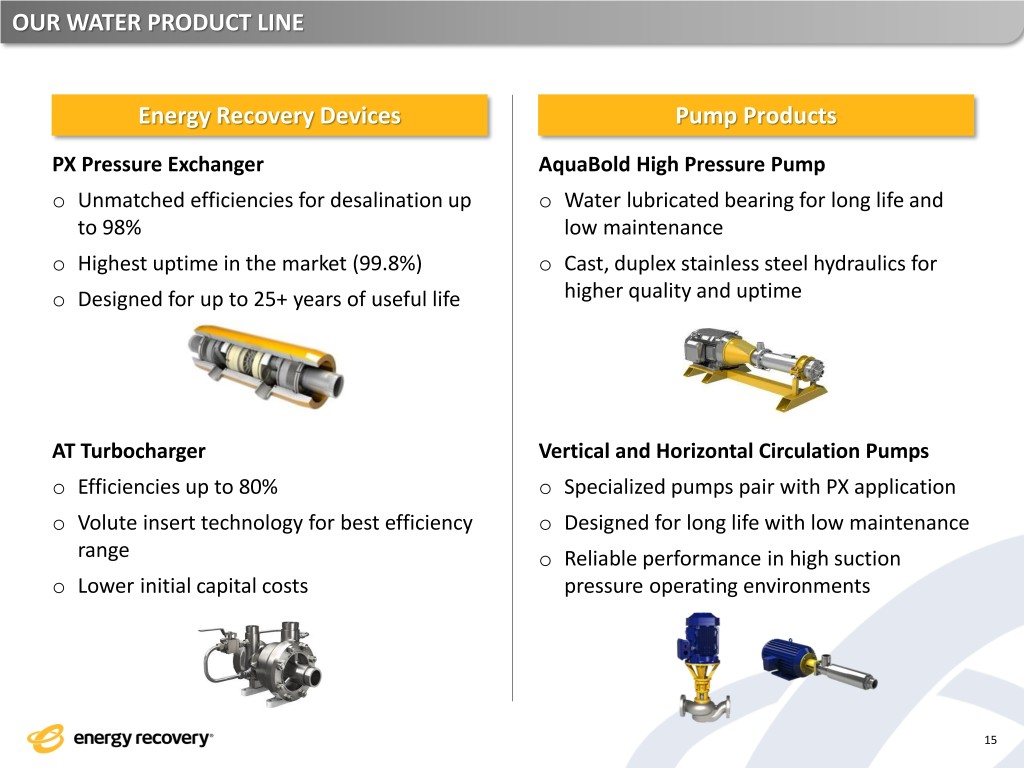

OUR WATER PRODUCT LINE Energy Recovery Devices Pump Products PX Pressure Exchanger AquaBold High Pressure Pump o Unmatched efficiencies for desalination up o Water lubricated bearing for long life and to 98% low maintenance o Highest uptime in the market (99.8%) o Cast, duplex stainless steel hydraulics for o Designed for up to 25+ years of useful life higher quality and uptime AT Turbocharger Vertical and Horizontal Circulation Pumps o Efficiencies up to 80% o Specialized pumps pair with PX application o Volute insert technology for best efficiency o Designed for long life with low maintenance range o Reliable performance in high suction o Lower initial capital costs pressure operating environments 15

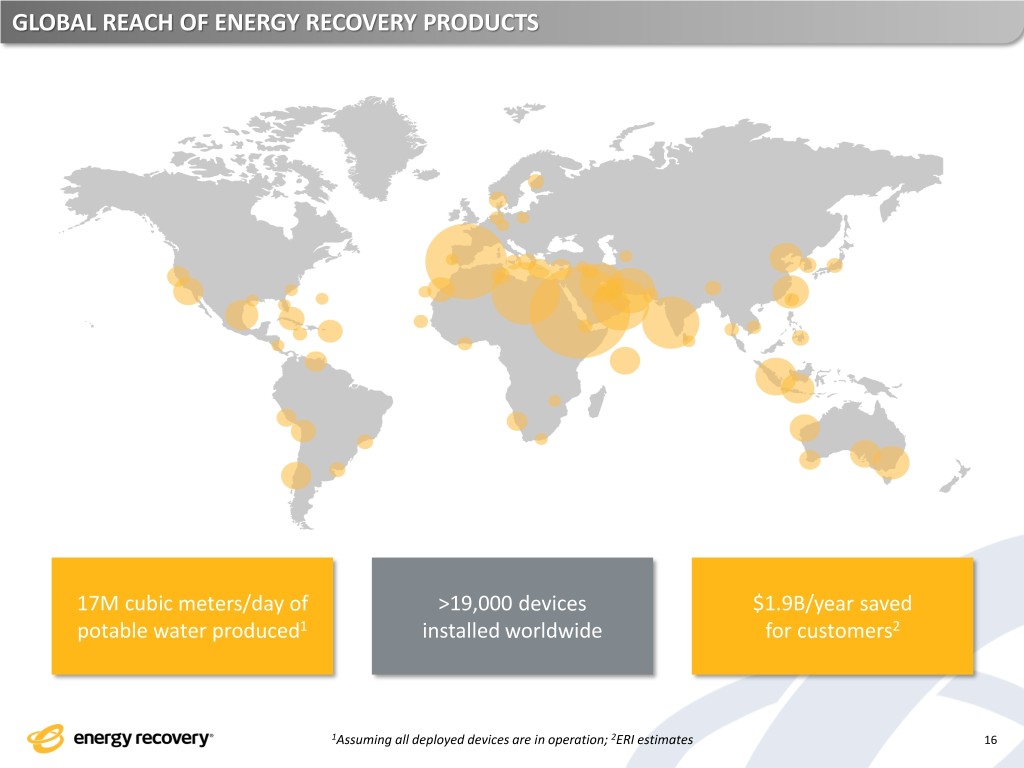

GLOBAL REACH OF ENERGY RECOVERY PRODUCTS 17M cubic meters/day of >19,000 devices $1.9B/year saved potable water produced1 installed worldwide for customers2 1Assuming all deployed devices are in operation; 2ERI estimates 16

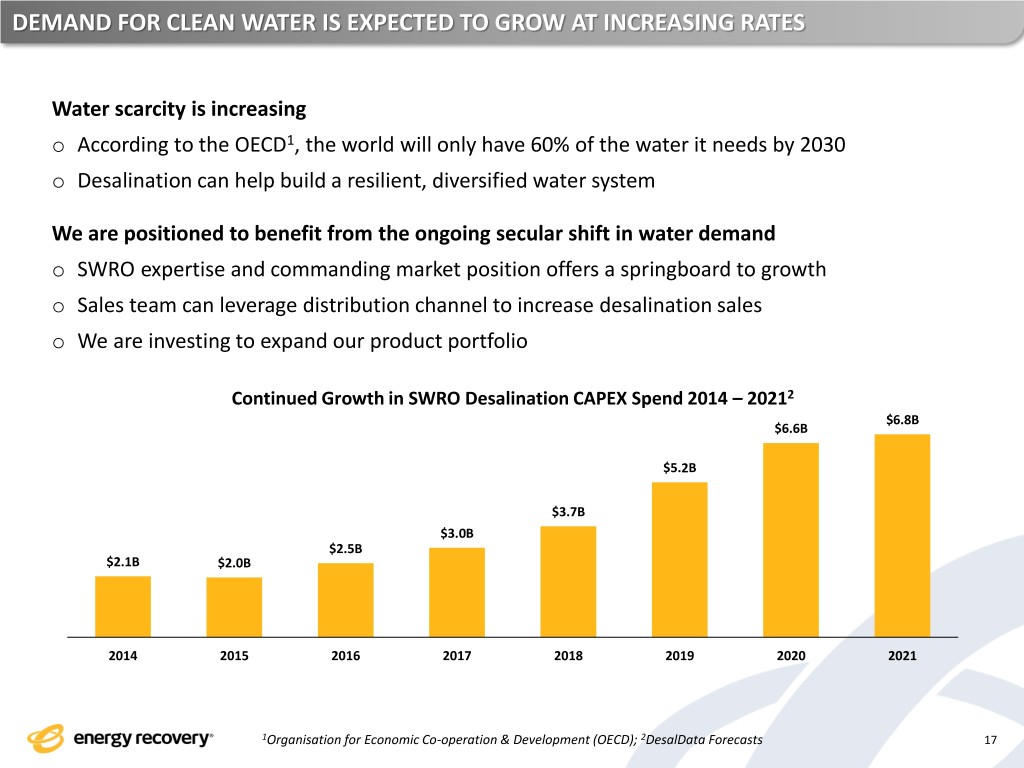

DEMAND FOR CLEAN WATER IS EXPECTED TO GROW AT INCREASING RATES Water scarcity is increasing o According to the OECD1, the world will only have 60% of the water it needs by 2030 o Desalination can help build a resilient, diversified water system We are positioned to benefit from the ongoing secular shift in water demand o SWRO expertise and commanding market position offers a springboard to growth o Sales team can leverage distribution channel to increase desalination sales o We are investing to expand our product portfolio Continued Growth in SWRO Desalination CAPEX Spend 2014 – 20212 $6.8B $6.6B $5.2B $3.7B $3.0B $2.5B $2.1B $2.0B 2014 2015 2016 2017 2018 2019 2020 2021 1Organisation for Economic Co-operation & Development (OECD); 2DesalData Forecasts 17

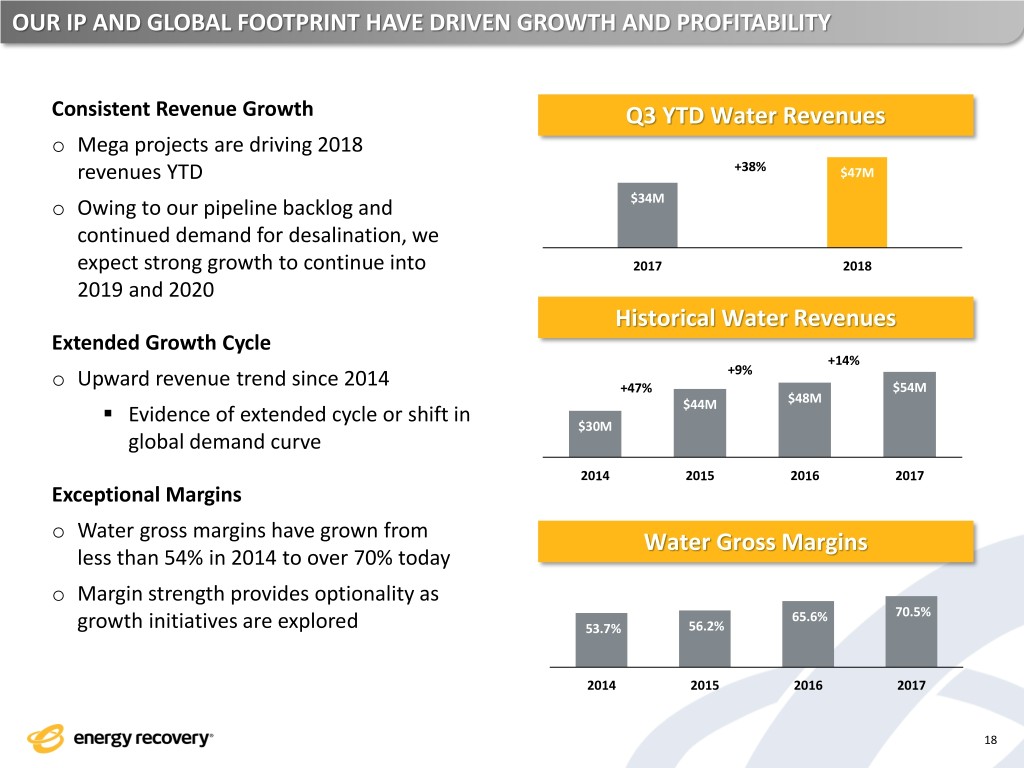

OUR IP AND GLOBAL FOOTPRINT HAVE DRIVEN GROWTH AND PROFITABILITY Consistent Revenue Growth Q3 YTD Water Revenues o Mega projects are driving 2018 revenues YTD +38% $47M o Owing to our pipeline backlog and $34M continued demand for desalination, we expect strong growth to continue into 2017 2018 2019 and 2020 Historical Water Revenues Extended Growth Cycle +14% +9% o Upward revenue trend since 2014 +47% $54M $48M ▪ Evidence of extended cycle or shift in $44M $30M global demand curve 2014 2015 2016 2017 Exceptional Margins o Water gross margins have grown from Water Gross Margins less than 54% in 2014 to over 70% today o Margin strength provides optionality as 65.6% 70.5% growth initiatives are explored 53.7% 56.2% 2014 2015 2016 2017 18

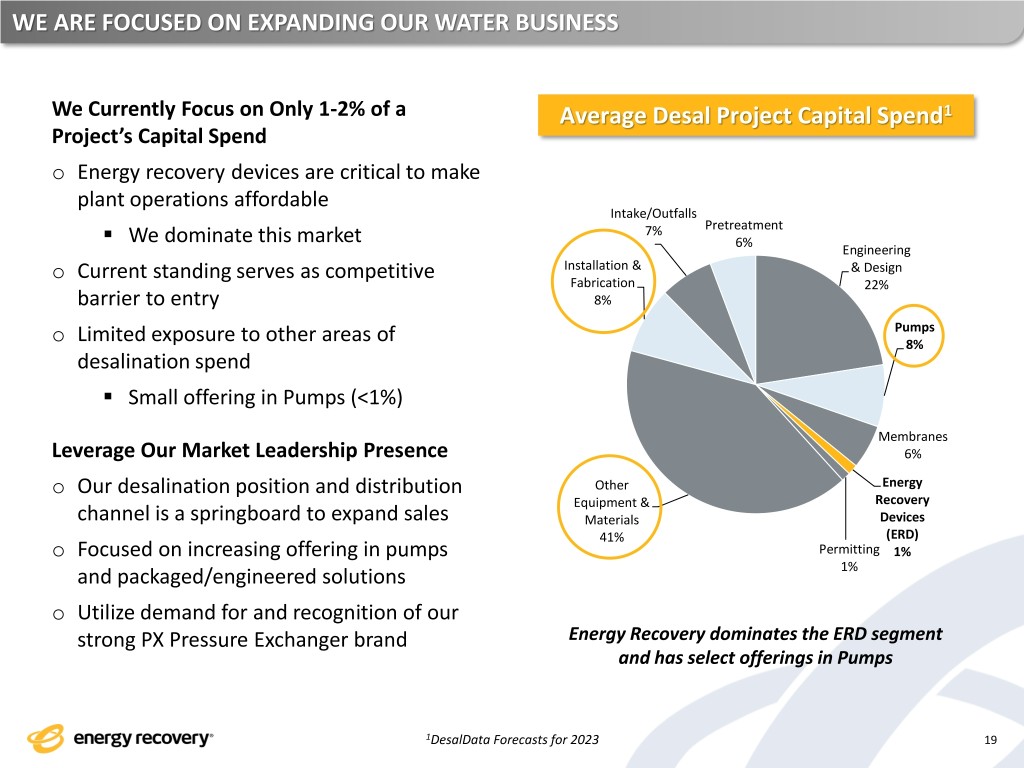

WE ARE FOCUSED ON EXPANDING OUR WATER BUSINESS We Currently Focus on Only 1-2% of a Average Desal Project Capital Spend1 Project’s Capital Spend o Energy recovery devices are critical to make plant operations affordable Intake/Outfalls ▪ 7% Pretreatment We dominate this market 6% Engineering o Current standing serves as competitive Installation & & Design Fabrication 22% barrier to entry 8% Pumps o Limited exposure to other areas of 8% desalination spend ▪ Small offering in Pumps (<1%) Membranes Leverage Our Market Leadership Presence 6% o Our desalination position and distribution Other Energy Equipment & Recovery channel is a springboard to expand sales Materials Devices 41% (ERD) o Focused on increasing offering in pumps Permitting 1% and packaged/engineered solutions 1% o Utilize demand for and recognition of our strong PX Pressure Exchanger brand Energy Recovery dominates the ERD segment and has select offerings in Pumps 1DesalData Forecasts for 2023 19

Oil & Gas – Our Next Market to Transform 20

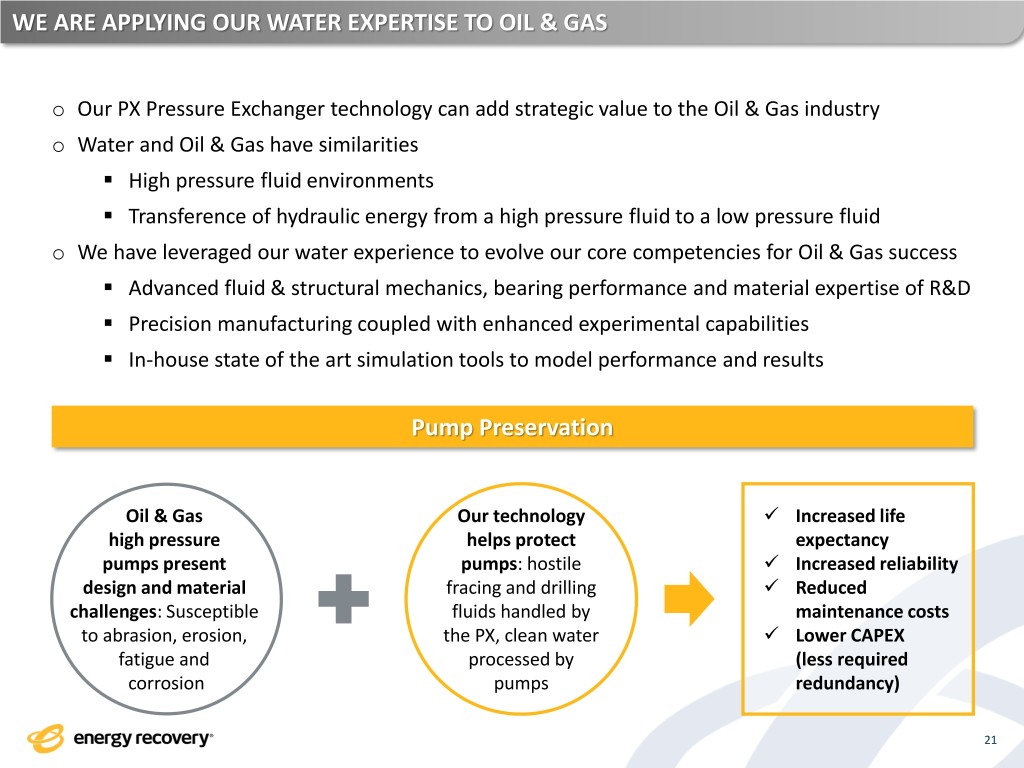

WE ARE APPLYING OUR WATER EXPERTISE TO OIL & GAS o Our PX Pressure Exchanger technology can add strategic value to the Oil & Gas industry o Water and Oil & Gas have similarities ▪ High pressure fluid environments ▪ Transference of hydraulic energy from a high pressure fluid to a low pressure fluid o We have leveraged our water experience to evolve our core competencies for Oil & Gas success ▪ Advanced fluid & structural mechanics, bearing performance and material expertise of R&D ▪ Precision manufacturing coupled with enhanced experimental capabilities ▪ In-house state of the art simulation tools to model performance and results Pump Preservation Oil & Gas Our technology ✓ Increased life high pressure helps protect expectancy pumps present pumps: hostile ✓ Increased reliability design and material fracing and drilling ✓ Reduced challenges: Susceptible fluids handled by maintenance costs to abrasion, erosion, the PX, clean water ✓ Lower CAPEX fatigue and processed by (less required corrosion pumps redundancy) 21

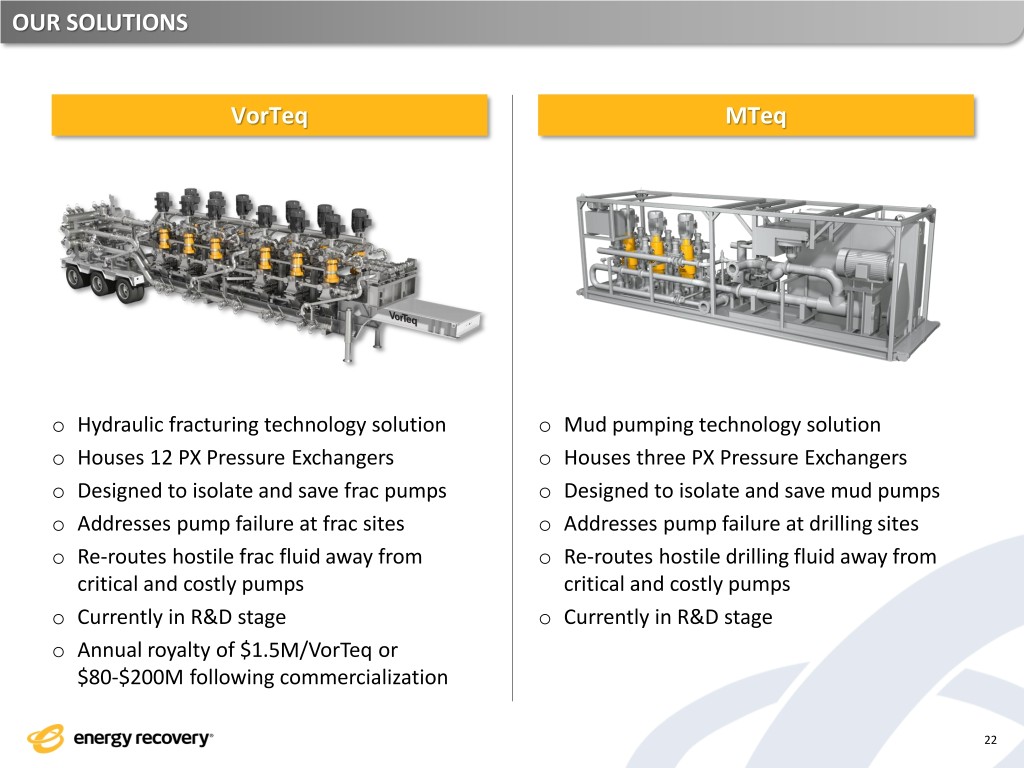

OUR SOLUTIONS VorTeq MTeq o Hydraulic fracturing technology solution o Mud pumping technology solution o Houses 12 PX Pressure Exchangers o Houses three PX Pressure Exchangers o Designed to isolate and save frac pumps o Designed to isolate and save mud pumps o Addresses pump failure at frac sites o Addresses pump failure at drilling sites o Re-routes hostile frac fluid away from o Re-routes hostile drilling fluid away from critical and costly pumps critical and costly pumps o Currently in R&D stage o Currently in R&D stage o Annual royalty of $1.5M/VorTeq or $80-$200M following commercialization 22

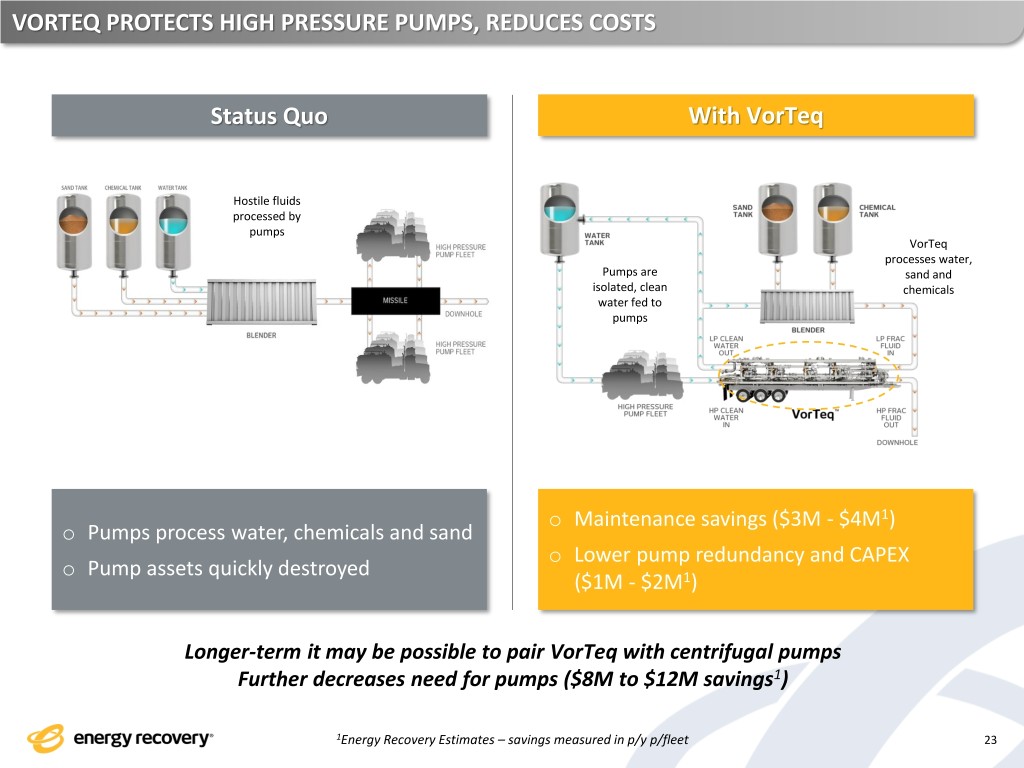

VORTEQ PROTECTS HIGH PRESSURE PUMPS, REDUCES COSTS Status Quo With VorTeq Hostile fluids processed by pumps VorTeq processes water, Pumps are sand and isolated, clean chemicals water fed to pumps o Maintenance savings ($3M - $4M1) o Pumps process water, chemicals and sand o Lower pump redundancy and CAPEX o Pump assets quickly destroyed ($1M - $2M1) Longer-term it may be possible to pair VorTeq with centrifugal pumps Further decreases need for pumps ($8M to $12M savings1) 1Energy Recovery Estimates – savings measured in p/y p/fleet 23

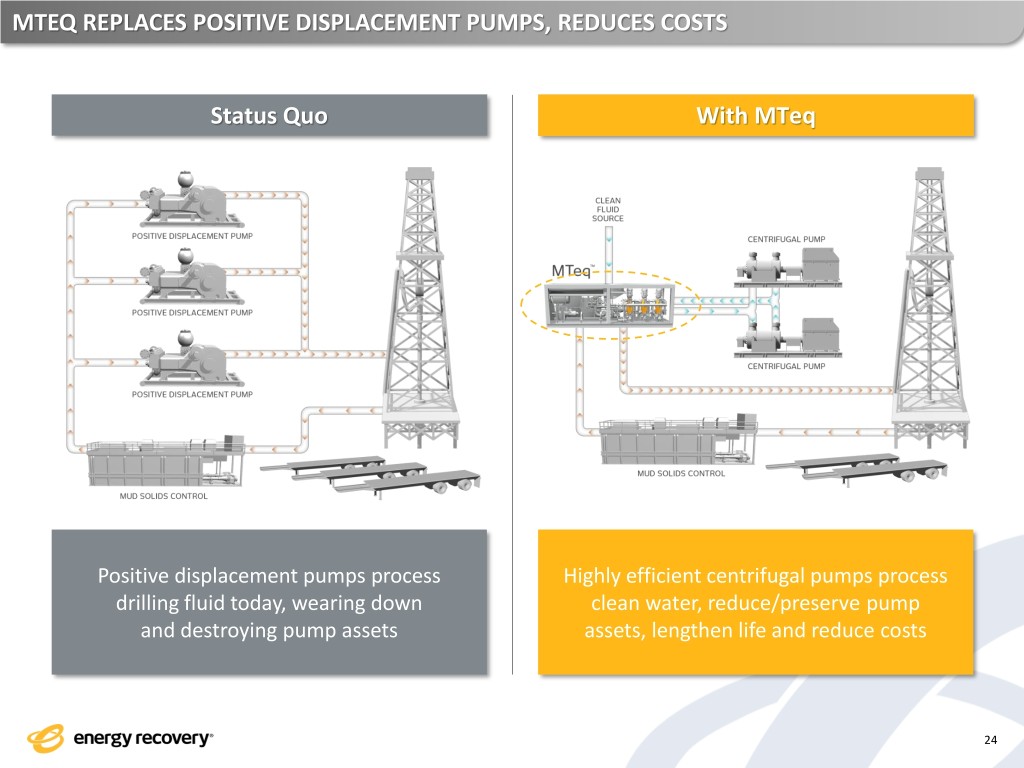

MTEQ REPLACES POSITIVE DISPLACEMENT PUMPS, REDUCES COSTS Status Quo With MTeq Positive displacement pumps process Highly efficient centrifugal pumps process drilling fluid today, wearing down clean water, reduce/preserve pump and destroying pump assets assets, lengthen life and reduce costs 24

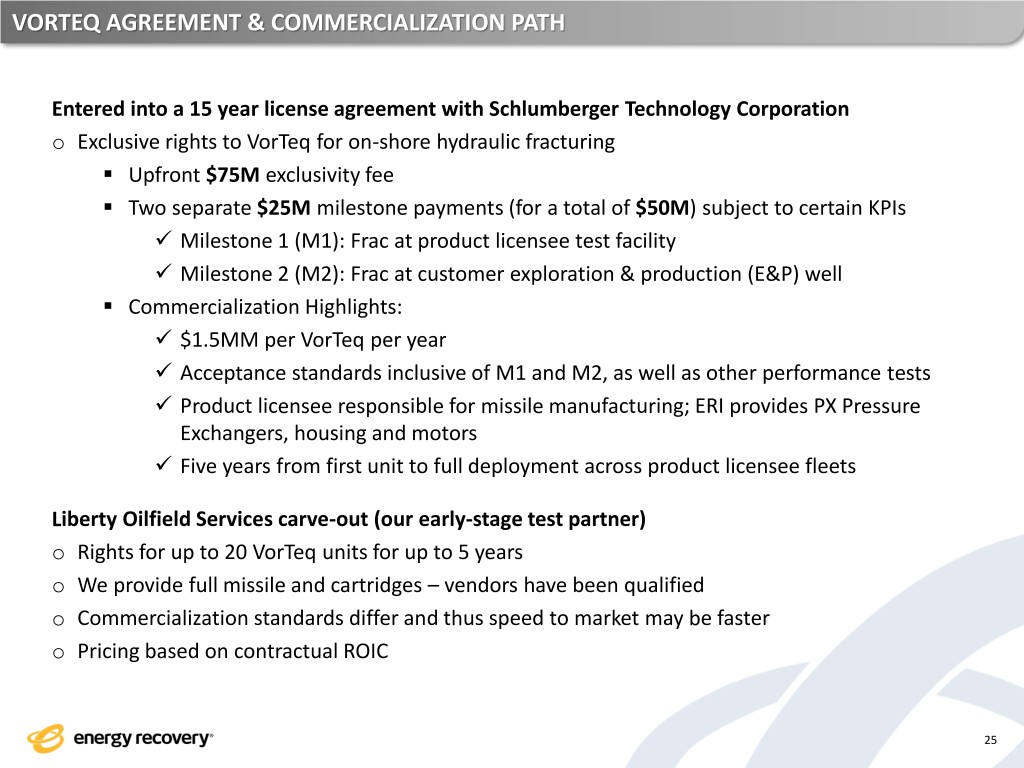

VORTEQ AGREEMENT & COMMERCIALIZATION PATH Entered into a 15 year license agreement with Schlumberger Technology Corporation o Exclusive rights to VorTeq for on-shore hydraulic fracturing ▪ Upfront $75M exclusivity fee ▪ Two separate $25M milestone payments (for a total of $50M) subject to certain KPIs ✓ Milestone 1 (M1): Frac at product licensee test facility ✓ Milestone 2 (M2): Frac at customer exploration & production (E&P) well ▪ Commercialization Highlights: ✓ $1.5MM per VorTeq per year ✓ Acceptance standards inclusive of M1 and M2, as well as other performance tests ✓ Product licensee responsible for missile manufacturing; ERI provides PX Pressure Exchangers, housing and motors ✓ Five years from first unit to full deployment across product licensee fleets Liberty Oilfield Services carve-out (our early-stage test partner) o Rights for up to 20 VorTeq units for up to 5 years o We provide full missile and cartridges – vendors have been qualified o Commercialization standards differ and thus speed to market may be faster o Pricing based on contractual ROIC 25

WE ARE TAKING CONTROL OF THE COMMERCIALIZATION PROCESS In 2018, we invested in critical human and capital resources o We purchased our own high pressure pumps and ancillary equipment to execute testing ▪ Already shown dividends when utilized at partner facility in 2018 o We hired field service personnel with fracing expertise to further build our operations team Lease signed for new four-acre Commercial Development Center near Houston, Texas. Once operational, the center will: o Allow us to test all our Oil & Gas technology solutions at scale and in real-world conditions o House advanced equipment to machine, inspect and test tungsten carbide components The expanded capabilities of the center should shorten the path to commercialization o Reduces time between design enhancement, implementation and testing o Removes reliance on partner and product licensee resource availability o Enables rigorous testing of tungsten carbide pressure exchangers prior to field deployment 26

STRATEGIC SUMMARY

ENERGY RECOVERY – A BALANCED RISK/REWARD APPROACH Water: Steady, Visible Growth o Global demand for potable water leads to further optimism o Robust backlog and pipeline driving expected water segment growth in 2019 and 2020 o Looking to leverage our current desalination position ▪ Sales and distribution channel offers product portfolio expansion potential ▪ Exploring organic and inorganic growth initiatives Oil & Gas: Applying PX Pressure Exchanger Expertise to a New Industry o Commercialization focus o Commercial Development Center increases autonomy ▪ Reduces the cycle time to test and validate PX advancements ▪ Allow us to test all our Oil & Gas technology solutions at scale and in real-world conditions Financially Flexible Balance Sheet o Solid net cash position enables progression of corporate strategy throughout industry cycles o Allows for strategic options 28

THANK YOU