ERI INVESTOR PRESENTATION

(NASDAQ: ERII)

2018

This presentation contains forward-looking statements within the “Safe Harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements in this report include, but are not limited to, statements about our

expectations, objectives, anticipations, plans, hopes, beliefs, intentions, or strategies regarding the future. Forward-looking

statements that represent our current expectations about future events are based on assumptions and involve risks and

uncertainties. If the risks or uncertainties occur or the assumptions prove incorrect, then our results may differ materially from

those set forth or implied by the forward-looking statements. Our forward-looking statements are not guarantees of future

performance or events. Words such as “expects,” “anticipates,” “believes,” “estimates,” variations of such words, and similar

expressions are also intended to identify such forward-looking statements.

These forward-looking statements are subject to risks, uncertainties, and assumptions that are difficult to predict; therefore,

actual results may differ materially and adversely from those expressed in any forward-looking statements. You should not

place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of this

presentation. All forward-looking statements included in this presentation are subject to certain risks and uncertainties, which

could cause actual results to differ materially from those projected in the forward-looking statements, as disclosed from time to

time in our reports on Forms 10-K, 10-Q, and 8-K as well as in our Annual Reports to Stockholders and, if necessary, updated in

our quarterly reports on Form 10 Q or in other filings. We assume no obligation to update any such forward-looking

statements. It is important to note that our actual results could differ materially from the results set forth or implied by our

forward-looking statements.

FORWARD LOOKING STATEMENT

Page 2

Page 3

VORTEQ UPDATE

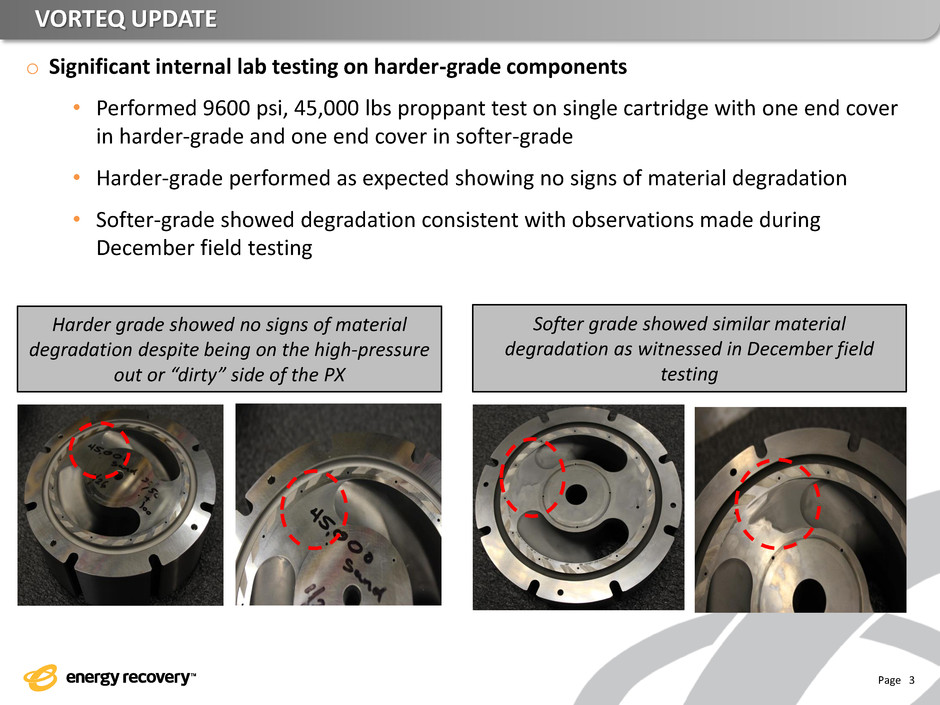

o Significant internal lab testing on harder-grade components

• Performed 9600 psi, 45,000 lbs proppant test on single cartridge with one end cover

in harder-grade and one end cover in softer-grade

• Harder-grade performed as expected showing no signs of material degradation

• Softer-grade showed degradation consistent with observations made during

December field testing

Harder grade showed no signs of material

degradation despite being on the high-pressure

out or “dirty” side of the PX

Softer grade showed similar material

degradation as witnessed in December field

testing

Page 4

VORTEQ UPDATE - CONTINUED

o Based on internal testing, Company opts to utilize harder-grade for all cartridge

components

o Cartridge components have arrived and will continue to arrive throughout Q1;

timing consistent with prior guidance

o Final machining and qualification of received components to continue in parallel

o Expect to resume field testing, up to and including milestone one, as soon as all

components have been received and qualified

o Next update will occur during conference call to discuss year-end results

ENERGY RECOVERY SNAPSHOT

Page 5

What We Do/Product Strategy

An energy solutions provider and technology

leader in applying fluid dynamics and

advanced materials science

Who We Are

Create markets to preserve or eliminate

pumps that are subject to and destroyed by

hostile process fluids

Convert wasted pressure energy into a

reusable asset

Pressure Energy is our Arbitrage

MATERIAL SCIENCE ARBITRAGE – PUMP PRESERVATION

Page 6

Typical pumps present design and material

composition challenges:

Multiple moving parts, multiple potential points

of failure

Components chiefly comprised of alloys, coated

alloys and polymers

Susceptible to abrasion, erosion, fatigue and corrosion

The pressure exchanger is elegant in design

and robust in material composition:

One moving part (rotor)

Components are cermet or ceramic

(tungsten carbide or alumina)

Hybrid bearing technology

(hydrostatic and hydrodynamic)

Design and Material Science Superiority Yields:

Increased life expectancy

Increased reliability

Lower R&M expenses

Lower CAPEX (less required redundancy)

Pressure Exchanger Advantage Status Quo Challenge

Value Arbitrage

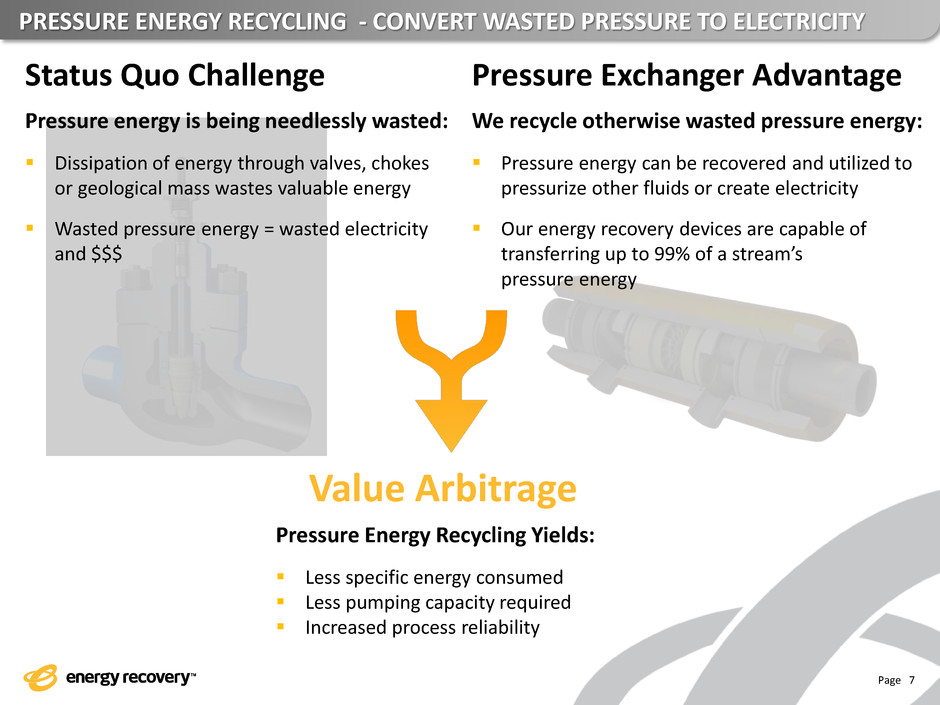

PRESSURE ENERGY RECYCLING - CONVERT WASTED PRESSURE TO ELECTRICITY

Page 7

Pressure energy is being needlessly wasted:

Dissipation of energy through valves, chokes

or geological mass wastes valuable energy

Wasted pressure energy = wasted electricity

and $$$

We recycle otherwise wasted pressure energy:

Pressure energy can be recovered and utilized to

pressurize other fluids or create electricity

Our energy recovery devices are capable of

transferring up to 99% of a stream’s

pressure energy

Pressure Energy Recycling Yields:

Less specific energy consumed

Less pumping capacity required

Increased process reliability

Pressure Exchanger Advantage Status Quo Challenge

Value Arbitrage

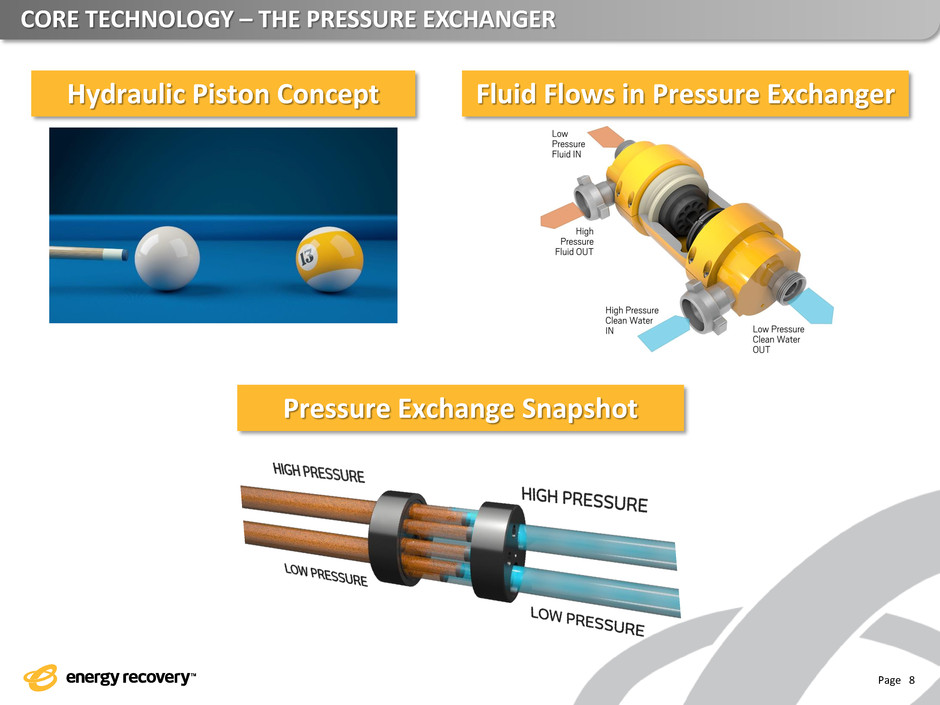

CORE TECHNOLOGY – THE PRESSURE EXCHANGER

Page 8

Fluid Flows in Pressure Exchanger Hydraulic Piston Concept

Pressure Exchange Snapshot

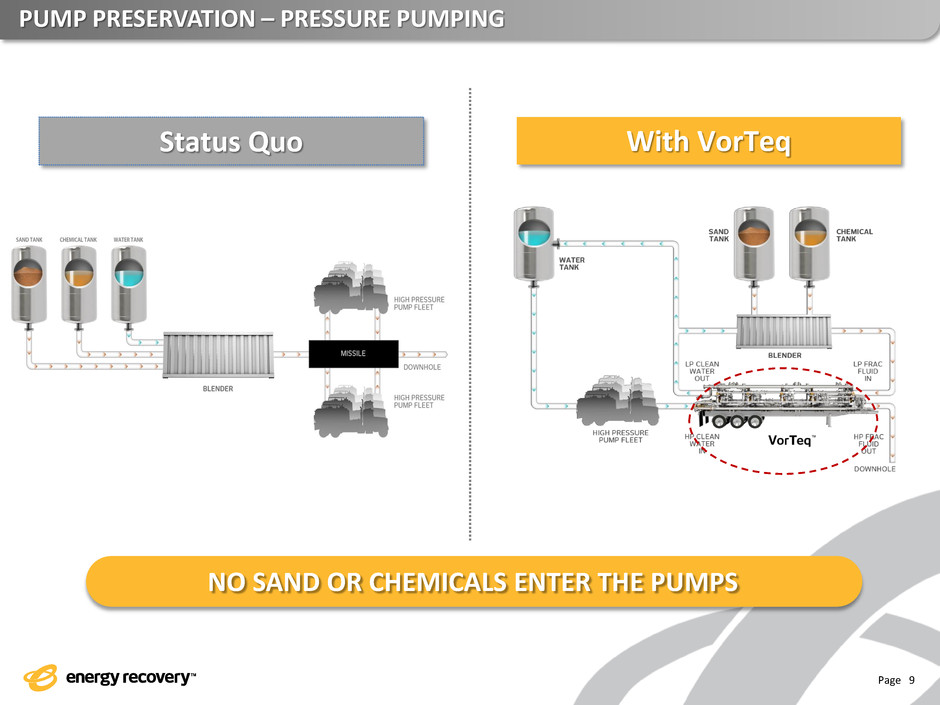

PUMP PRESERVATION – PRESSURE PUMPING

Page 9

Status Quo With VorTeq

NO SAND OR CHEMICALS ENTER THE PUMPS

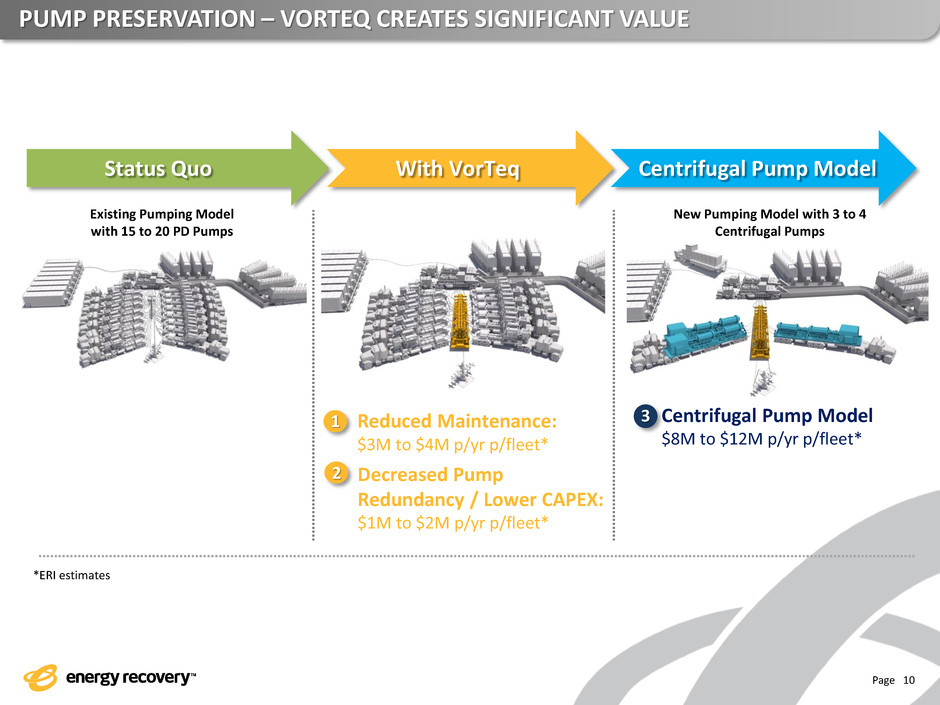

PUMP PRESERVATION – VORTEQ CREATES SIGNIFICANT VALUE

Page 10

Existing Pumping Model

with 15 to 20 PD Pumps

New Pumping Model with 3 to 4

Centrifugal Pumps

Centrifugal Pump Model

$8M to $12M p/yr p/fleet*

Reduced Maintenance:

$3M to $4M p/yr p/fleet*

Decreased Pump

Redundancy / Lower CAPEX:

$1M to $2M p/yr p/fleet*

With VorTeq Status Quo Centrifugal Pump Model

1

2

3

*ERI estimates

Page 11

VORTEQ COMMERCIALIZATION PATH

Commercialization is twofold:

Schlumberger Licensing Agreement

• Acceptance standards inclusive of M1 & M2 as well as other performance tests

• SLB responsible for missile manufacturing, ERII to provide PXs, housing and

motors

• Five years from first unit to full deployment of SLB fleet

• $1.5MM per VorTeq per year

Liberty has rights for up to 20 VorTeq units

• ERII provides full missile and cartridges – vendors have been qualified

• Pricing based on contractual ROIC

• Performance standards differ and thus speed to market may be faster

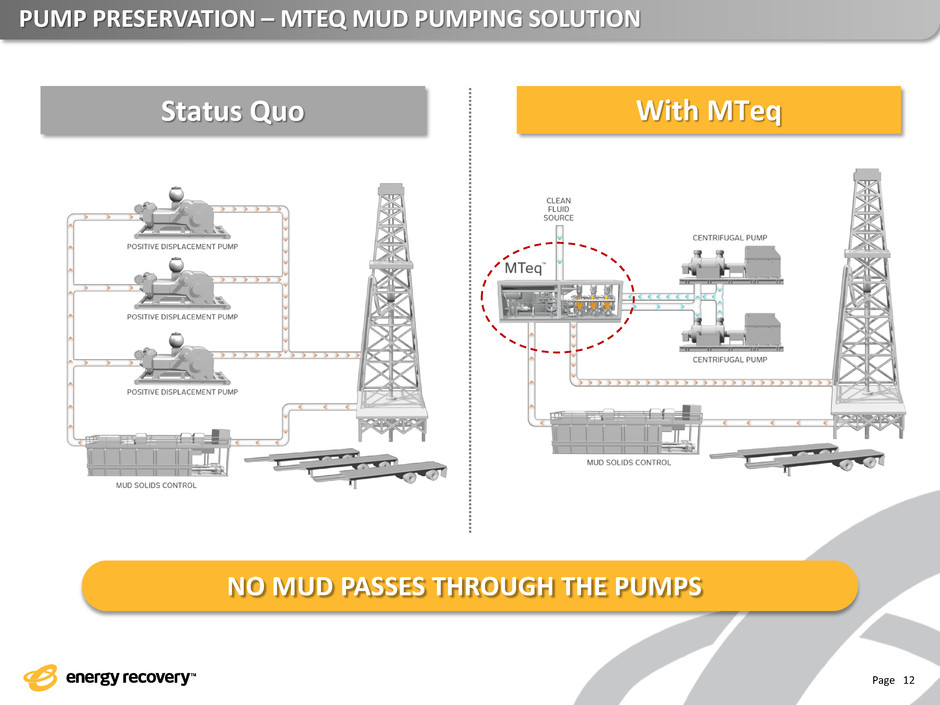

PUMP PRESERVATION – MTEQ MUD PUMPING SOLUTION

Page 12

Status Quo With MTeq

NO MUD PASSES THROUGH THE PUMPS

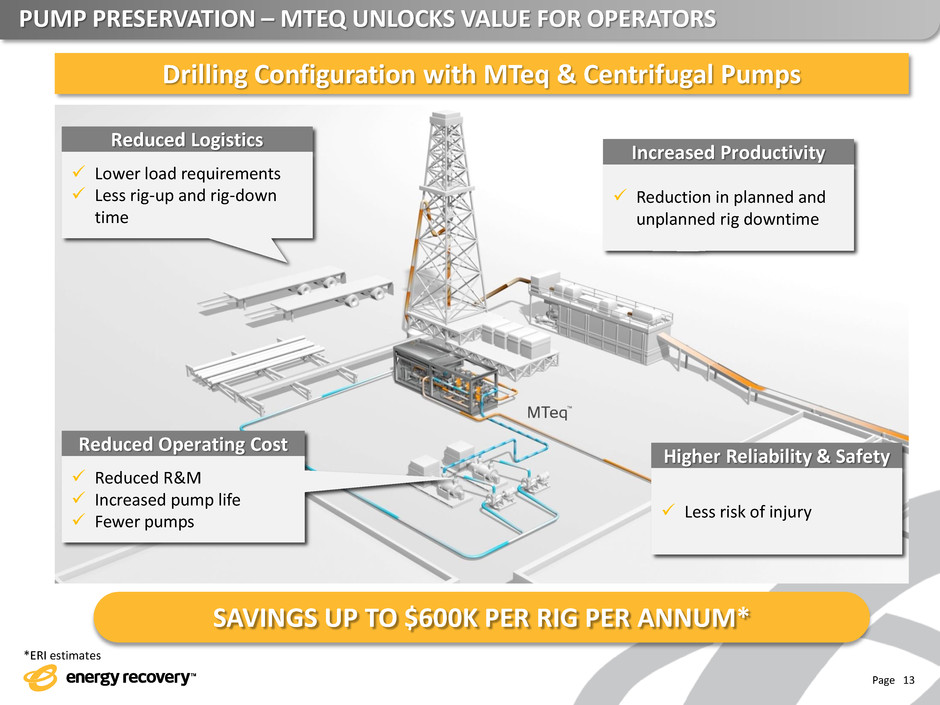

PUMP PRESERVATION – MTEQ UNLOCKS VALUE FOR OPERATORS

Page 13

Drilling Configuration with MTeq & Centrifugal Pumps

Reduced Operating Cost

Reduced R&M

Increased pump life

Fewer pumps

Reduced Logistics

Lower load requirements

Less rig-up and rig-down

time

Increased Productivity

Reduction in planned and

unplanned rig downtime

Higher Reliability & Safety

Less risk of injury

SAVINGS UP TO $600K PER RIG PER ANNUM*

*ERI estimates

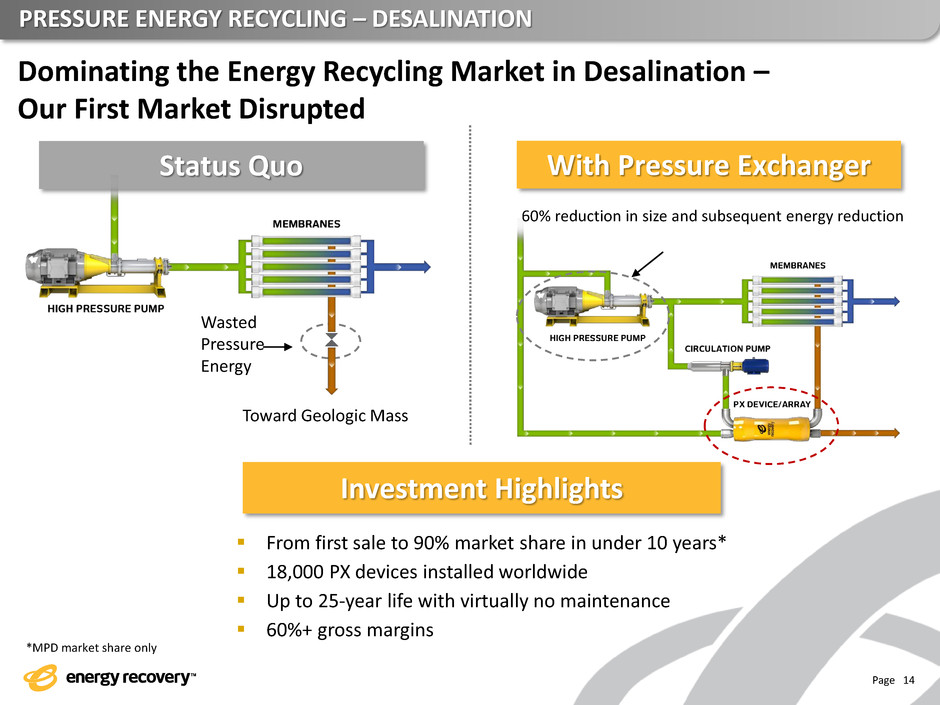

PRESSURE ENERGY RECYCLING – DESALINATION

Page 14

Status Quo With Pressure Exchanger

From first sale to 90% market share in under 10 years*

18,000 PX devices installed worldwide

Up to 25-year life with virtually no maintenance

60%+ gross margins

Wasted

Pressure

Energy

Toward Geologic Mass

60% reduction in size and subsequent energy reduction

Dominating the Energy Recycling Market in Desalination –

Our First Market Disrupted

Investment Highlights

*MPD market share only

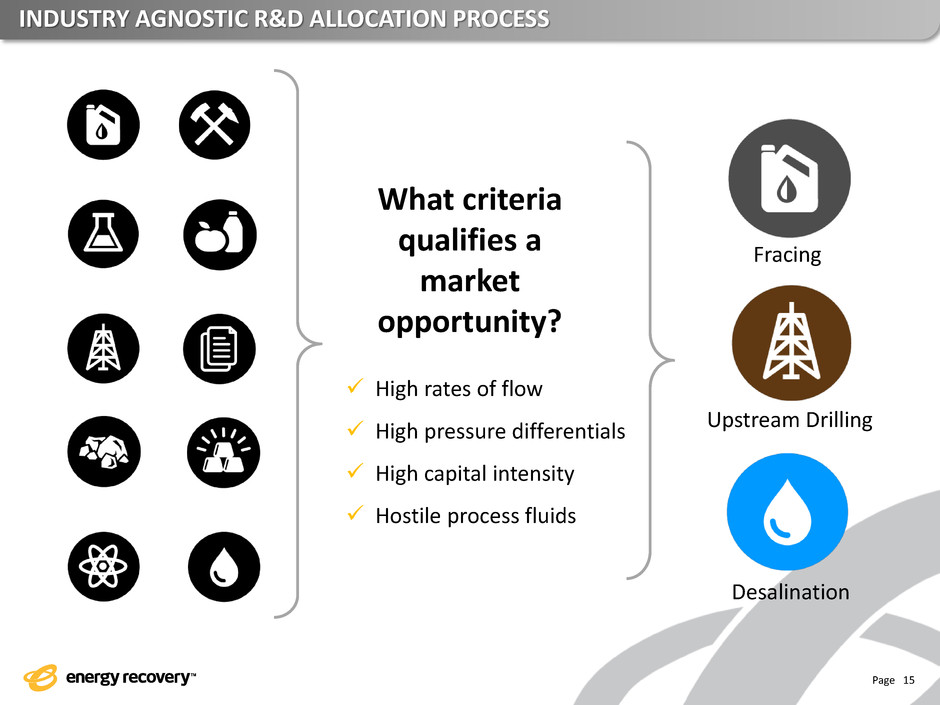

INDUSTRY AGNOSTIC R&D ALLOCATION PROCESS

Page 15

What criteria

qualifies a

market

opportunity?

High rates of flow

High pressure differentials

High capital intensity

Hostile process fluids

Fracing

Upstream Drilling

Desalination

Page 16

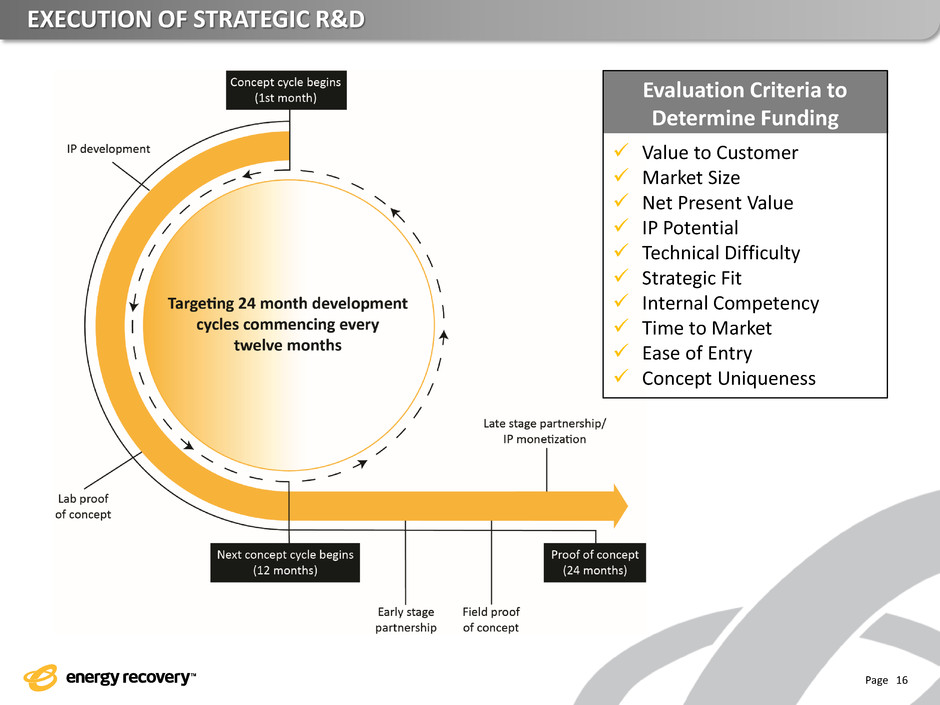

EXECUTION OF STRATEGIC R&D

Evaluation Criteria to

Determine Funding

Value to Customer

Market Size

Net Present Value

IP Potential

Technical Difficulty

Strategic Fit

Internal Competency

Time to Market

Ease of Entry

Concept Uniqueness

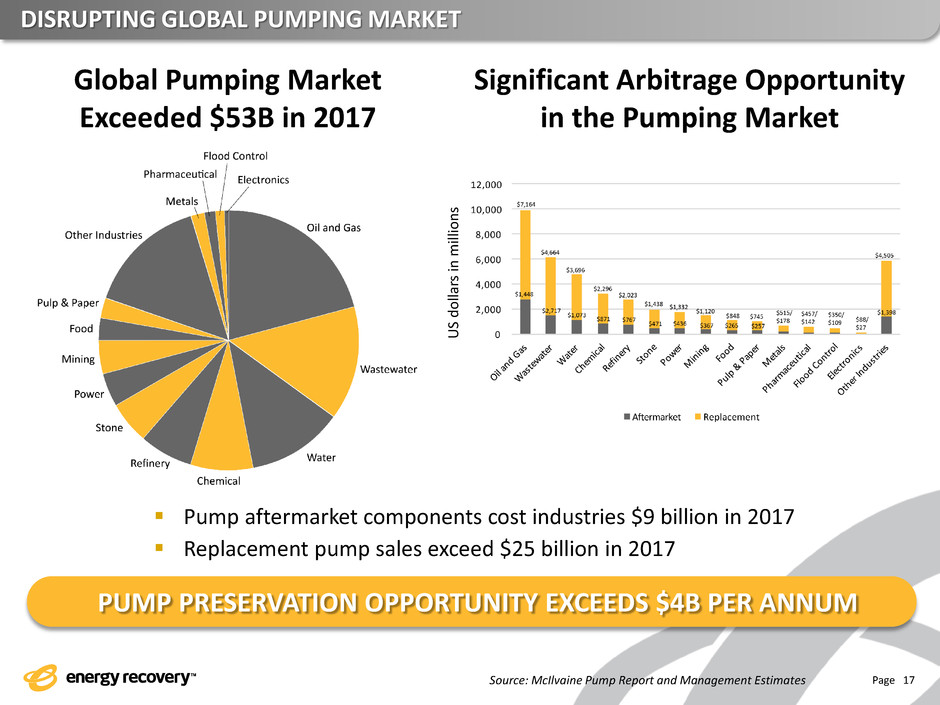

DISRUPTING GLOBAL PUMPING MARKET

Page 17

Global Pumping Market

Exceeded $53B in 2017

Significant Arbitrage Opportunity

in the Pumping Market

Pump aftermarket components cost industries $9 billion in 2017

Replacement pump sales exceed $25 billion in 2017

Source: McIlvaine Pump Report and Management Estimates

PUMP PRESERVATION OPPORTUNITY EXCEEDS $4B PER ANNUM

US

d

o

lla

rs

in

milli

o

n

s

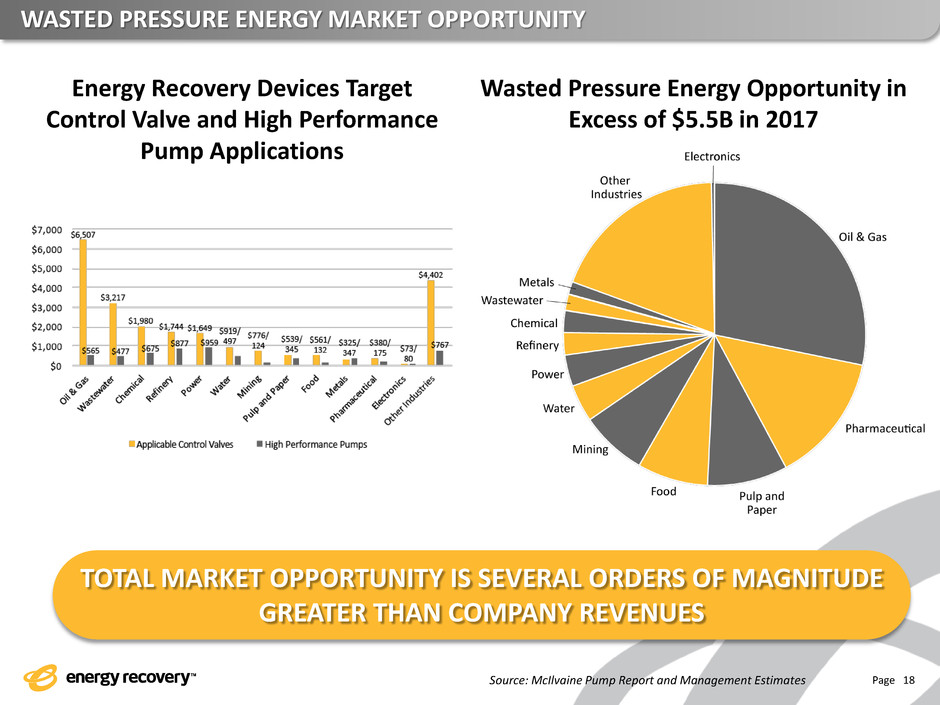

WASTED PRESSURE ENERGY MARKET OPPORTUNITY

Page 18 Source: McIlvaine Pump Report and Management Estimates

Energy Recovery Devices Target

Control Valve and High Performance

Pump Applications

Wasted Pressure Energy Opportunity in

Excess of $5.5B in 2017

TOTAL MARKET OPPORTUNITY IS SEVERAL ORDERS OF MAGNITUDE

GREATER THAN COMPANY REVENUES

Page 19

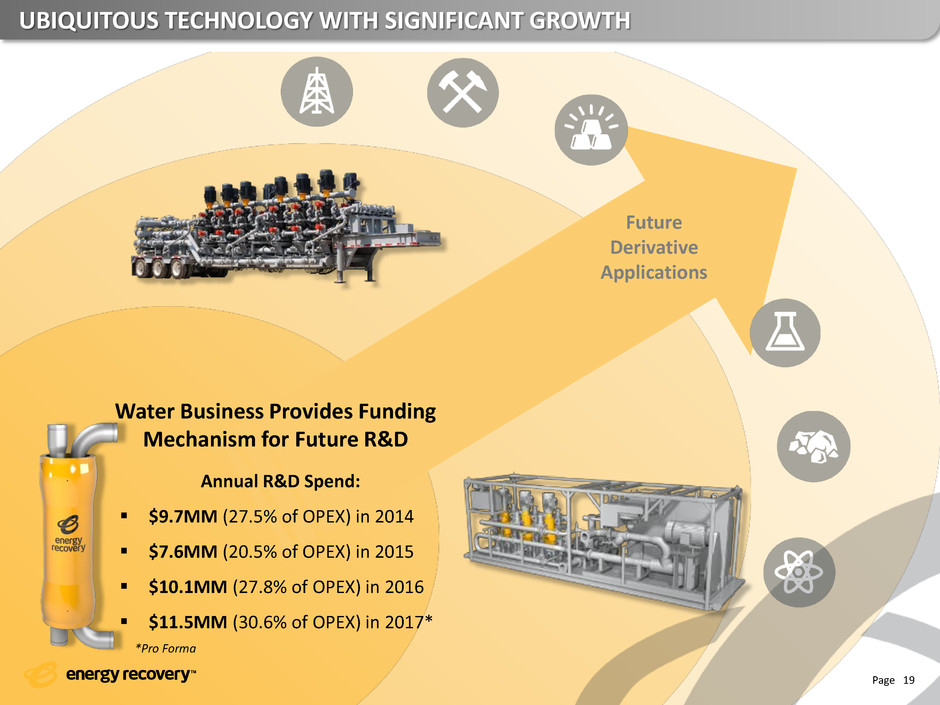

UBIQUITOUS TECHNOLOGY WITH SIGNIFICANT GROWTH

*Pro Forma

Water Business Provides Funding

Mechanism for Future R&D

Future

Derivative

Applications

Annual R&D Spend:

$9.7MM (27.5% of OPEX) in 2014

$7.6MM (20.5% of OPEX) in 2015

$10.1MM (27.8% of OPEX) in 2016

$11.5MM (30.6% of OPEX) in 2017*

THANK YOU